GBP/USD

The British pound showed good growth yesterday (0.41% while the dollar index declined by 0.27%), but it was likely a technical rise to test the May high of 1.2678. Weak indicators have been coming out of the UK in recent days, so in case of a dollar recovery, the British pound may show a leading decline. Exactly one week from now, the Bank of England intends to raise the rate by 0.25% to "squeeze inflation out of the system," but the British economy appears more vulnerable to high rates in our time than the economies of Europe, let alone the United States. Therefore, the pound's reaction to this rate hike may be a decline.

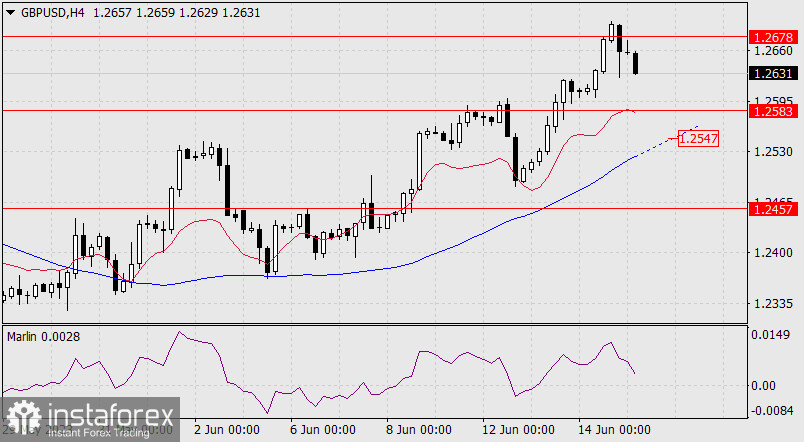

So, on the daily chart, the price has reversed from the 1.2678 resistance level, and the Marlin oscillator is turning downwards. To confirm this reversal, the price needs to break below the nearest support level at 1.2583 and consolidate. The target will then be 1.2457. The MACD indicator line is approaching this level.

On the 4-hour chart, the price is currently declining. The signal line of the Marlin oscillator is decreasing with a lead over the price, which is a positive sign for the bears. Below the level of 1.2583, the price will encounter the MACD indicator line (1.2547). The price needs to surpass this line in order for it to fall further, indicating that the support level at 1.2583 needs to be broken and confirmed on the daily chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română