GBP/USD

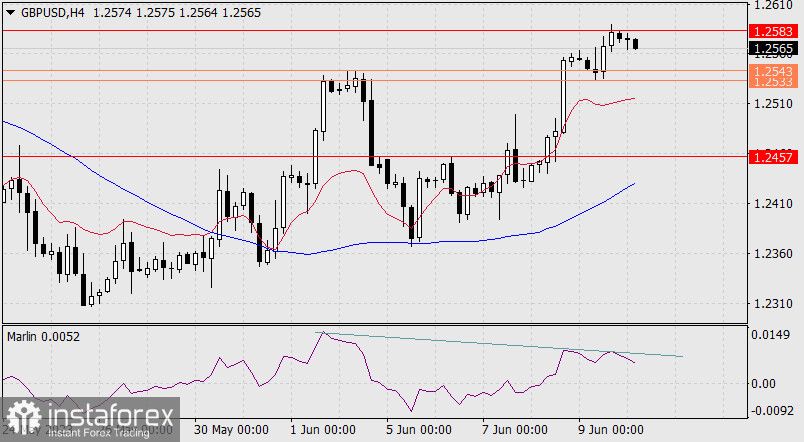

On Friday, the British pound reached the target level at 1.2583. This morning, it is slightly declining with the support of the downward-turning Marlin oscillator. The first target for the decline is the support level at 1.2457, followed by the MACD indicator line at 1.2410.

To solidify the medium-term trend, it needs to fall by at least 150 points. This could happen quickly if the Federal Reserve raises interest rates on Wednesday. We believe that the central bank will raise rates, making the 1.2273 target - the April 3rd low - a prospective short-term target.

On the 4-hour chart, the price divergence with the oscillator is strengthening. However, here, as well as on the daily chart, the price is above the balance indicator line (red), so the decline may be feeble, especially considering that the US will release important inflation data tomorrow. The range of the nearest extremes at 1.2533/43 provides support as we wait.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română