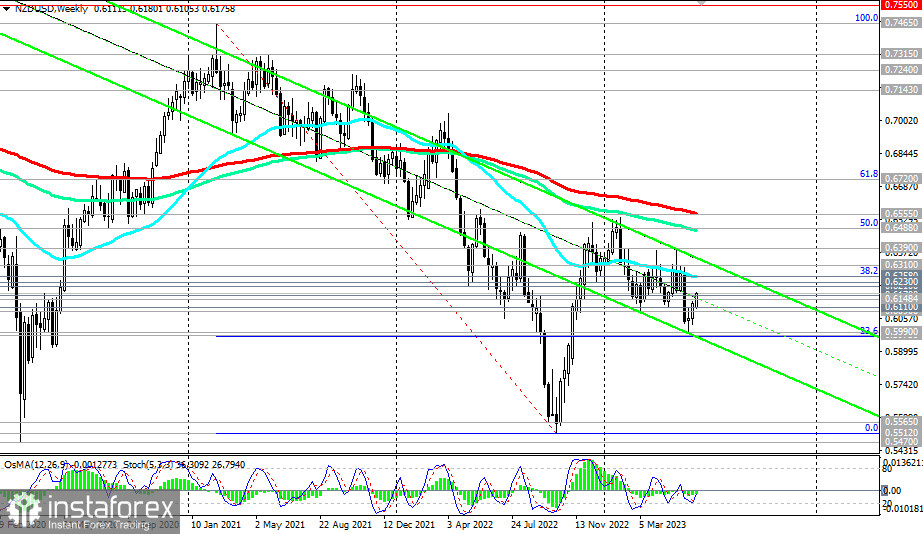

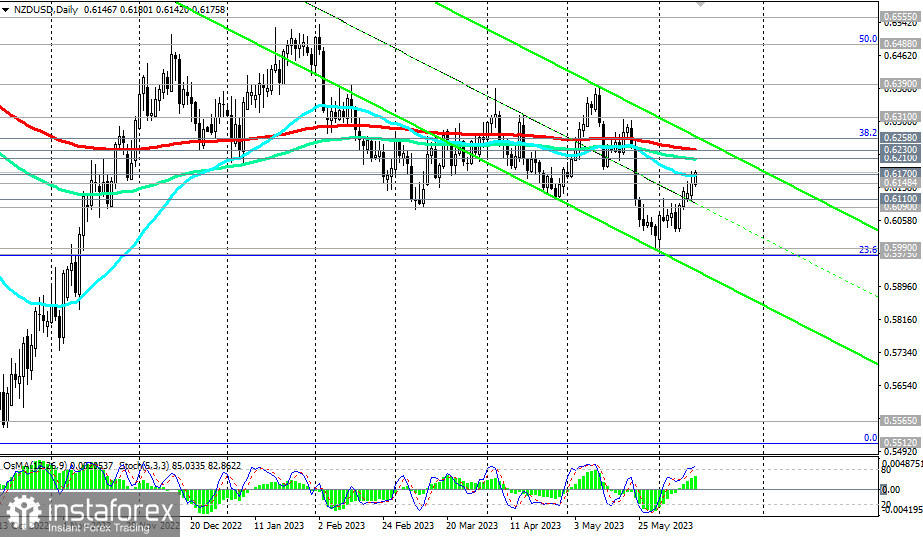

NZD/USD has been developing an upward trend since the beginning of the month, moving towards the balance zone and key resistance levels of 0.6230 (200 EMA on the daily chart), 0.6258 (50 EMA on the weekly chart and the 38.2% Fibonacci level in the downward wave of the pair from the level of 0.7465 in February 2021 to the level of 0.5510 reached in October 2022).

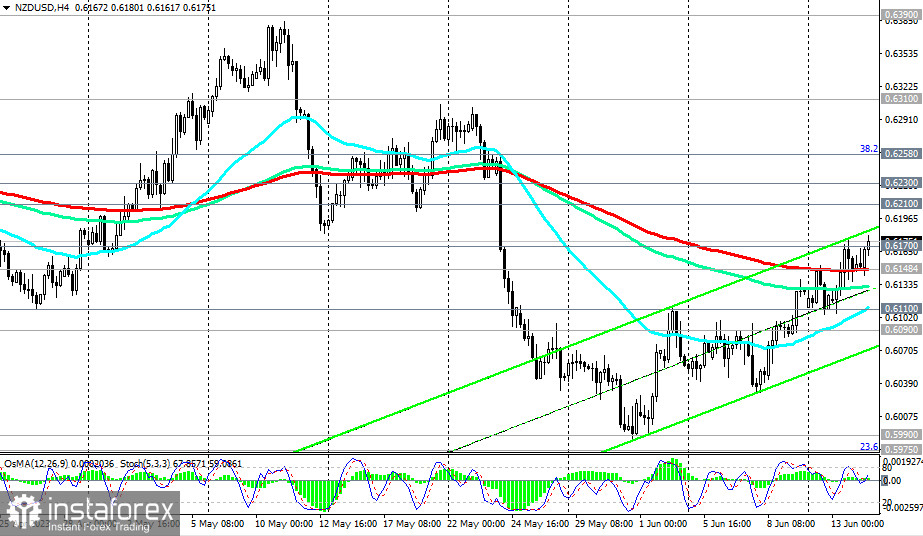

A successful breakout of the 0.6170 resistance level (50 EMA on the daily chart), which the price is currently surpassing, will confirm our assumption.

Meanwhile, a breakout of the 0.6258 resistance level may trigger further growth towards key resistance levels of 0.6488 (144 EMA on the weekly chart and the 50% Fibonacci level), 0.6555 (200 EMA on the weekly chart). Their breakout will lead NZD/USD into a long-term bullish market zone. Although, to break into the global bullish market zone, the price must overcome the 0.6720 resistance level (200 EMA on the monthly chart and the 61.8% Fibonacci level).

In an alternative scenario, NZD/USD will resume its decline. A breakdown of the 0.6148 support level (200 EMA on the 4-hour chart) will be the first signal for resuming short positions, while a breakdown of the important short-term support level of 0.6110 (200 EMA on the 1-hour chart) will confirm it.

The medium-term downside target is the annual low of 0.5990, with a mark at 0.5975 (23.6% Fibonacci level) and 0.5900 (lower line of the downward channel on the daily chart).

Support levels: 0.6148, 0.6110, 0.6100, 0.6090, 0.6000, 0.5990, 0.5975, 0.5900

Resistance levels: 0.6170, 0.6200, 0.6210, 0.6230, 0.6258, 0.6300, 0.6310, 0.6390, 0.6488, 0.6500, 0.6555, 0.6720

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română