The British pound surprisingly found new reasons to climb yesterday. The unemployment rate in the UK decreased, and the number of jobless claims shrunk. Traders expected the opposite, but economic data pleasantly surprised bulls. Positive data from the UK also emerged this morning. The GDP level in May increased by 0.2% month-on-month, matching traders' expectations. Industrial production volumes decreased by 0.3% in April, but the downturn in manufacturing is hardly a surprise – business activity indices are below 50.0 in many countries, including the US, EU, and the UK. Thus, today's reports are quite positive because any GDP growth now implies a new tightening of the Bank of England's monetary policy, which is good for the British pound.

This evening, we await a press conference with Jerome Powell and the FOMC rate decision. Hawkish decisions and statements are highly unlikely. US inflation is falling quite rapidly, and the Fed rate has almost reached its peak. There is no reason to tighten monetary policy in June or promise to tighten it in July yet. Thus, quite unexpectedly, the British pound finds new reasons to climb. The Producer Price Index may also support bulls, as it is unlikely to accelerate following the inflation report.

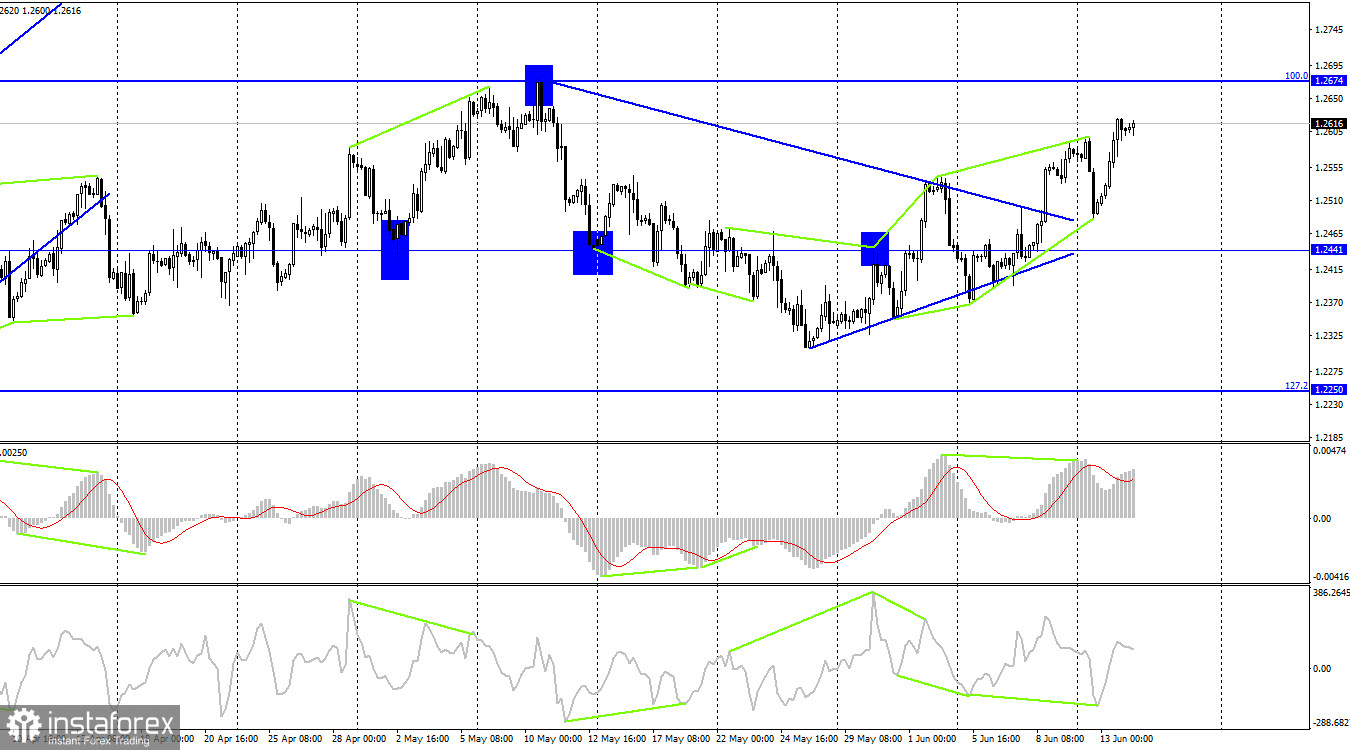

On the 4-hour chart, the pair has secured a position above the triangle, suggesting that it may continue to rise towards the Fibonacci level at 100.0% - 1.2674. Despite a bearish divergence formed by the MACD indicator, which led to a slight drop in the pair, a bullish divergence emerged the next day, returning the pair to its upward trend.

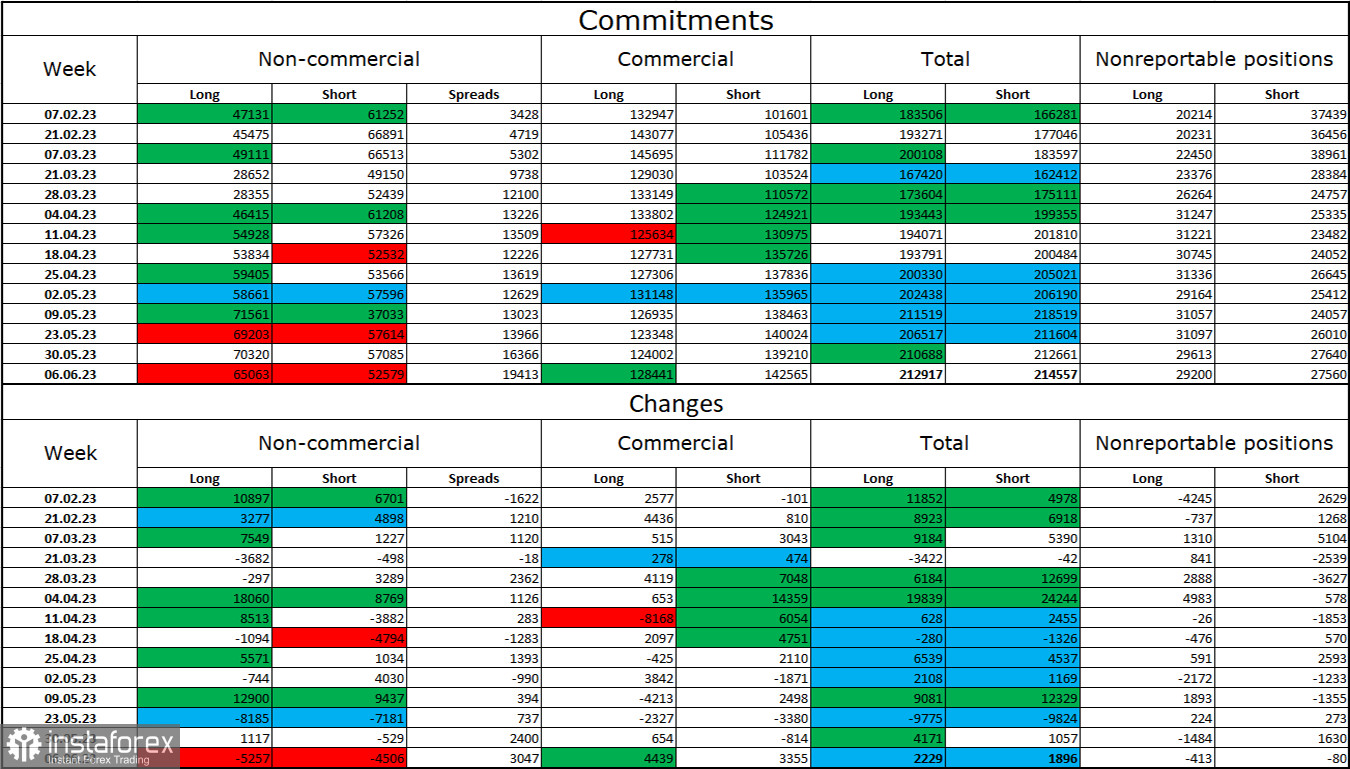

COT report:

Over the last reporting week, the sentiment of non-commercial traders became slightly less bullish. The number of long contracts held by speculators decreased by 5,257, while the number of short contracts reduced by 4,506. The overall sentiment of large players remains solidly bullish, but the number of long and short contracts is now almost equal - 65,000 and 52,000 respectively. The British pound has a good chance to continue its upward movement, with the current news backdrop supporting it more than the US dollar. Nevertheless, a significant appreciation of the pound is not expected in the upcoming months. The outcomes of the Bank of England meeting next week will provide a better understanding of the pound's outlook.

US and UK economic calendar:

UK - GDP (May) (06-00 UTC).

UK - Industrial Production (06-00 UTC).

UK - Visible trade balance (06-00 UTC).

US - Producer Price Index (PPI) (12-30 UTC).

US - Federal Reserve rate decision (18-00 UTC).

US - FOMC economic forecasts (18-00 UTC).

US - FOMC statement (18-00 UTC).

US - FOMC press conference (18-30 UTC).

On Wednesday, the economic calendar contains numerous key events, but all reports from the UK are already known to traders. Markets are waiting for the Federal Reserve meeting late in the evening and the PPI release. The influence of the news background on traders' sentiment today can be significant.

GBP/USD forecast and recommendations for traders:

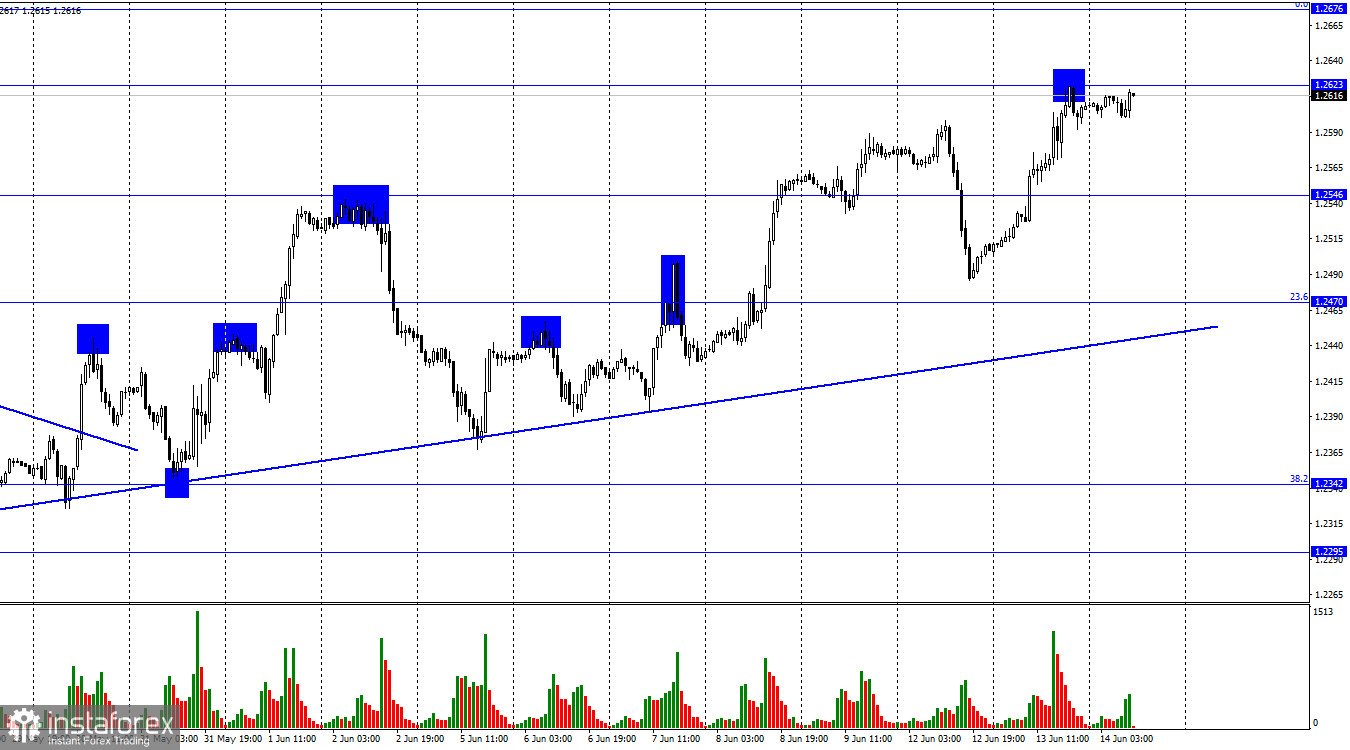

Traders can consider selling the pound if it bounces from 1.2623 on the hourly chart, with targets at 1.2546 and 1.2470. Buying the pound was an option upon closing above 1.2546, targeting 1.2623. This target has been reached. New purchases can be considered if the pair closes above 1.2623, with a target of 1.2676.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română