While the British pound is approaching its monthly highs, the UK housing market is facing new obstacles. Since the country faced cost of living crisis, economic uncertainty and a rapid rise in borrowing costs could inflict significant damage to the housing market.

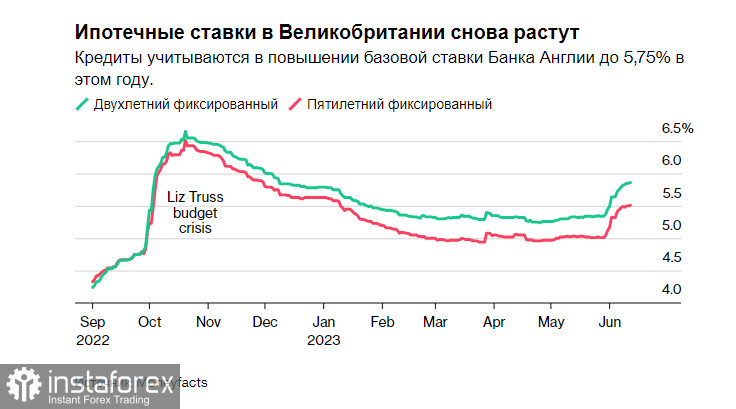

Pressure on the market is snowballing, especially amid a new jump in mortgage rates and the desire of creditors, including HSBC Holdings Plc and Banco Santander SA, to abandon existing lending products due to another spike in bond yields, a peak of which was last seen in 2008. These factors are causing a lot of concerns as interest rates continue to rise, loans are becoming more expensive, and good deals are increasingly hard to find.

Some economists are already predicting that housing prices will drop by almost 10% from their peak. Two-year mortgage rates are already around 6%, which is a relatively high level for the UK. The problem in the real estate sector can significantly affect the economic growth pace and negatively influence future forecasts of economists. Not long ago, economists published fairly good forecasts for the UK's GDP growth rate by the end of the year. However, the rapidly deteriorating situation in the loan market may force economists to revise their expectations.

Next week will be very important as the UK will issue its inflation figures and the Bank of England will take a monetary policy decision. This could inflict even more damage to the property market and cause a more significant price drop. Soaring prices will fuel rumors that the Bank of England will have to tighten its monetary policy even more than expected. This will have huge implications for British real estate, where mortgage approvals are almost the weakest since the global financial crisis. Data shows that the number of approved mortgage loans in the UK fell after the pandemic boom, and the sentiment in the industry has become more pessimistic.

On top of that, a faster than expected rise in wages on Tuesday prompted traders to increase bets on future key rate hikes. The central bank has already raised the key rate by 440 basis points to 4.5%. On Tuesday, the likelihood that the rate would reach 5.75% by the beginning of 2024 was just 6%.

As for the technical picture of GBP/USD, demand for the pound sterling remains high. We can expect the pair to grow after gaining control over 1.2630. Only breaking through this level will strengthen the hope for further recovery to the area of 1.2670. After that, we can start talking about a more rapid jump to 1.2710. If the pair falls, bears will attempt to take control over 1.2580. If they succeed, a breakout of this range will hit bulls' positions and push GBP/USD to the low of 1.2530 with a perspective of reaching 1.2470.

As for the technical picture of EUR.USD, buyers could maintain control, if they protect 1.0768 and reach 1.0800. This will allow teh pair the climb to 1.0830. From this level, it may increase to 1.0875, but it would be quite difficult without good fundamental statistics from the eurozone. In the case of a decline, I only expect actions from major buyers around 1.0765. Otherwise, it would be good to wait for the update of the low of 1.0730 or to open long positions at 1.0700.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română