The report on US inflation growth did not favor the American currency. All components of the release either came out in the "red zone" or at the forecast level, reflecting a slowdown in the consumer price index. The market reaction was short in coming. In particular, the probability of maintaining the status quo at the June meeting of the Federal Reserve reached 100%. In other words, the market is confident that the Fed will announce a pause in interest rate hikes tomorrow. The question is how long this pause will be and whether it is possible, in the current circumstances, to talk about the end of the current cycle of tightening monetary policy. The intrigue remains.

By and large, the hawkish prospects of the July meeting are the only straw that can provide significant support to the greenback. If even this option "does not work," buyers of EUR/USD will completely take the initiative, especially if the ECB implements at least the basic scenario, which implies a 25-basis-point rate hike.

The significance of today's release is hard to overestimate. The smokescreen that "blinded" buyers and sellers of EUR/USD over the past two weeks is gradually dissipating. Since the end of May, the pair has been trading in a wide price range, bouncing off its boundaries. At the bottom, around the 1.0650 mark, and at the top, in the area of 1.0770. When writing these lines, the pair has entered the 1.08 range: traders have allowed themselves to leave the specified price range for the first time in almost three weeks.

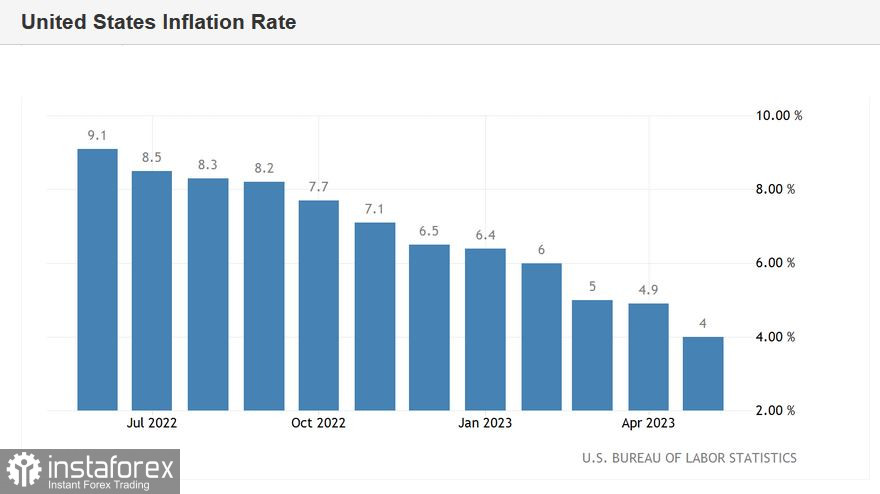

The situation looks as follows. Every month, the overall consumer price index came out at 0.1% after April's growth of 0.4% (the forecast was at 0.2%). In annual terms, the overall CPI also ended up in the "red zone": with a forecast of 4.1% growth, the indicator reached 4.0%. This is the slowest pace of growth since March 2021.

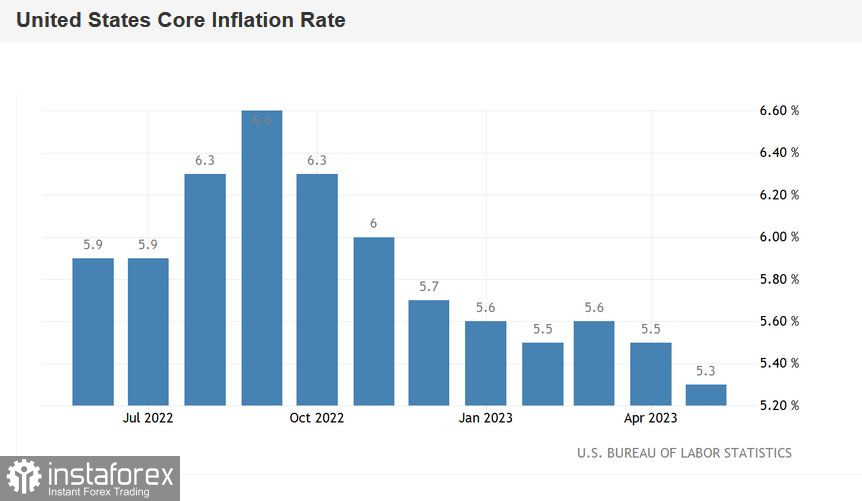

The core consumer price index, excluding food and energy prices, matched the forecasts. In monthly terms, the indicator came out at the same level as the previous month (0.4%), while in annual terms, a decline was recorded again, this time to 5.3%. It is worth noting that in April, this component of the report also showed a downward trend, dropping to 5.5%.

The structure of today's report indicates that energy prices in May decreased by 11.7% after a 5.1% decrease in April. In addition, the rate of price increase for food products slowed down significantly: in May, prices rose by 6.7% after an increase of 7.7% the previous month.

What does the release indicate?

What does today's release say? First, it indicates that the Federal Reserve will likely maintain the parameters of the monetary policy decision unchanged based on the outcome of the June meeting. That's what the CME FedWatch Tool suggests, which relatively rarely reflects 100% certainty in specific events. However, the chances of maintaining the status quo have risen to 100% after today's publication.

Second, the probability of a rate hike in July is decreasing. Although according to the CME FedWatch Tool, the probability of a 25-basis-point scenario is nearly 58%. This can be explained by the fact that many currency strategists were already considering a pause in June, even before the inflation release, while also allowing for further tightening of monetary policy at one of the upcoming meetings, either in July or September. For example, the recent forecast by MUFG Bank suggests that the Federal Reserve will pause this month but simultaneously signal that it is indeed a pause and not the end of the current rate hike cycle. This way, the central bank would open the door for another rate hike, possibly at the July meeting.

Economists surveyed by Bloomberg also mostly stated that the Federal Reserve would take a break from rate hikes in June. However, opinions among respondents differed on whether this would mark the end of the current tightening cycle or just a temporary pause. Although most of them expressed confidence that the Federal Reserve would verbally leave the door open for further rate hikes in case inflation picks up again. In the accompanying statement, the central bank may indicate that it would utilize this option "if necessary."

There are recent examples of this: the Reserve Bank of Australia paused in April but then raised the rate twice in May and June. However, the Federal Reserve will not present such a generous gift to dollar bulls, at least verbally, in the context of announcing its further actions.

Conclusions

Overall, the situation regarding the EUR/USD pair remains uncertain ahead of the announcement of the outcomes of the June Federal Reserve meeting. However, today buyers of the pair obtained an important advantage that increases the probability of a bullish trend in the near term. Today's release is another argument in favor of a wait-and-see position from the Federal Reserve, and this argument is far from being the only one. It is necessary to recall Jerome Powell's (quite resonant) May speech, during which he expressed concerns about the crisis in the banking sector and hinted at a possible pause in rate hikes in that context. Evidently, the spring "banking turmoil" will continue to haunt the hawks at the Federal Reserve for quite some time.

Nevertheless, despite the rise in EUR/USD, opening long positions on the pair is risky. The probability of a 25-basis-point rate hike in the June meeting has dropped to zero, but the prospects for the July meeting remain unclear. Hypothetically, the market could interpret the vague wording about "possible future hikes" as a hawkish signal. In such a case, the dollar would remain afloat and attempt to regain lost ground. In the face of such uncertainty, staying out of the market is advisable.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română