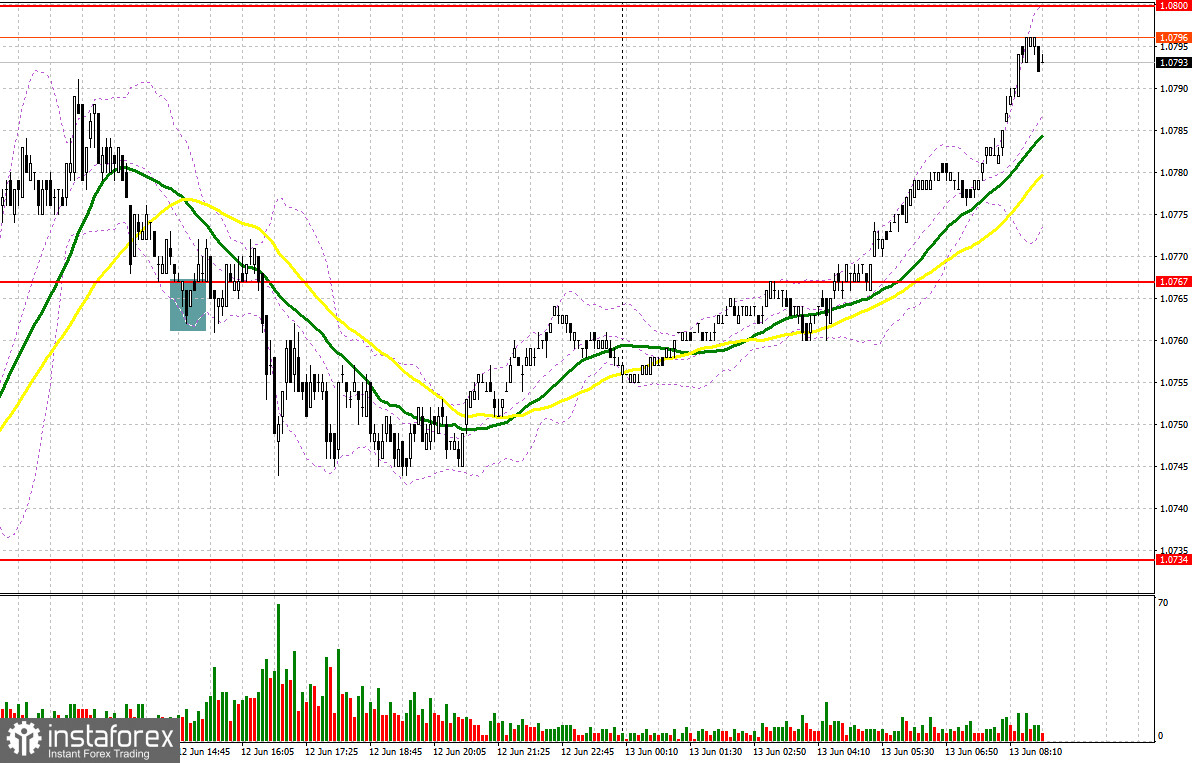

Yesterday, several entry signals came. Let's look at the 5-minute chart to get a picture of what happened. Previously, I considered entering the market from the level of 1.0784. Growth and a false breakout through 1.0784 generated a sell signal, but a significant downward movement did not occur. In the second half of the day, after a false breakout through 1.0767, I closed losing trades. No surge in price followed.

When to open long positions on EUR/USD:

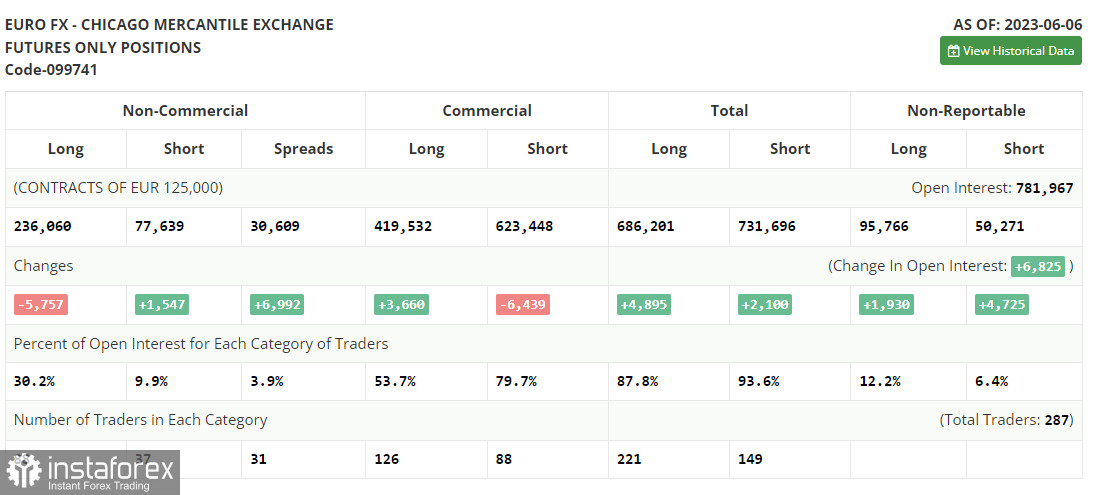

Before analyzing EUR/USD, let's see what happened in the futures market and how the Commitments of Traders changed. The COT report for June 6 revealed a fall in long positions and a slight increase in short positions. The decision of the Federal Reserve on interest rates this week can significantly change the situation in the market. If the Federal Reserve decides to pause hiking rates, the euro will gain significantly while the US dollar will weaken. With an aggressive European Central Bank and despite the signs of a slowdown in underlying inflationary pressures, risk assets will likely continue strengthening against the US dollar. According to the COT report, non-commercial long positions decreased by 5,757 to 236,060, while non-commercial short positions increased by 1,457 to 77,060. The overall non-commercial net position dropped to 158,224 from 163,054. The weekly closing price fell to 1.0702 from 1.0732.

Today, in the first half of the day, euro buyers will face significant challenges as disappointing statistics are expected from Germany and the eurozone. However, for us as traders, this is actually a favorable situation as it allows us to enter the market on a decline. A steep drop in the ZEW economic sentiment index in Germany and the eurozone will cause a fall in EUR/USD towards 1.0767, which is in line with the bullish moving averages. I will open long positions only after a false breakout through the mark, anticipating a surge toward new weekly resistance at 1.0800. A breakout and a downside test of this range will strengthen demand, creating an additional buy entry point, with a target at a high of 1.0830. The ultimate target remains in the area of 1.0870, where I will take profits.

Bearish activity may increase only happen if Germany's inflation shows a sharp decrease and if there is a lack of buyers at 1.0767. In such a case, the pair will feel an increase in pressure. Therefore, only a false breakout around the next support level at 1.0734 will generate a buy signal. I will open long positions only on a bounce from a low of 1.0705, allowing an upward correction of 30-35 pips within the day.

When to open short positions on EUR/USD:

Volatility is high ahead of the meetings of the Federal Reserve and the European Central Bank, which makes it difficult to determine who has full control over the market. If an upward correction that started during the Asian session continues, the bears should protect the nearest resistance level at 1.0800. A false breakout through this level will make a sell signal, targeting intermediate support at 1.0767. In case of consolidation below this range, as well as an upside retest, the pair will head toward 1.0734. The most distant target is seen at a low of 1.0705, where I will take profit. In case of growth in EUR/USD during the European session and the absence of bears at 1.0800, which cannot be ruled out if Germany and the eurozone publish upbeat data, bullish sentiment will improve. The bulls will attempt to regain control of the market. In such a case, I will open short positions at 1.0830 after failed consolidation. I will also open short positions immediately on a bounce from a high of 1.0870, allowing a downward correction of 30-35 pips.

Indicator signals:

Moving averages:

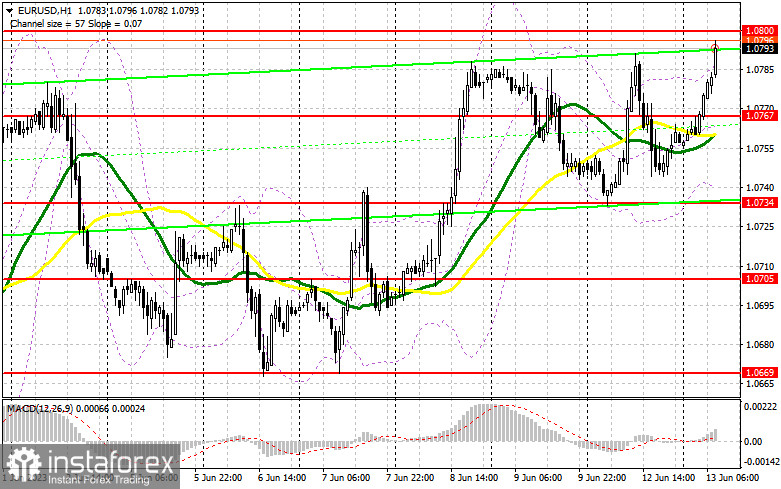

Trading is carried out above the 30-day and 50-day moving averages, which indicates a possibility of a bullish continuation.

Note: The author considers periods and prices of moving averages on the H1 (1-hour) chart that differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

Support stands at 1.0735, in line with the lower band. Resistance is seen at 1.0790, in line with the upper band.

Indicator description:

Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

Bollinger Bands. Period 20

Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

Long non-commercial positions are the total long position of non-commercial traders.

Non-commercial short positions are the total short position of non-commercial traders.

Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română