US stock market futures continued to decline on Thursday as bullish sentiments were dampened by the hawkish stance of the Federal Reserve and weak economic data from China.

US futures took a hit after Jerome Powell, the Chairman of the US Federal Reserve, suggested yesterday that almost all committee members anticipate further interest rate hikes this year following a slight pause in June. S&P 500 futures are currently trading down by 0.3%, while the NASDAQ index shed by about 0.4%.

After the Fed curbed market enthusiasm for potential rate cuts later this year, investors are now trying to assess the European Central Bank's forthcoming policy. The bank is expected to increase the key rate by 25 basis points to 3.5%, with the main focus on what additional measures officials plan to take to combat inflation, which is nearly three times above the target.

The US dollar slipped after strengthening against several risk assets yesterday due to prospects of further rate hikes in the US. Meanwhile, Treasury bond yields have risen.

In Asia, Chinese stocks gained after the People's Bank of China cut its benchmark lending rate, fueling speculation about imminent additional stimulus. This also boosted US-listed Chinese companies like Alibaba Group Holding Ltd. and Baidu Inc., which gained in premarket trading.

The People's Bank of China stimulates the real estate market and domestic demand. However, data shows that retail sales in May fell more than expected has heightened concerns about further slowdown in China. Industrial production was also down, though it met forecasts.

In the commodities sector, gold has been falling for five consecutive days, marking the longest drop since February this year, as the prospect of further tightening by the Fed has made the precious metal less appealing.

In addition to the European Central Bank's decision, US retail sales figures for May are to be released. A reduction in this indicator is likely to be perceived negatively by traders, though it could help curb inflationary pressures. Weekly initial jobless claims, coupled with changes in industrial production, will also draw interest.

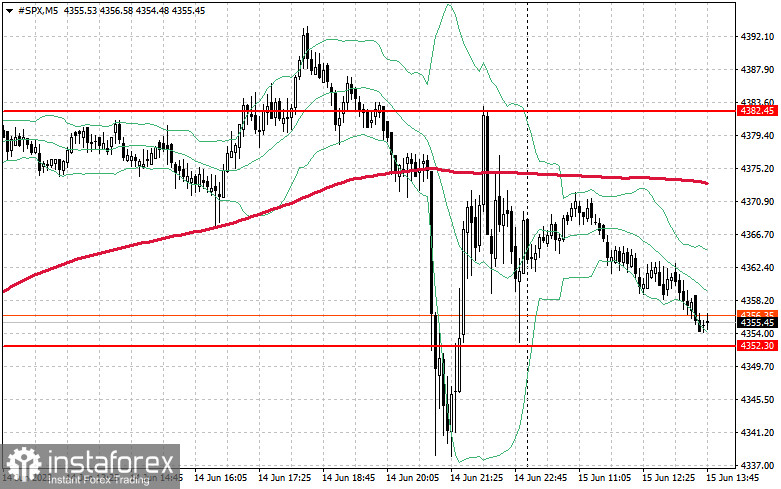

As for the S&P 500 index, despite the dip, the demand for the index remains relatively high. Bulls have chances to continue the upward trend but they need to defend $4,350, from where a rally could potentially occur back to $4,380. Controlling $4,410 is also a key for bulls, as it would help solidify the bullish market. Should the market move downwards amid decreased risk appetite, bulls should protect $4,350. Breaking through this level, the trading instrument may return to $4,320 and $4,290.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română