Since the Federal Reserve will announce its decisions on Wednesday night as part of the June meeting, I believe it is necessary to shed more light on this topic and understand what we can expect from both instruments. I won't be mistaken if I say that Tuesday's US inflation data determined a lot, if not everything. As the Fed tightens its monetary policy to combat high inflation, inflation is what matters most to the central bank. We learned that inflation slowed down to 4% in May, and core inflation decreased to 5.3%. Both indicators have dropped, which means one thing: inflation is decreasing without any "buts" that, for example, exist in the UK or the European Union.

If inflation is decreasing, then the doves might win. It is no secret that Fed officials are currently divided into two parts. A smaller part supports a 25 basis points rate hike in June or at least in July. The larger part believes that a pause is necessary since an additional rate hike will exert additional pressure on economic growth, which should be avoided at all costs. If inflation is decreasing, and even at a faster rate than expected, then the doves have a very strong argument to keep rates steady and prevent an increase in the number of hawks. Therefore, the outcome of the Fed meeting is 90% predetermined.

What can we expect from the British and European currencies if the rate remains at 5.25% on Wednesday? I believe that both instruments will be traded more actively during the announcement of the results, but there won't be significant price changes. Since both wave counts currently anticipate an increase in quotes and the Fed's decision will be dovish, the euro and pound have slightly higher chances of appreciation than the dollar.

On Thursday, the results of the European Central Bank meeting will be announced, which are also unlikely to have a significant impact on market sentiment, but at the same time, they might support the euro more than the dollar. The ECB rate is likely to increase by another 25 basis points, which the market already knows, but it is still a hawkish decision. Therefore, it is more logical to expect increased demand for the euro. Based on everything that I mentioned, the US currency has low chances of growth this week.

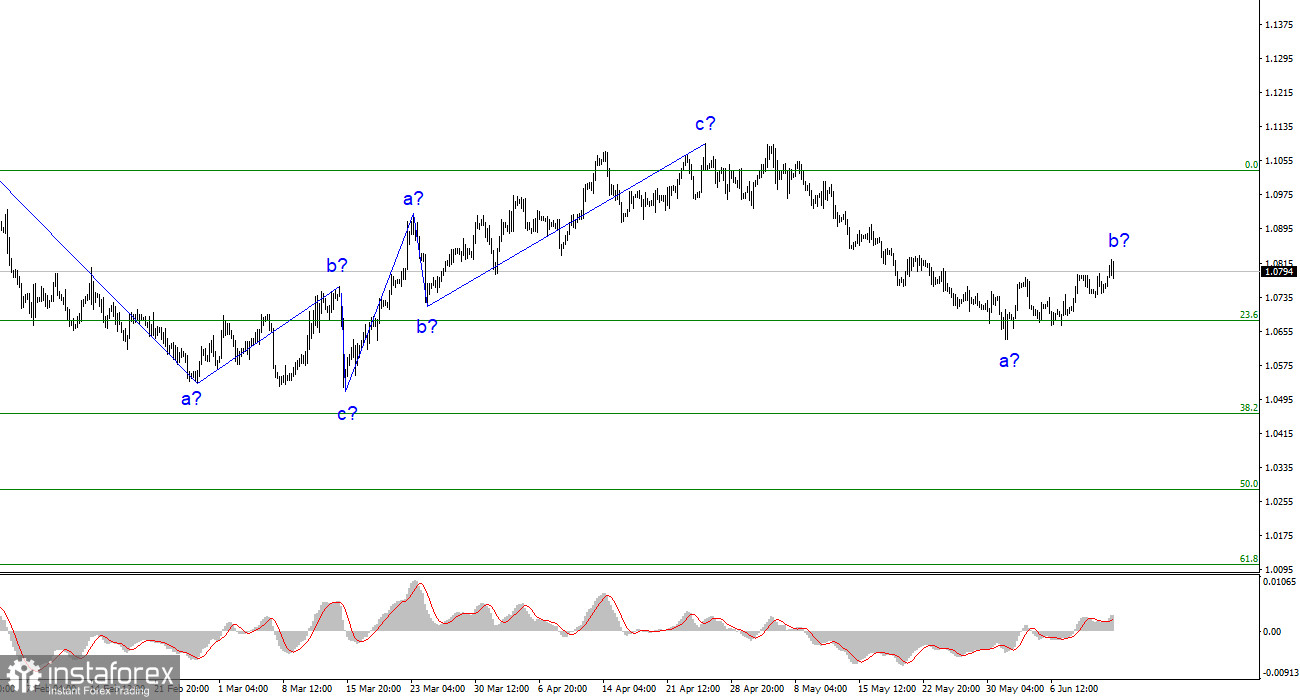

Based on the analysis conducted, I conclude that a new downtrend is currently being built. Therefore, I would recommend selling at this point, since the instrument has enough room to fall. I believe that targets around 1.0500-1.0600 are quite realistic. I advise selling the instrument using these targets. A corrective wave started from the 1.0678 level, so you can consider short positions if the pair surpasses this level or after wave b has obviously been completed. Within the correction, the instrument may reach the 0.9 figure, but wave b already has enough grounds for completion.

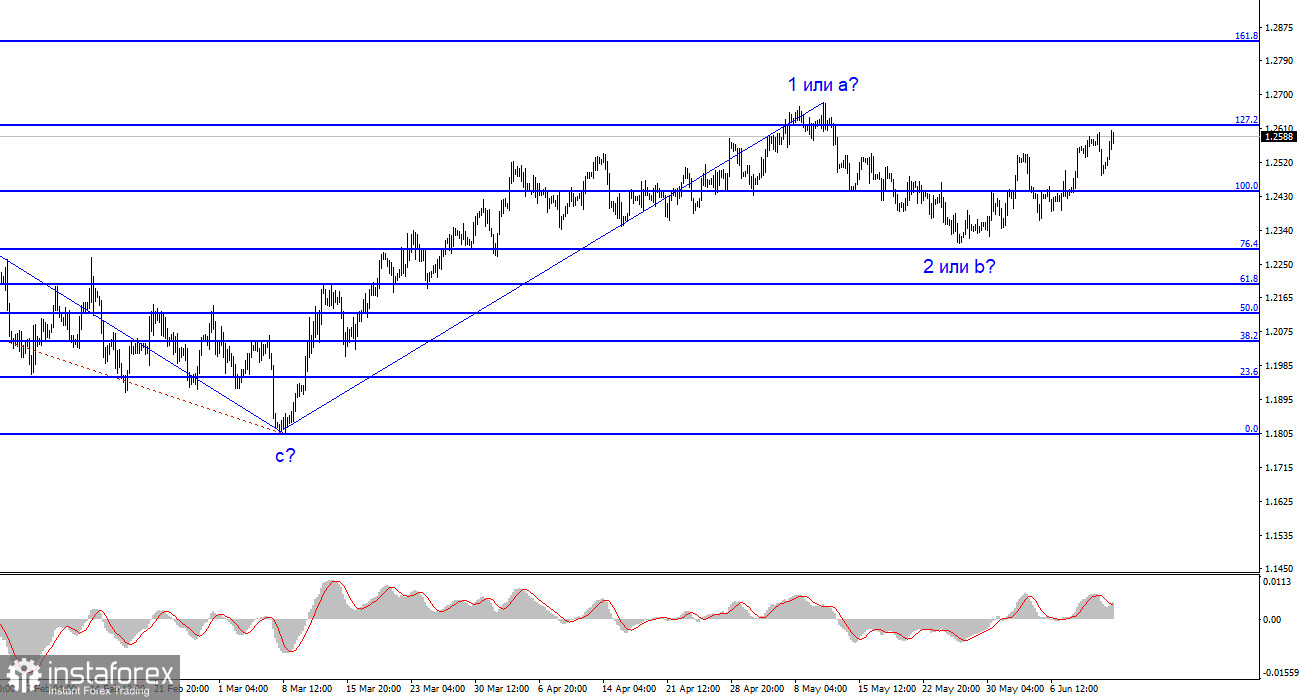

The wave pattern of the GBP/USD pair has long suggested a downward wave. Wave b could be very deep, since all the waves have recently been equal. However, the recent growth indicates a possible completion of this wave on May 25th. In this case, this could turn into a full uptrend, and this is already a completely different picture and other conclusions with recommendations. Therefore, for now, I recommend selling the pound with targets around the 23 and 22 figures, but with each passing day, the chances of a resumption of the decline within wave 2 or b diminish.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română