The previous trading week was characterized by complete dominance of sellers for Bitcoin. The asset's price constantly tested local support levels, but the bulls managed to resist. However, with a decrease in trading activity over the weekend, the cryptocurrency was not spared from a collapse and experienced a bearish breakthrough below the $26k level.

The dominance of bears continues, and there are all reasons to believe that the price of BTC will continue to decline. At the same time, the macro situation continues to improve, and if all positive forecasts are realized, Bitcoin bulls will have the opportunity to regain their positions and continue the upward movement.

Fundamental Background

The current week promises to be extremely volatile due to a number of key macroeconomic factors. First and foremost, the publication of inflation data and the Federal Reserve meeting are expected. Regarding these events, the market is highly optimistic, which ultimately can work in favor of Bitcoin.

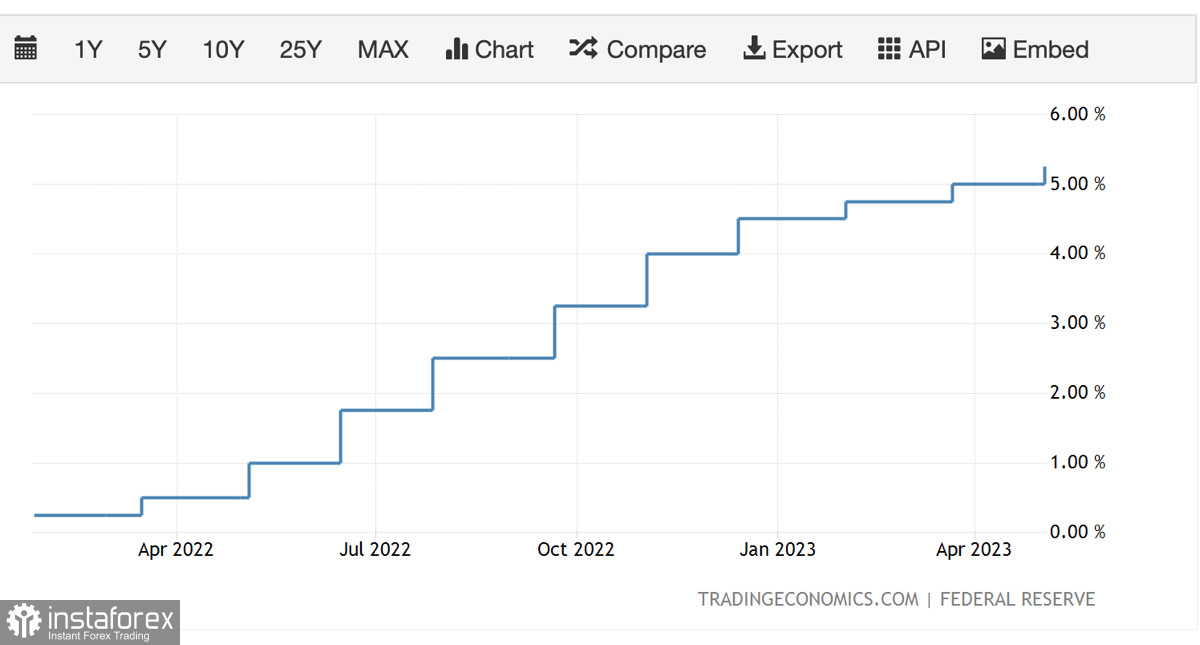

Investors and analysts believe that the consumer price index for May will decrease from 4.9% to 4.1%. BBG's survey also shows that investors are confident that the Fed will pause raising the key interest rate in June. Furthermore, an increasing number of investors are confident that the rate reduction cycle will begin in late summer or early fall 2023.

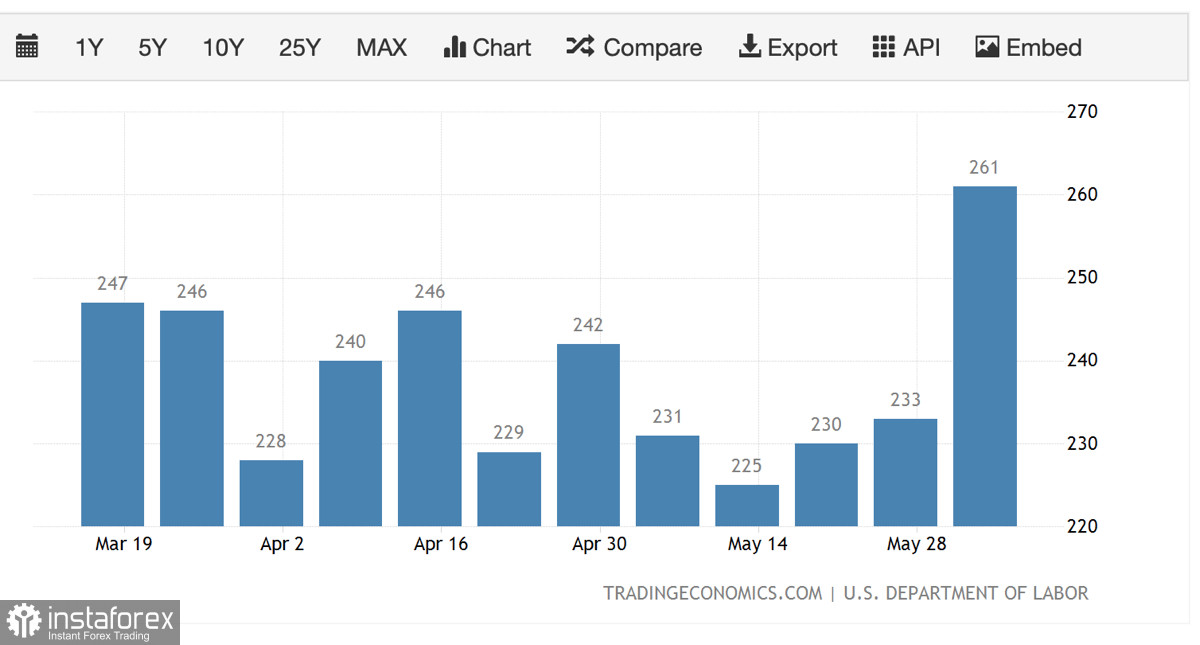

Such a scenario is quite realistic, as the main argument of the Federal Reserve, namely the labor market, is starting to show weakness. According to the latest data, the figure reached 260,000 initial jobless claims, exceeding expectations of 240,000. However, a stable decline in the inflation rate remains the main requirement for the Federal Reserve to loosen its grip.

As for the events in the crypto market, the situation is not as optimistic as on the macro front. The regulatory policies of the SEC continue to negatively impact investor interest in cryptocurrencies. The main news of recent days is that the largest retail trading platform in the United States has delisted Cardano, Polygon, and Solana. All three assets are among the top 15 cryptocurrencies by market capitalization.

BTC/USD Analysis

The situation in the Bitcoin market remains ambiguous. On one hand, there is low trading activity from buyers, resulting in a decline in the asset's market capitalization. On the other hand, active accumulation continues, and CryptoQuant has been recording significant outflows of BTC from centralized exchanges for several consecutive weeks.

The number of unique addresses in the BTC network also continues to grow and has already reached a 6-week high. Given the panic sentiments within and around the crypto industry, this may be associated with funds flowing out of centralized platforms amid the aggressive policies of the SEC.

As of June 12, the peak of the bullish trend for BTC was at $31k, after which the price dropped to the base of the upward trend near the $25k level. Over the past two months, the asset has lost 18% of its market capitalization and is on the verge of completely breaking the structure of the upward trend.

In the past eight days, BTC has dipped below the $25.5k level five times, ultimately leading to a shift in the range of trading activity. The main target for bears remains the $24.6k–$25k range, and a break below it would disrupt the structure of the upward trend.

As of June 12, the BTC weekly chart indicates that bearish targets may be reached. The main technical metrics continue their downward movement, indicating the strength of the downward trend. However, positive macro events in the coming days may disrupt the bears' plans.

Conclusion

Bitcoin is within a downward trend and is approaching the final breakdown of the structure of the upward trend. However, impulsive price movements due to expected positive macro events may help BTC return to the consolidation range of $26.5k–$27.5k. At the same time, it is unlikely that this will significantly change the situation in the BTC market.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română