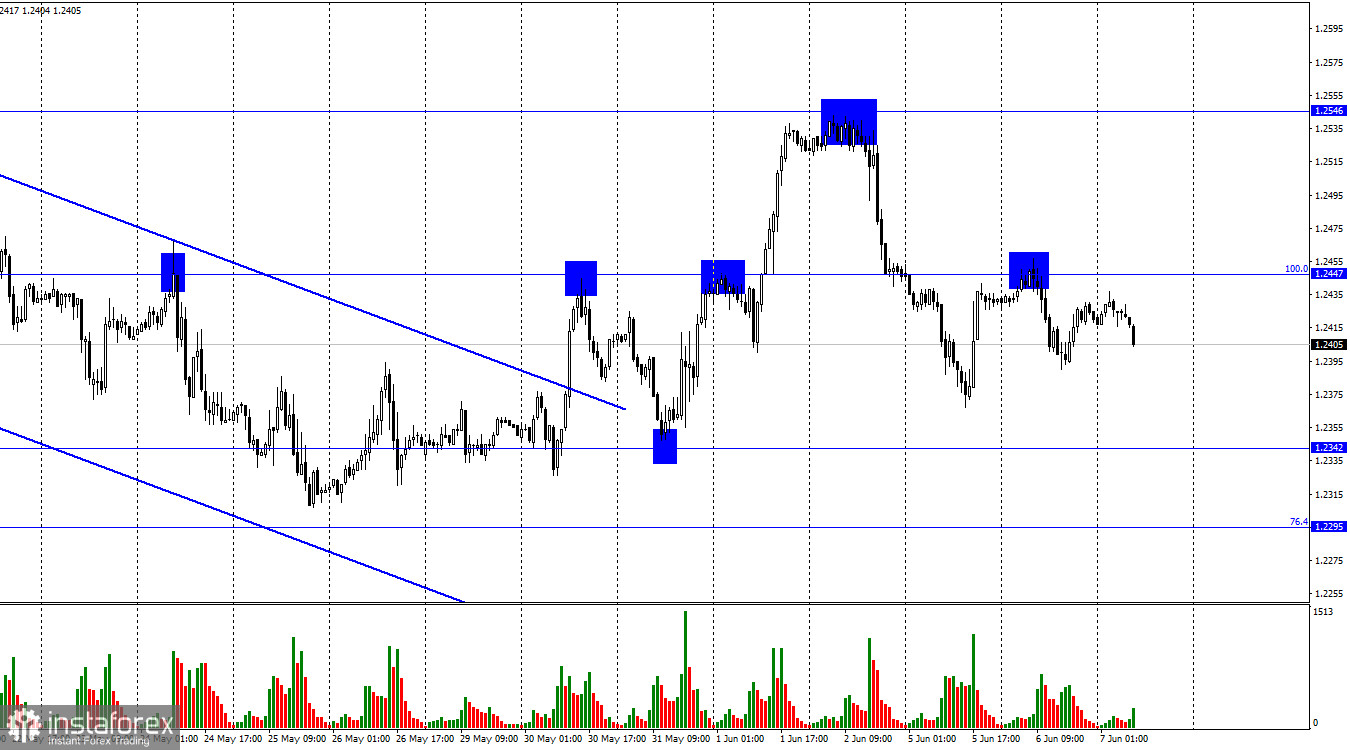

Good day, dear traders! On the hourly chart, GBP/USD bounced off the 100.0% Fibonacci level of 1.2447, reversed to the downside, and fell to the 1.2342 mark on Tuesday. Currently, traders can continue selling. A bounce off the 1.2342 level may cause a bullish reversal and growth toward the 1.2447 level. The pair has already bounced off this level before.

With a lack of fundamental factors, traders have to pay attention to far from the most important statistical data, which if they affect inflation and economic growth, do so very sluggishly and indirectly. Yesterday, for example, the construction PMI was released. It remained above 50 in May. This morning, the house price index was delivered. It barely changed on a monthly basis in May and decreased by 1% on an annual basis. The fall in housing prices provides support for the main inflation indicator, as it takes into account all prices in the UK. Thus, inflation is slowing down, which is good news for the Bank of England.

However, the BoE is still far from ending tightening. In June, traders expect the regulator to raise the interest rate by another 0.25% one of the last times perhaps. Indeed, interest rates have already been lifted 12 times and are currently at 4.5%. Inflation slowed down significantly in April. Andrew Bailey has repeatedly emphasized that he expects a decrease in the CPI from April. However, traders, aware of the current inflation level, are confident that rates will be raised some two more times. That is why the pound is in sluggish demand.

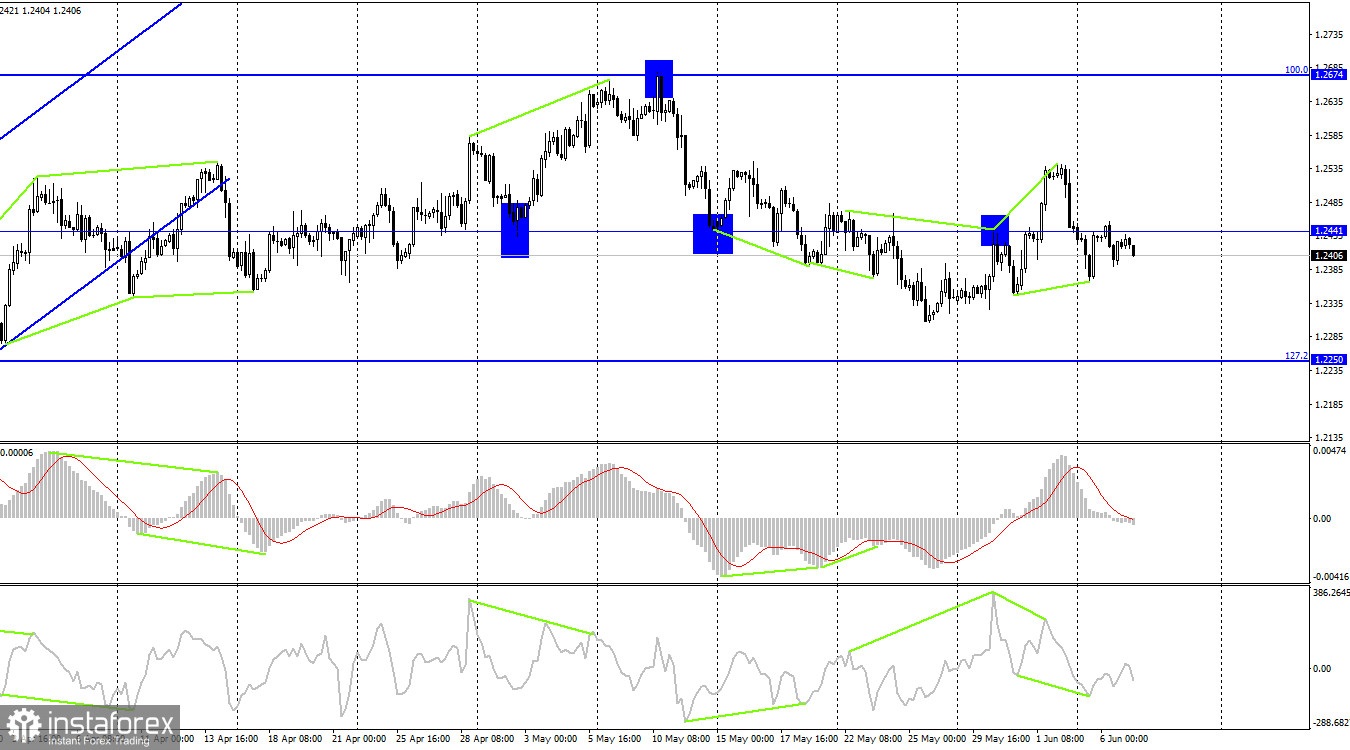

On the 4-hour chart, a bearish reversal occurred after the formation of a bearish CCI divergence. However, it was followed by a bullish CCI divergence, which helped the pair return to 1.2441. A rebound from this level triggered a decline in value to the retracement level of 1.2250.

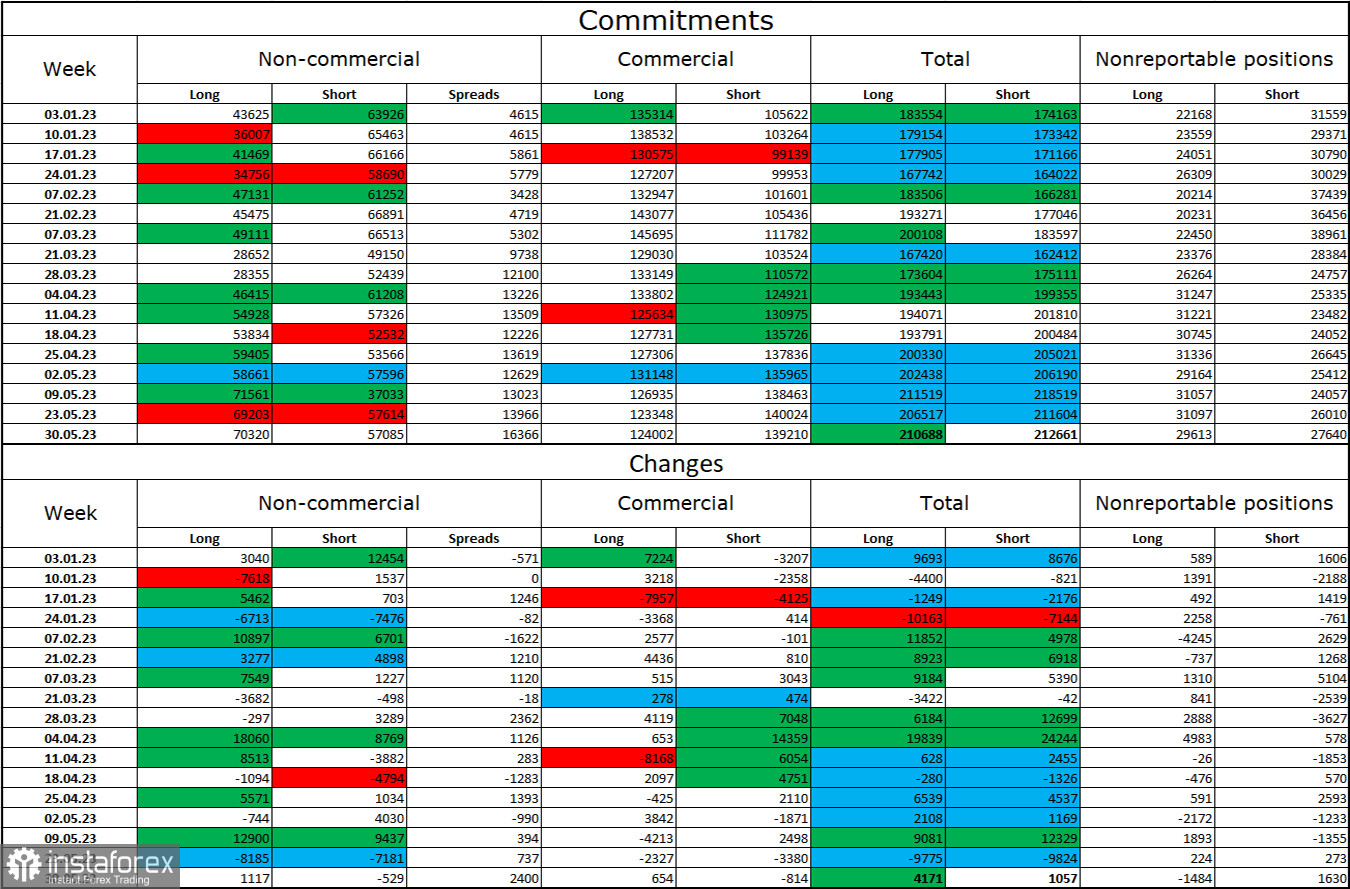

Commitments of Traders (COT):

The sentiment of non-commercial traders has become more bullish over the last reporting week. The number of long positions increased by 1,117 and that of short positions dropped by 529. Overall, the sentiment of large traders remains bullish. For a long time, it has been bearish. The number of long and short positions is now almost equal – 70,000 and 57,000 respectively. The pound sterling has enough growth potential but the fundamental backdrop is favorable neither for the US dollar nor the pound sterling. The latter has been bullish for a long time. The net position of non-commercial traders has been rising for a long time. It remains to be seen whether the British currency will climb on the same drivers. I believe we should not expect the upward trend to resume any time now.

Economic calendar:

United States – Balance of Trade (12-30 UTC).

On Wednesday, the economic calendar contains only one report from the US, which will hardly affect the greenback. In the second half of the day, the fundamental backdrop will unlikely have some influence on trader sentiment.

Outlook for GBP/USD:

We could open short positions after a pullback from 1.2447 on the hourly chart with targets at 1.2342 and 1.2295, and open long positions after a rebound from the levels of 1.2342 or 1.2295 with a target of 1.2447.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română