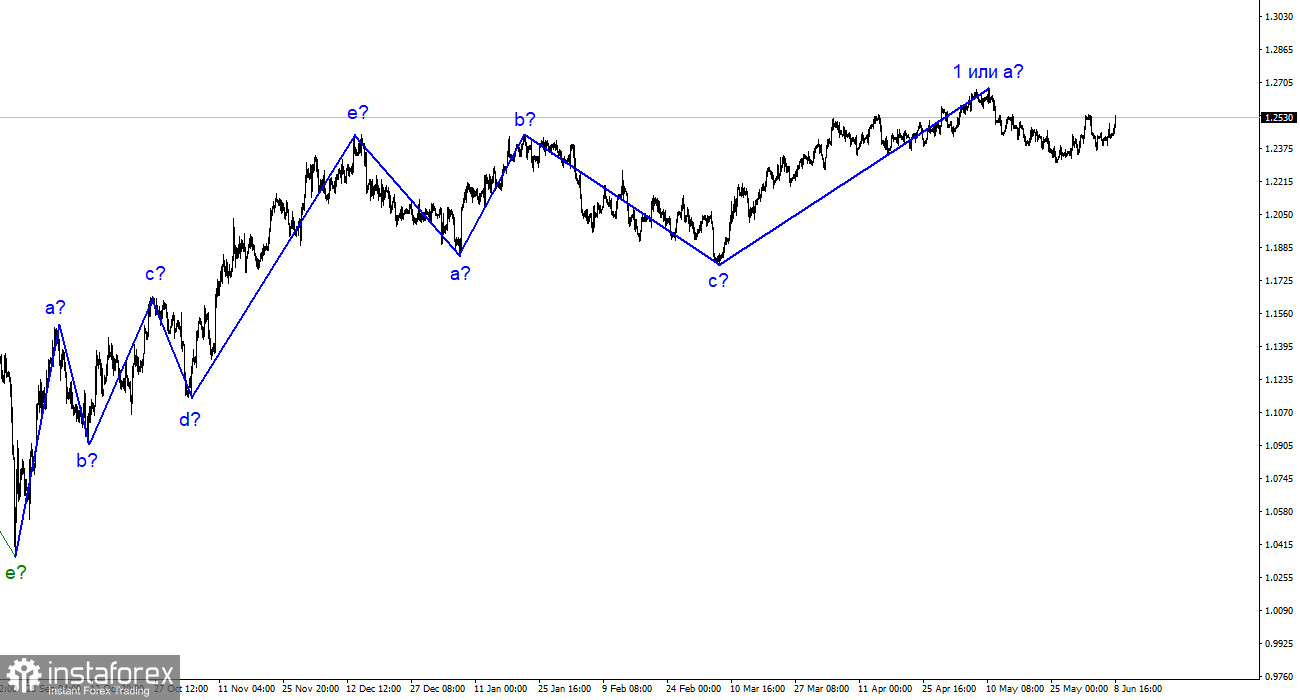

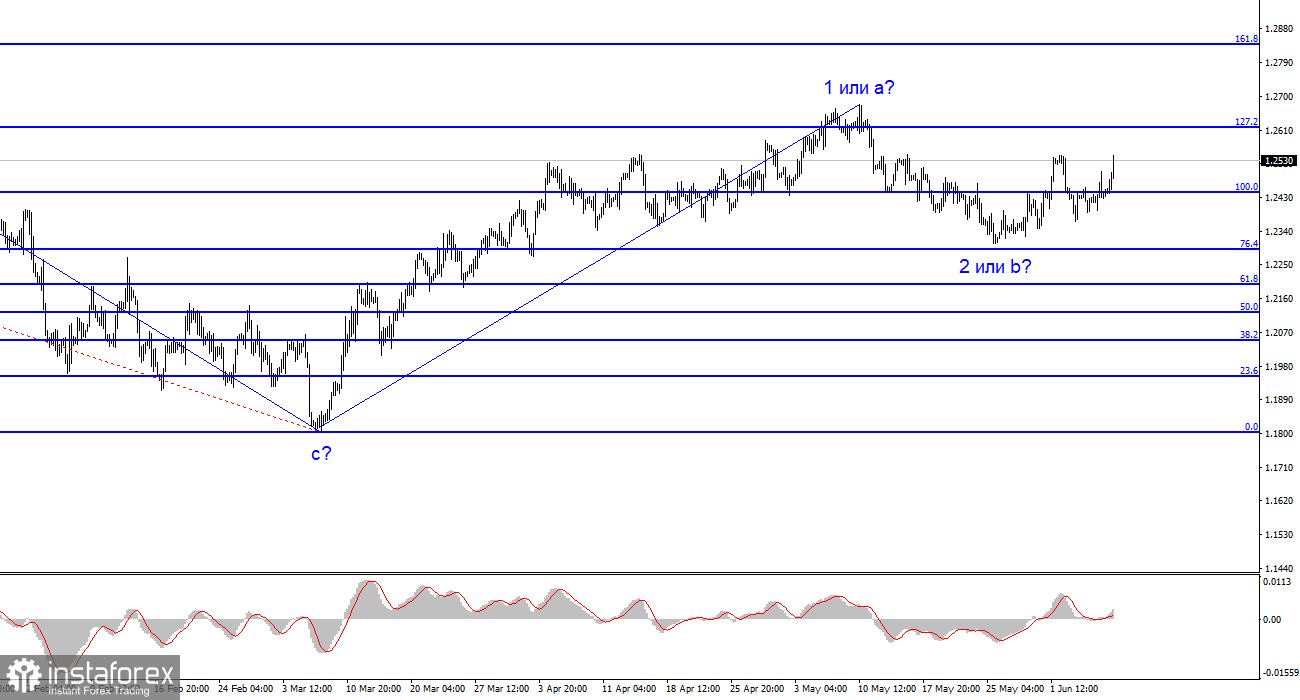

The wave analysis for the pound/dollar pair looks complex and ambiguous. After a horizontal correction phase of the trend, I expected a similar downward slope, but the rise in quotes over the past two weeks suggests that the market is ready to build a full-fledged upward impulse trend. The presumed wave 2 or b could have completed its formation last week. If this is the case, forming an ascending wave 3 or c has already begun, providing an excellent opportunity for the British pound to rise to the 26-30 figure range. It is up to you to decide whether the current news background justifies this. Throughout this week, there has been almost no news in favor of the British pound.

The wave pattern for the EUR/USD pair will significantly differ from that of GBP/USD, which is already starting to do so. The euro is expected to build a descending wave set, and the hypothetical complexity of the upward trend segment needs to be added to the agenda. At the same time, everything indicates a new upward trend segment for the British pound. The news background for the sterling pound has hardly changed recently, so what is driving the market to increase demand for the pound?

The British pound is rising quite logically if we disregard the news background.

The pound/dollar exchange rate increased by 100 basis points on Thursday. The Euro currency had at least one report, which it successfully ignored, while the British pound had none, and it rose even stronger than the euro. If we look at the current wave analysis, it does not seem that the pound is moving strangely. Rather, its increase fully corresponds to the current wave pattern. Only two aspects raise questions. First, the mismatch in wave patterns between the euro and the pound. Second, the news background.

From a wave perspective, it is possible to construct an ascending trend segment, even a five-wave impulse. Therefore, even without news support, the British pound can enjoy demand. However, the current news background is either absent, neutral or not in favor of the pound. Global factors are needed for the market to confidently and persistently increase demand for the pound. I can only assume one thing: the market believes that the Bank of England will continue to raise interest rates not just once or twice soon but for much longer. I don't know the basis for such assumptions. The Bank of England has indicated with its actions that there will be at most two more tightenings. The rate has been rising for over a year and has increased 12 times. It has already reached 4.5%. Inflation is falling slightly, but the economy may soon decline rapidly.

General conclusions.

The wave pattern for the pound/dollar pair still suggests the formation of a descending wave. Wave b may be very deep, as all recent waves are approximately equal. However, the increase in recent weeks indicates a possible completion of this wave on May 25th. In this case, the trend segment may transform into a full-fledged ascending one, representing a completely different wave pattern and conclusions with recommendations. Therefore, at this point, I advise selling the pound with targets around the 23 and 22 figures, but now we need to wait for signals of a resumption of the descending wave, which are currently absent.

The picture resembles the euro/dollar pair on a larger wave scale, but there are still some differences. The descending correction phase of the trend is complete, but the formation of a descending wave is still ongoing. This wave may be deep and extensive, and the entire trend segment may be horizontal, just like the previous one.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română