EUR/USD

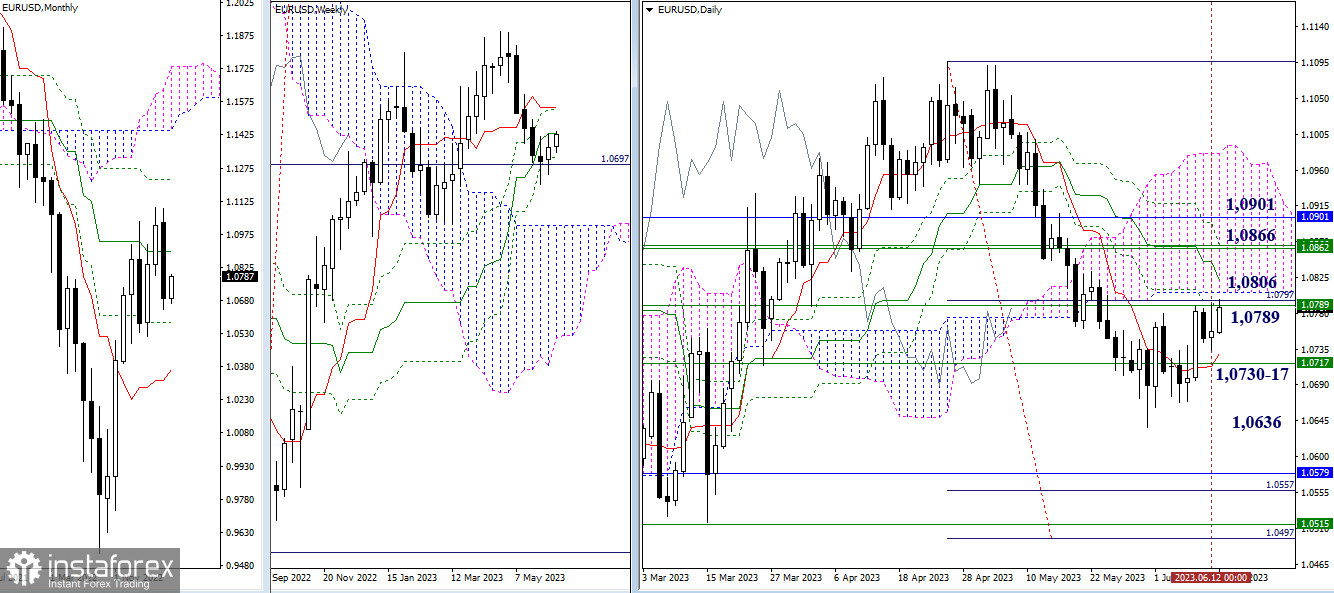

Higher timeframes

Uncertainty prevailed last week. However, bullish players managed to rise above important resistances on higher timeframes and began testing them. The success of this endeavor will allow them to gain support from the weekly medium-term trend (1.0789) and reenter the daily cloud (1.0806). The next bullish tasks will involve eliminating the daily cross (1.0821 - 1.0865) and gaining support from the weekly short-term trend (1.0866), as well as shifting the monthly medium-term trend (1.0901) in favor of bullish players. In the event of a rebound formation, the pair will return to a bearish position, and the first step on this path would be to overcome the range of 1.0730 - 1.0717 (daily short-term trend + final level of the weekly cross) and establish a new local low (1.0636).

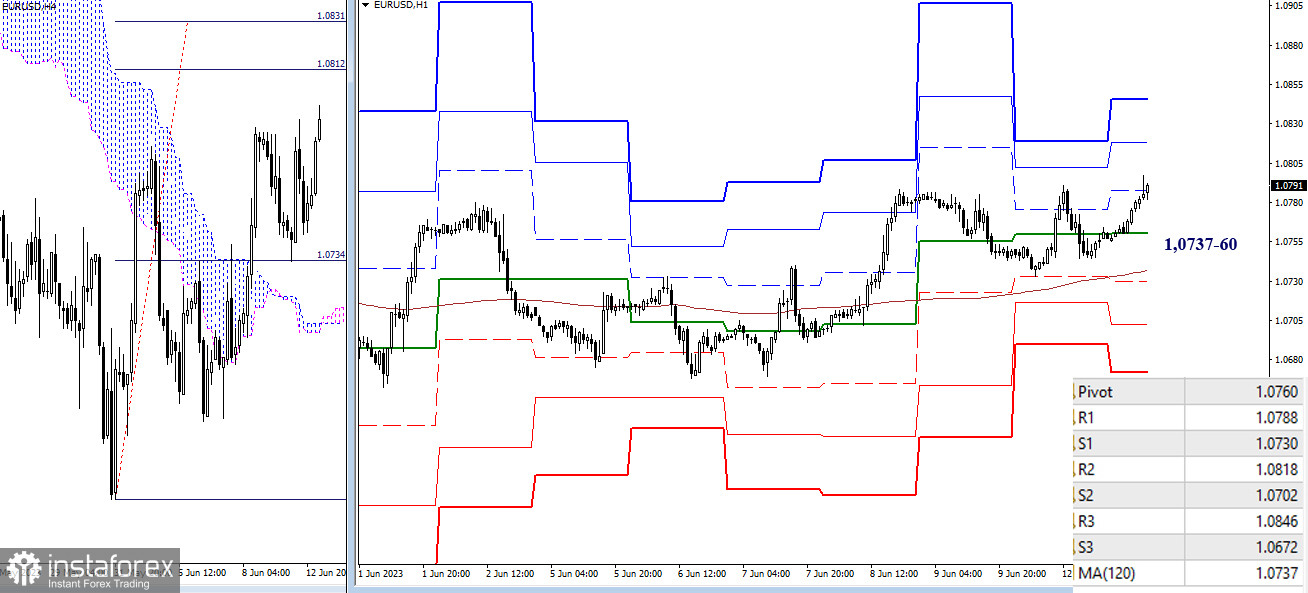

H4 - H1

Today on lower timeframes, bulls have updated the previous high and are testing the first resistance of the classic pivot points (1.0788). Furthermore, their bullish targets include R2 (1.0818) - R3 (1.0846) and breaking through the H4 cloud (1.0812-31). Today, key levels serve as supports. In the event of a correction, they will encounter the pair around 1.0760-37 (central pivot point + weekly long-term correction). Further strengthening of bearish sentiments may occur through breaking the supports of the classic pivot points (1.0730 - 1.0702 - 1.0672).

***

GBP/USD

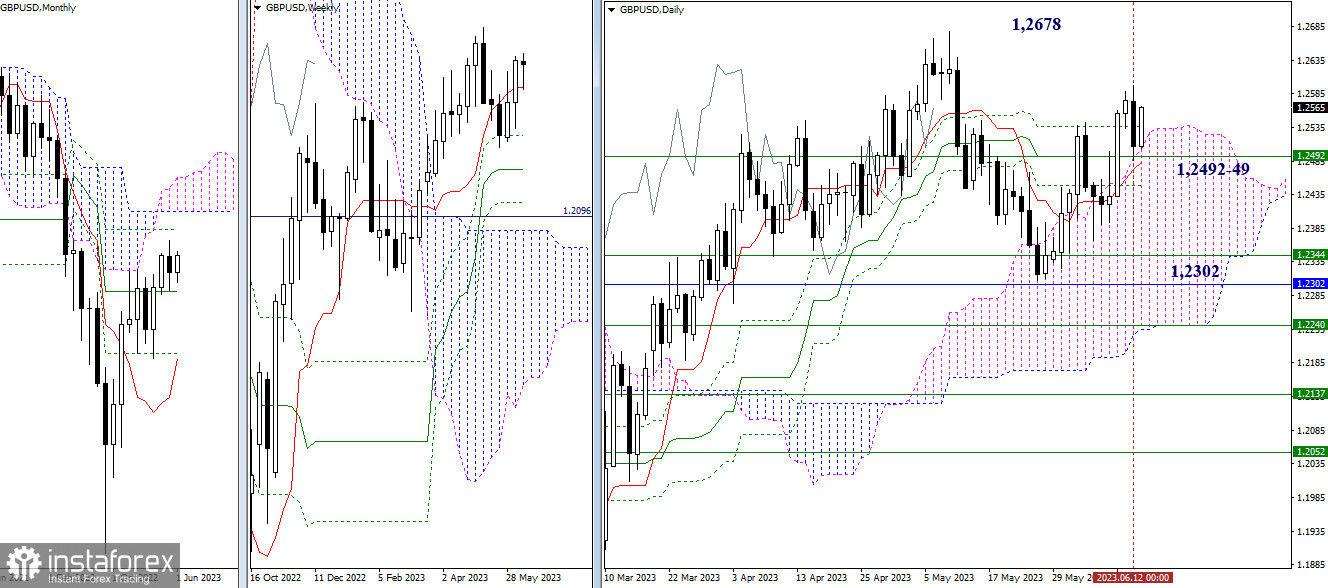

Higher timeframes

The previous week ended with some bullish optimism. The current week should determine whether the bulls have enough strength and desire to continue the ascent, aiming to exit the weekly correction zone (1.2678). Failure of bulls and bearish activity may push the market beyond the supports of the weekly short-term trend (1.2492) and the daily cross (1.2449). Further attention will be directed towards bearish players regaining such an important support level as the monthly medium-term trend (1.2302).

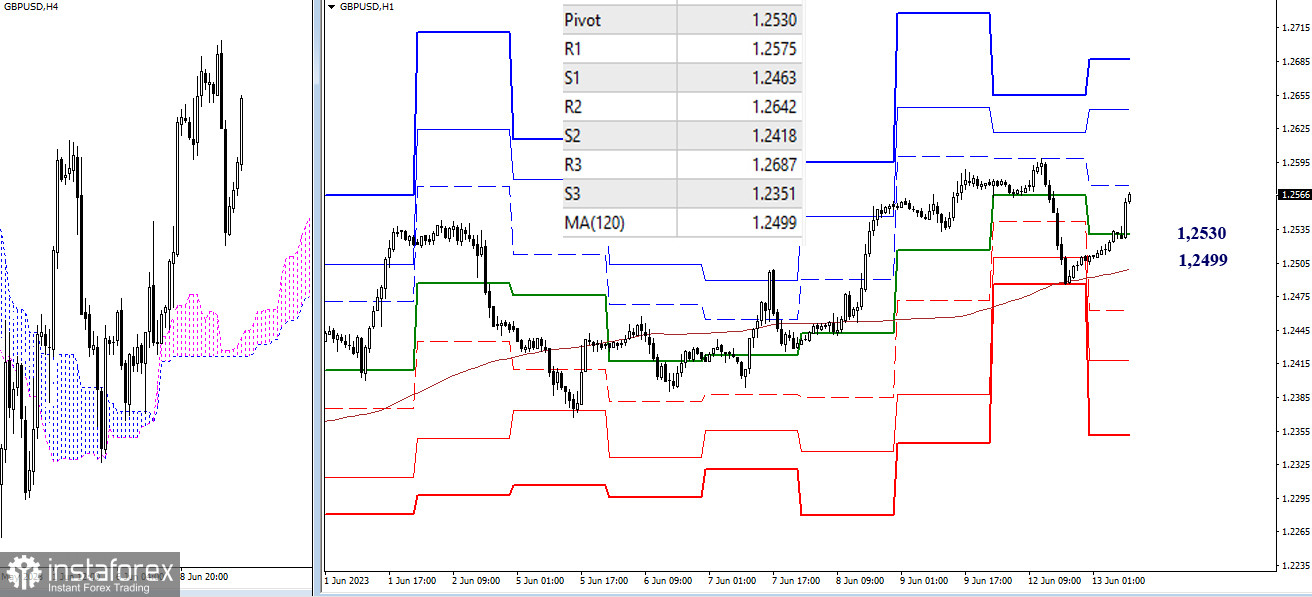

H4 - H1

On lower timeframes, the weekly long-term trend held the market from shifting the balance of power. While maintaining their main advantage, bulls are attempting to regain their positions today. Currently, they have reached the first resistance of the classic pivot points (1.2575). Furthermore, if the ascent continues, R2 (1.2642) and R3 (1.2687) will come into play. Key levels today are located within 1.2530 (central pivot point of the day) and 1.2499 (weekly long-term trend). A breakthrough and consolidation below these levels will change the current balance of power. In the event of a decline, the next targets will be the supports of the classic pivot points (1.2463 - 1.2418 - 1.2351).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română