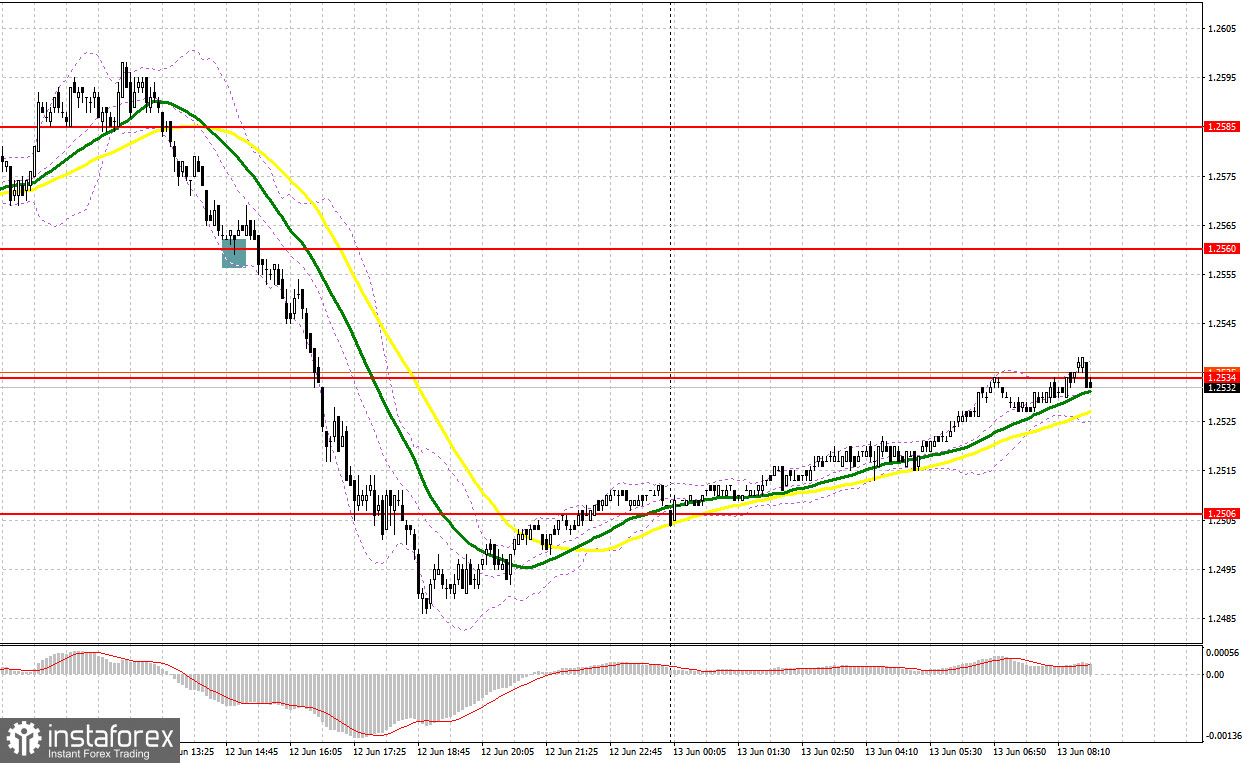

Yesterday, there were several entry points. Now, let's look at the 5-minute chart and figure out what actually happened. In my morning article, I turned your attention to 1.2587 and recommended making decisions with this level in focus. Bears managed to protect the resistance level 1.2587, which gave entry points into short positions. However, the pair failed to start a downward movement, which forced investors to activate Stop Loss orders. In the afternoon, bulls defended 1.2560, providing a buy signal. Yet, the fall of GBP/USD continued contrary to all expectations, which also led to losses.

When to open long positions on GBP/USD:

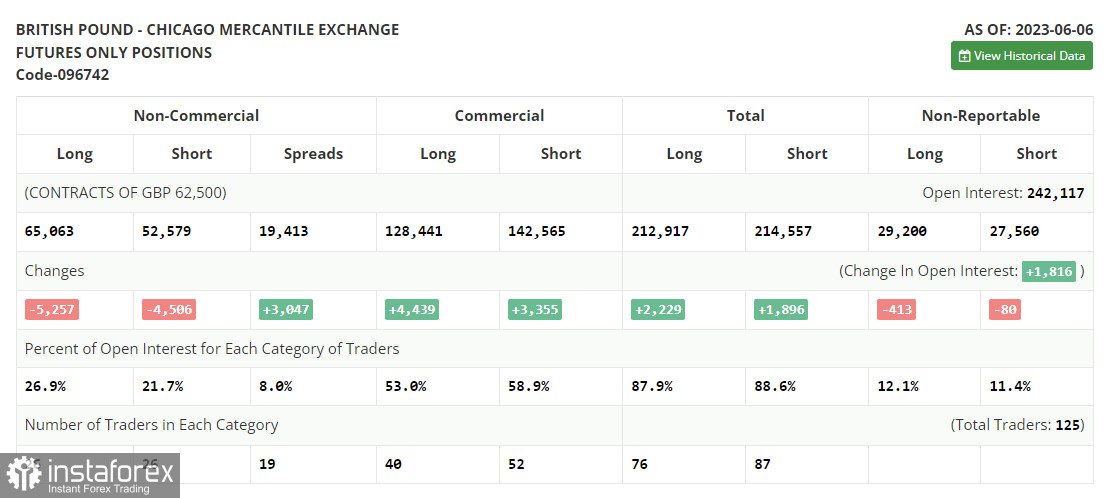

Before moving to the technical outlook of the pound sterling, let's look at what happened in the futures market. According to the COT report (Commitment of Traders) for June 6, there was a drop in short and long positions. The pound sterling has risen markedly recently. It means that investors are betting on further aggressive tightening by the BoE. Risk appetite is growing amid expectations that the economy could avoid a recession this year. The Fed is widely expected to take a pause in the tightening cycle. It is extremely bullish for GBP/USD. The latest COT report showed that short non-commercial positions decreased by 4,056 to 52,579, while long non-commercial positions fell by 5,257 to 65,063. It led to a slight decline in the non-commercial net position to 12,454 against 13,235 a week earlier. The weekly price rose to 1.2434 against 1.2398.

Today, the UK will unveil a batch of economic reports, namely average weekly earnings and initial jobless claims data. If average earnings grow and initial jobless claims decrease the pair is likely to climb in the morning. If the unemployment rate in the UK, on the contrary, jumps, it will put pressure on the pound sterling. It may trigger a fall to 1.2516. At this level, I'm going to enter the market. A false breakout there will signal the presence of big traders in the market, which will give an excellent entry point into long positions. The pair could recover to 1.2553. A breakout and a downward retest of this level will create a buy signal, which could push the pair to a monthly high of 1.2596. Without reaching this level, it will be difficult for GBP/USD to maintain its bull run. If the pair rises to this level, it may approach 1.2636 where I recommend locking in profits.

If GBP/USD falls and bulls fail to defend 1.2516, the pressure on the pound sterling will escalate. If so, I would advise you to postpone long positions until a false breakout of 1.2479. You could buy GBP/USD at a bounce from 1.2444, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on GBP/USD:

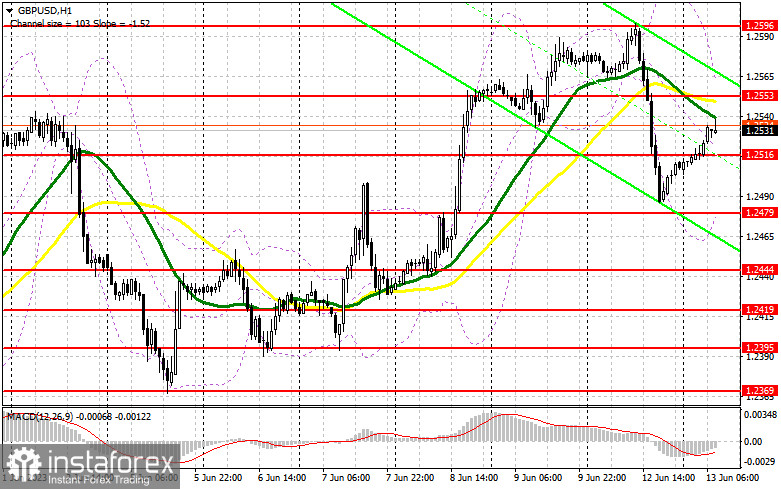

Bears have already lost control today. Upbeat macro stats could help bulls to push the pair to the resistance level of 1.2553 where the moving averages are passing in negative territory. Therefore, only a false breakout may give a sell signal in the expectation of a decline to the support level of 1.2516. This drop should be quite fast. If the pair does not fall after a false breakout, it is better to close short positions. A breakout and an upward retest of 1.2516 will provide an entry point into short positions. the pair is likely to decrease to 1.2479 which will allow sellers to return the market under their control. A more distant target level will be a low of 1.2444 where I recommend locking in profits.

If GBP/USD rises and bears fail to protect 1.2553 after positive reports, bulls are likely to regain control. In this case, only a false breakout of the resistance level of 1.2596 could create an entry point into short positions. If there is no downward movement from this level, I would advise you to sell GBP/USD from 1.2636, keeping in mind a downward intraday correction of 30-35 pips.

Indicators' signals:

Trading is carried out below the 30 and 50 daily moving averages, which indicates bears' attempt to keep the market under their control.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of a rise, the indicator's upper border at 1.2562 will act as resistance. If the pair decline, the indicator's lower border at 1.2479 will serve as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română