US stock index futures are trading slightly higher following yesterday's rally, as traders anticipate Federal Reserve Chairman Jerome Powell to announce a halt in interest rate hikes today. S&P 500 futures have risen by 0.2% after a fourth straight rise – the longest streak since early April. NASDAQ futures are also up 0.3%. In Europe, a miners' rally has boosted the Stoxx 600 to a three-week high.

Yesterday's data indicated that US inflation is slowing down. This supports the expectation that the Federal Open Market Committee will maintain interest rates within the 5% to 5.25% range today. Swap traders estimate the probability of a rate hike at only 10%, but still see a potential for a hike in July – especially considering that inflation remains more than double the central bank's target. Today, the US producer price index report is due as well, which could further affect the Fed's decision.

Powell is expected to adopt a somewhat hawkish tone during the press conference to prevent a dovish market reaction, underlining that inflation is still too high. It is also projected that the Fed will keep the door open for a potential rate hike in July.

Against this backdrop, Treasury bond yields have stabilized after the yield on 2-year notes surged to a high not seen since March. The dollar index is hovering around a one-month low.

Notably, Fed actions will be data-dependent. Considering the Committee's aggressive policy over the past 15 months, its effects are not yet fully realized in the economy, including inflation. Therefore, while a pause is significant, it does not suggest that the central bank has entirely achieved its objectives and is set to stand back.

Many economists also anticipate that the Fed's statement will undergo hawkish revision, leading to the reassessment of further tightening expectations in upcoming meetings – a positive sign for the stock market, which could result in another rally.

Meanwhile, oil continues to trade near lows, slightly rebounding. Gold moves within a range.

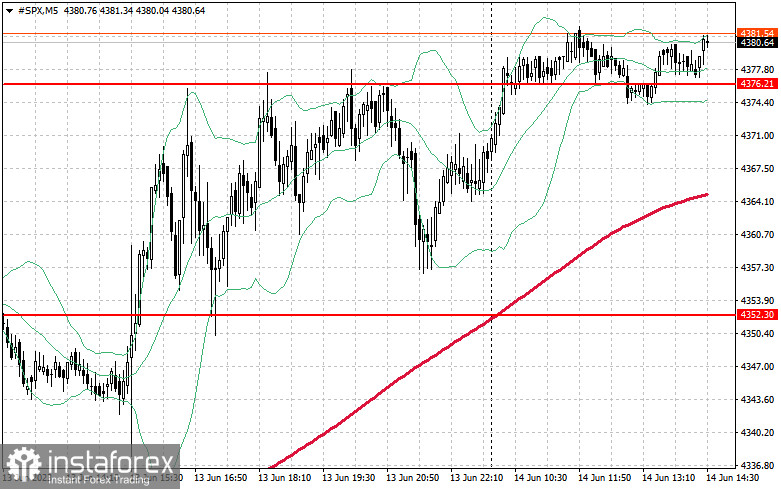

As for the S&P 500 index, the demand remains relatively high. Bulls may continue the upward trend. They need to defend $4,320 and push the price to $4,350. Protecting the level of $4,375, bulls may reinforce the bull market. If the index declines due to reduced risk appetite ahead of the Fed meeting, bulls will have to protect $4,320. Breaking through this level, the price may return to $4,290 and $4,175.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română