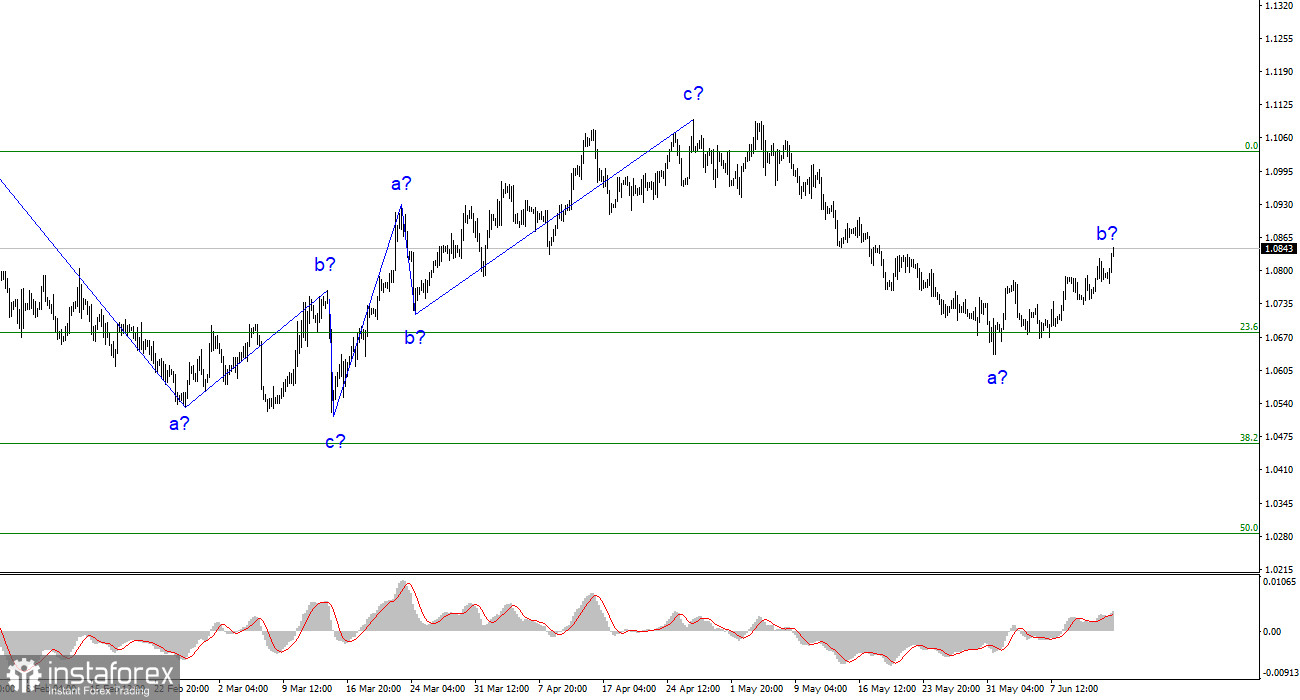

The wave count on the 4-hour chart for the euro/dollar pair remains non-standard but understandable. The prices continue to move away from the previous lows, presumably within wave b. The entire ascending trend, which started on March 15th, may still theoretically form a more complex structure, but at the moment, I expect a downward phase of the trend, which is likely to be a three-wave structure as well. Recently, I have regularly mentioned that I expect the pair near the 5th figure, where the upward three-wave pattern began.

The high point of the last segment of the trend was only a few dozen points above the peak of the previous upward phase. Since December of last year, the pair's movement can be considered horizontal, and such a character of movement will continue. The presumed wave b, which could have started on May 31st, has a convincing appearance and could end at any moment, as it already shows a clear three-wave structure.

The dollar continues to lose value

The euro/dollar exchange rate rose by 50 basis points on Wednesday. The market continues to respond to various factors, most of which (this week) do not support the dollar. At present, the wave count does not conflict with the news background. The euro currency continues to build a corrective wave, supported by negative news from the United States. Yesterday, the Consumer Price Index for May fell more than expected by the markets. Today, the Producer Price Index slowed down even more. Both of these indicators reduce the chances of seeing the Federal Reserve's tightening of monetary policy this evening. Moreover, if inflation continues to decline at the same pace, then at all remaining meetings in 2023, decisions not to make adjustments to the policy are likely to be made.

Since the wave count suggests the formation of another downward wave, one must inevitably look for a news background that would support demand for the U.S. currency. The prospects for the dollar remain quite good since both the Federal Reserve and the ECB may conclude their policy tightening procedures this summer. Even if both central banks conclude them with a difference of one or two meetings, the market has already priced in this difference because the euro currency has increased more frequently than decreased over the past year. Since the last descending wave cannot be interpreted as part of the upward trend, there will be another downward wave, possibly even without the support of the news background. In any case, it will take quite a lot of time to build it, and in a month, the ECB may raise interest rates for the last time.

Overall conclusions.

Based on the conducted analysis, a new downward phase of the trend is continuing. Therefore, selling positions can be recommended at the moment, and the pair has significant room for decline. I still consider targets around 1.0500-1.0600 quite realistic, and I advise selling the pair with these targets. I suggest entering new sell positions after the clear completion of wave b, starting from the level of 1.0678. I consider selling opportunities above the level of 1.0866, which corresponds to a 50.0% Fibonacci retracement of wave a, using MACD reversals to the downside.

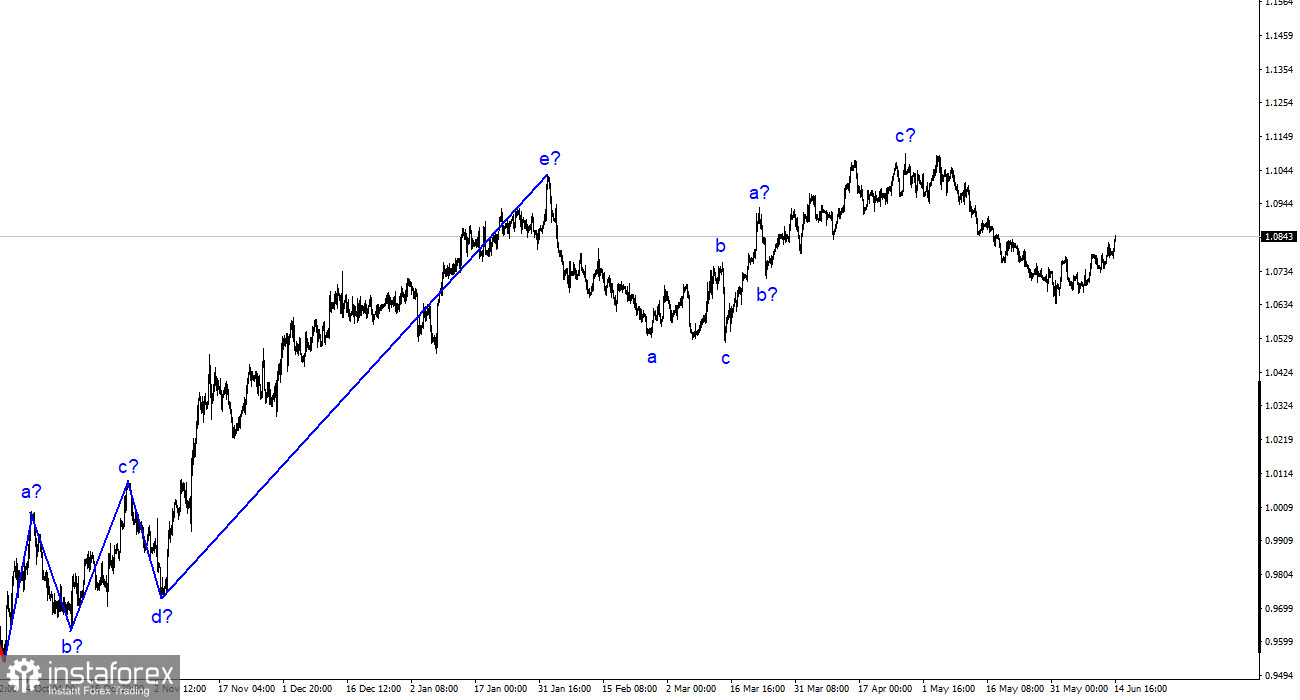

On a larger wave scale, the wave count of the upward segment of the trend has taken on an extended form but is likely to be completed. We have seen five upward waves, most likely a structure of a-b-c-d-e. Then the pair formed two three-wave patterns, downward and upward. It is likely in the process of building another downward three-wave structure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română