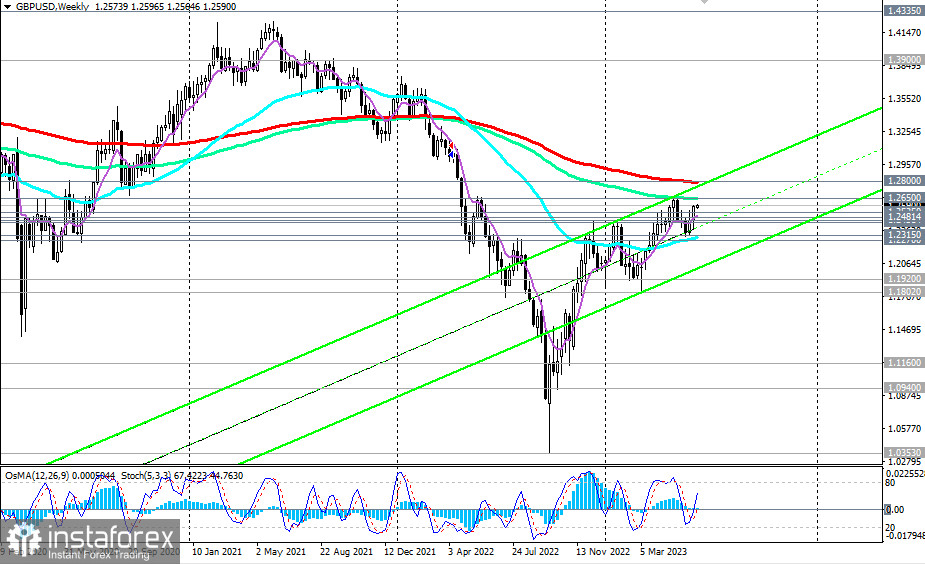

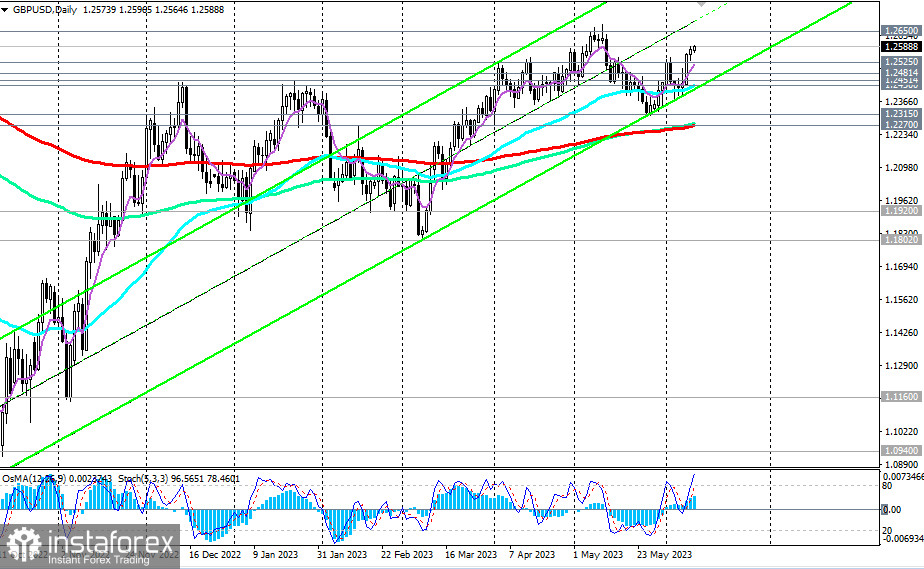

GBP/USD is trading in the zone of short-term and medium-term bullish markets, above key medium-term support levels of 1.2315 (50 EMA on the weekly chart), 1.2270 (200 EMA, 144 EMA on the daily chart), demonstrating a tendency for further growth.

In this regard, it is possible to enter long positions at the current price (1.2588 as of writing) with the prospect of growth towards the long-term resistance level of 1.2800 (200 EMA and upper boundary of the upward channel on the weekly chart).

In this case, a breakthrough of the resistance level at 1.2650 (144 EMA on the weekly chart) will confirm our assumption, and a breakthrough of the key long-term resistance level at 1.2800 will take GBP/USD into the zone of a long-term bullish market.

The ultimate growth targets are the key strategic resistance levels of 1.3900 (144 EMA on the monthly chart) and 1.4335 (200 EMA on the monthly chart), below which GBP/USD remains in the zone of a global bearish market.

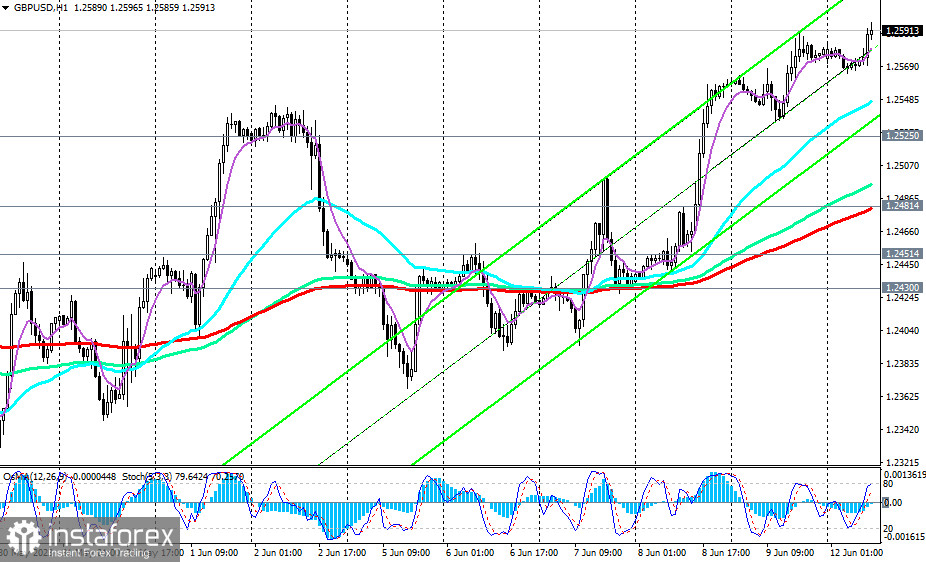

In an alternative scenario, a breakthrough of the local support level at 1.2525 will be the first signal to resume short positions, and a breakthrough of the important short-term support level at 1.2481 (200 EMA on the 1-hour chart) will confirm it. A breakthrough of the key support level at 1.2270 will return GBP/USD to the long-term bearish market zone.

Support levels: 1.2525, 1.2500, 1.2481, 1.2451, 1.2430, 1.2400, 1.2315, 1.2300, 1.2270

Resistance levels: 1.2600, 1.2650, 1.2700, 1.2800

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română