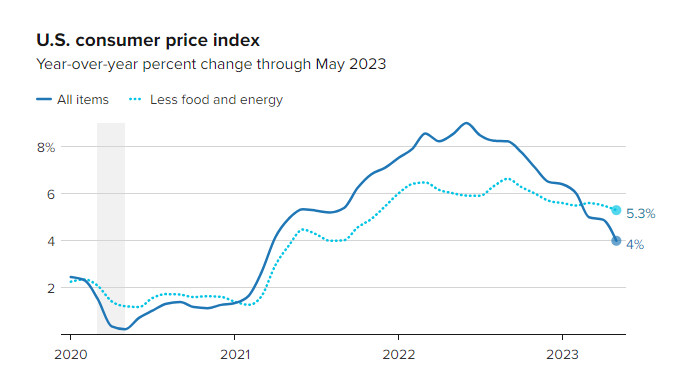

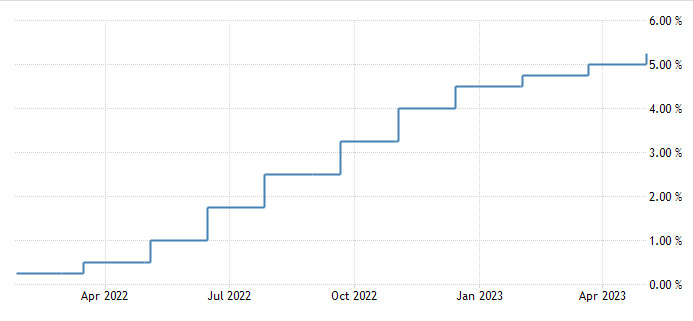

The dollar is on the back foot, as traders scramble to interpret what direction the Fed will take with interest rates today. Where should traders focus their attention?May's employment report amplified the ambiguity, as the notable uptick in new jobs pushes the Fed further into rate hike territory. At the same time, unexpectedly weak US services PMI data bolstered expectations of a pause.Inflation data for May once again highlighted the pressing need to wind down monetary policy tightening. Price growth decelerated to 4%, while core inflation stubbornly remained at 5.3% YoY. Overall, the data matched expectations.

A pause seems highly likely, with the consensus estimates indicating almost a 100% chance of this outcome. In the event of an inflation shock, the regulator has a narrow window of opportunity to reconsider a rate hike. Currently, the markets expect such a move to occur in July.

Many economists have started voicing their opinions that the Fed might find it challenging to resume tightening. Consequently, this pause is seen as the likely end of the historic rate hike series.

Economists and CFOs speak out

During a CNBC CFO teleconference on Tuesday, corporate executives sent a clear message to the Federal Reserve: it was time to halt the hikes, not pause or skip them.

This sentiment, coming from within corporations across the economy, aligned with the results of the latest survey published by CNBC on Tuesday. While the markets are seeing a 68% chance of a hike in July, about 63% of survey respondents see no change on the horizon and believe the Fed is actually at the end of its tightening cycle.

The CFOs pointed out that rate hikes are clearly working. Moreover, lagging and more significant economic effects are coming.

The consumer weakness that began in Q1 has continued, and top executives are concerned that the Fed's actions are yet to be fully reflected in CPI data. However, it is due to happen quite soon.

"There is a chance we find out Q2 is a recession, and we may not learn that until sometime deep into the third quarter. Services is in contraction territory we haven't seen in a long time," one executive noted.

If tightening continues, indicators will deteriorate significantly in the future, resulting in a recession that might range from moderate to severe. This could end up being an unwelcome surprise in 2024.

After the regional banking crisis in the US, Fed economists warned at the March FOMC meeting that a shallow recession is possible.

In addition, among underprivileged consumers, 80% have returned to their pre-pandemic levels of credit delinquencies. This figure continues to rise.

"The consumer is being smart, but the Fed's focus on unemployment growth could break the consumer. I urge them to be cautious," the CFO commented.

Another signal is coming from the stock market. Bank of America noted that the bear market has officially ended, with the S&P 500 climbing by 20% compared to the October 2022 low.

Some may question the new call for a bull market, but they might have to accept it in the future.

Recession predictions

Recent studies indicate a shifting stance on the possibility of a US recession among experts over the last seven months. According to a CNBC poll, 54% of respondents are predicting a recession within the next 12 months, pinpointing early November as the likely starting point.

This forecast lags two months behind the previous survey, and five months behind the survey made in early June.

The latest Fed statements indicated the regulator is monitoring lagging indicators and is ready to adjust its policy as needed.

However, there's a disagreement between the business community and the Fed regarding how fast these lag factors work. Company CFOs have noted a slowdown in consumer purchases flow, from buying orders to warehouses, transport, and production.

They have argued that the issue lies in the lagging factors, which have pushed unemployment significantly above the 4% mark. It may take several more months for growth to slow down.

In the manufacturing industry there are currently no signs of a recession, one CFO cited by CNBC noted. However, if the Fed continues to hike rates, it may trigger a recession, which is likely to begin in Q4.

The US central bank may raise the rates once or twice more if necessary. But will it do so?

Experts have warned about the possible recession tied to Fed rate hikes. The increasing disagreement about the speed of lagging factors and slowing consumer spending is causing alarm among CFOs. However, the ultimate outcome will depend on the Fed's future actions and policy decisions.

Why rates could be hiked again

Despite all this, financial experts continue forecasting further rate hikes. Randy Kroszner, a professor of economics at the University of Chicago Booth School of Business and a former Fed governor, pointed out that while inflation is easing, it still remains elevated.

He anticipates several rate hikes to follow and expects the Fed to maintain its hawkish stance, leaning more towards the term 'skip' rather than 'pause' at Wednesday's meeting.

Notably, the labor market remains tense, and wage growth has created a higher wage base that can't be turned back.

However, along with the benefits come risks and fears. Kroszner concurs with financial directors that there's a risk of a sharp economic slowdown that models don't always predict. He cites the possibility of a "double whammy" scenario where rising unemployment and falling house prices pose severe difficulties for consumers.

The stability of the housing market also has an impact on the economy.

Overall, CFO and analysts acknowledge the complexity of the current situation and note the Fed's capability of controlling the process is limited. This requires a cautious approach as well as proper solution to prevent a recession.

What to expect from EUR/USD

The EUR/USD pair briefly touched June highs following the release of US inflation data. The pair temporarily exceeded 1.0800. Now everyone is wonder where the pair will go, focusing on the Fed.

The market leans towards going short on the US dollar, but some experts believe it may not be the most prudent strategy considering the upcoming FOMC meeting. Risk appetite is likely to be low until this event.

The decline in US short-term bond yields following the data release could also reflect the market's view on the decreased likelihood of further rate hikes. However, there is still a risk of the Fed choosing a different move.

In the end, the situation in the currency market remains uncertain, and traders are keeping a close eye on data and the Fed meeting to gauge the future trajectory of EUR/USD.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română