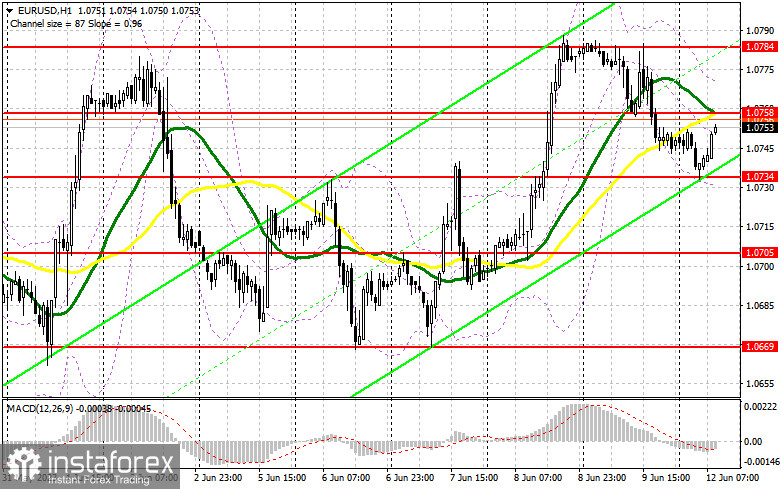

Yesterday, there were no signals to enter the market. Let's look at the 5-minute chart and figure out what happened. Previously, I considered entering the market from 1.0768. The euro fell but there was no false breakout. In the second half of the day, trading around 1.0768 did not generate any signals either.

For long positions on EUR/USD:

Today's lack of data could help the euro compensate for Friday's losses. However, you should be careful ahead of the Federal Reserve's important meeting, since it is not clear what the central bank will do. For this reason, action will only be taken on the support level of 1.0734, which was formed at the end of the day. A false breakout of this level would create a buy signal, allowing the pair to reach a new resistance around 1.0758, which is in line with the bearish moving averages. A breakout and a downward retest of this range would increase the demand for EUR, maintaining its chance to rise to 1.0784. The level of 1.0870 remains the most distant target, where I will take profit.

If EUR/USD declines and bulls are idle at 1.0734, which is more likely in the morning, pressure on the pair will significantly increase, and bears will attempt to erase Thursday's gains.Therefore, only the formation of a false breakout of the next support level of 1.0705 would provide a buy signal for the euro. I will open long positions immediately if EUR/USD bounces off the low at 1.0669 targeting an upward intraday correction of 30-35 pips.

For short positions on EUR/USD:

The bears are doing quite well and now we have to do everything to stop the price from climbing above 1.0758, which was last Friday's support. A false breakout at 1.0758 A false breakout at this level would provide a sell signal capable of pushing EUR/USD towards 1.0734, which is an important support that plays an important role in the pair's daily direction. Consolidation below this range, as well as a reverse test from below to above, would pave the way to 1.0705. The ultimate target would be the low at 1.0669, where I will take profits.

If EUR/USD rises during the European session and bears are idle around 1.0758, trading will move to the side channel, which will probably take advantage of the pause in the Fed's rate hike cycle, which might be announced this Wednesday. In that case, I will postpone going short on the pair until it reaches the next resistance level of 1.0784 . New short positions can also be opened there, but only after a failed consolidation. I will open short positions immediately if EUR/USD bounces off the high of 1.0807, targeting a downward correction of 30-35 pips.

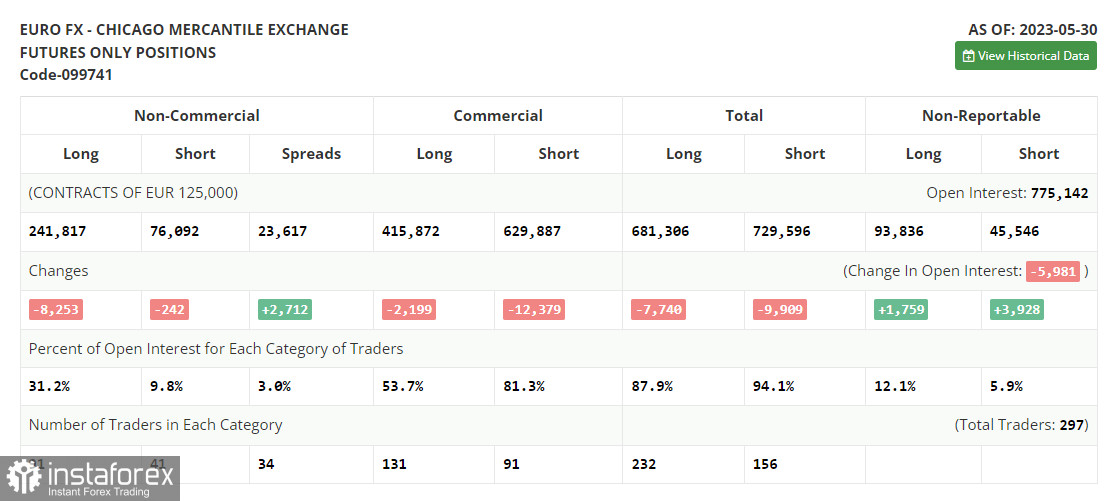

COT report:

According to the COT report (Commitment of Traders) for May 30, there was a decline in long and short positions. However, a drop in long positions was bigger. It indicates falling demand for risk assets. Traders are unwilling to buy the euro due to fears of a slowdown in the European economy and a recession. What is more, the ECB sticks to aggressive monetary tightening even despite the first signs of a steady decline in inflation. Therefore, they prefer a wait-and-see approach. Meanwhile, the US labor remains resilient. Even if the Fed takes a pause in June, it is likely to keep raising rates, boosting demand for the US dollar. The COT report showed that long non-commercial positions decreased by 8,253 to 241,817, while short non-commercial positions fell by 242 to 76,092. At the end of the week, the total non-commercial net position amounted to 163,054 against 185,045. The weekly closing price slipped to 1.0732 against 1.0793.

Indicator signals:

Moving Averages

Trading is carried out below the 30 and 50-day moving averages, which indicates bearish attempts to return to the market.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair falls, the lower band of the indicator at 1.0734 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română