The U.S. Federal Reserve does not want to raise the federal funds rate in June but does not exclude monetary restrictions in July. Therefore, the U.S. dollar has taken a wait-and-see position, aided by a strong report on American employment. However, the correction in the EUR/USD pair did not materialize. On the other hand, the euro cannot restore its upward trend, hindered by the weakness of the German economy and a gradual decrease in inflation expectations in the eurozone.

An unpleasant surprise for the euro came in the form of a reduction in German manufacturing orders in April by 0.4% on a monthly basis, further worsening the prospects for the largest economy in the eurozone. Bloomberg experts predicted a confident growth of the indicator by 2.8%, but the actual result turned out to be much worse. After the recession from October to March, the German economy is heading towards stagnation. In such a context, a rally in EUR/USD would seem illogical.

Dynamics of production orders in Germany

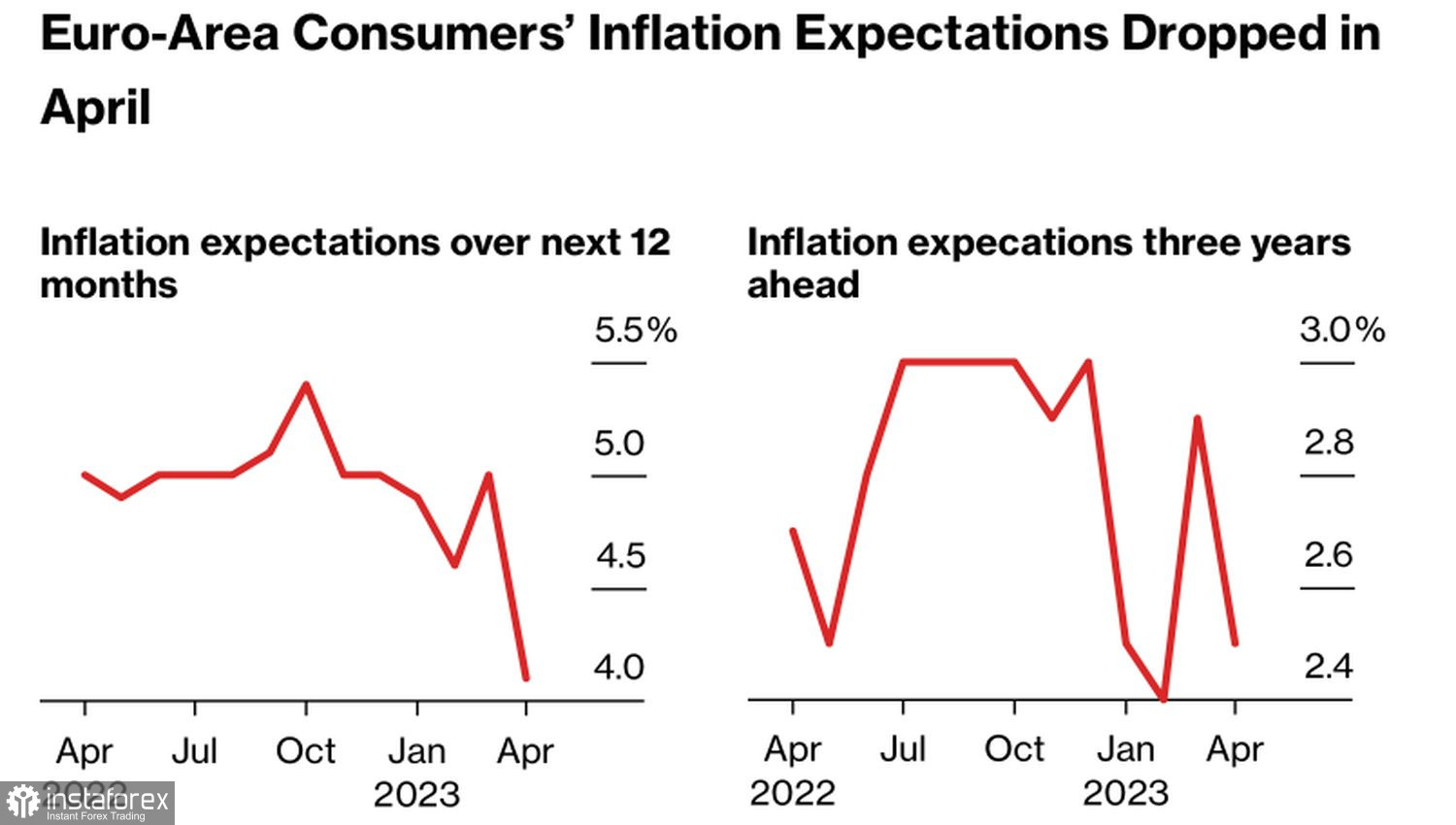

The decrease in 12-month inflation expectations in the eurozone from 5% to 4.1% also puts pressure on the euro. The indicator for the next three years has fallen from 2.9% to 2.5% and is approaching the medium-term target of 2%. It seems that the European Central Bank (ECB) is doing a good job and may not overdo it with raising the deposit rate. The spot market estimates its expected ceiling at 3.75%, refering to two acts of monetary restriction, each by 25 basis points. The tightening monetary policy cycle will likely be completed in the summer, depriving EUR/USD of an important trump card.

The "hawkish" statements of ECB President Christine Lagarde did not help the main currency pair. According to the Frenchwoman, interest rates will be brought to the restrictive levels that will allow inflation to return to the target of 2%. Then the cost of borrowing will remain at these levels for a long time.

Dynamics of inflation expectations in the eurozone

The sentiment in the non-manufacturing sector from the Institute for Supply Management spoiled the mood for the U.S. dollar. The May indicator came close to the critical level of 50. A drop below it would indicate a direct path to recession.

Thus, both the bulls and the bears in EUR/USD have their vulnerable spots. This circumstance increases the risks of consolidation for the main currency pair. Especially since the report on U.S. inflation and the FOMC meeting are just around the corner—it is better not to rush into medium-term long or short positions. As a result, the euro enters a narrow trading range against the U.S. dollar.

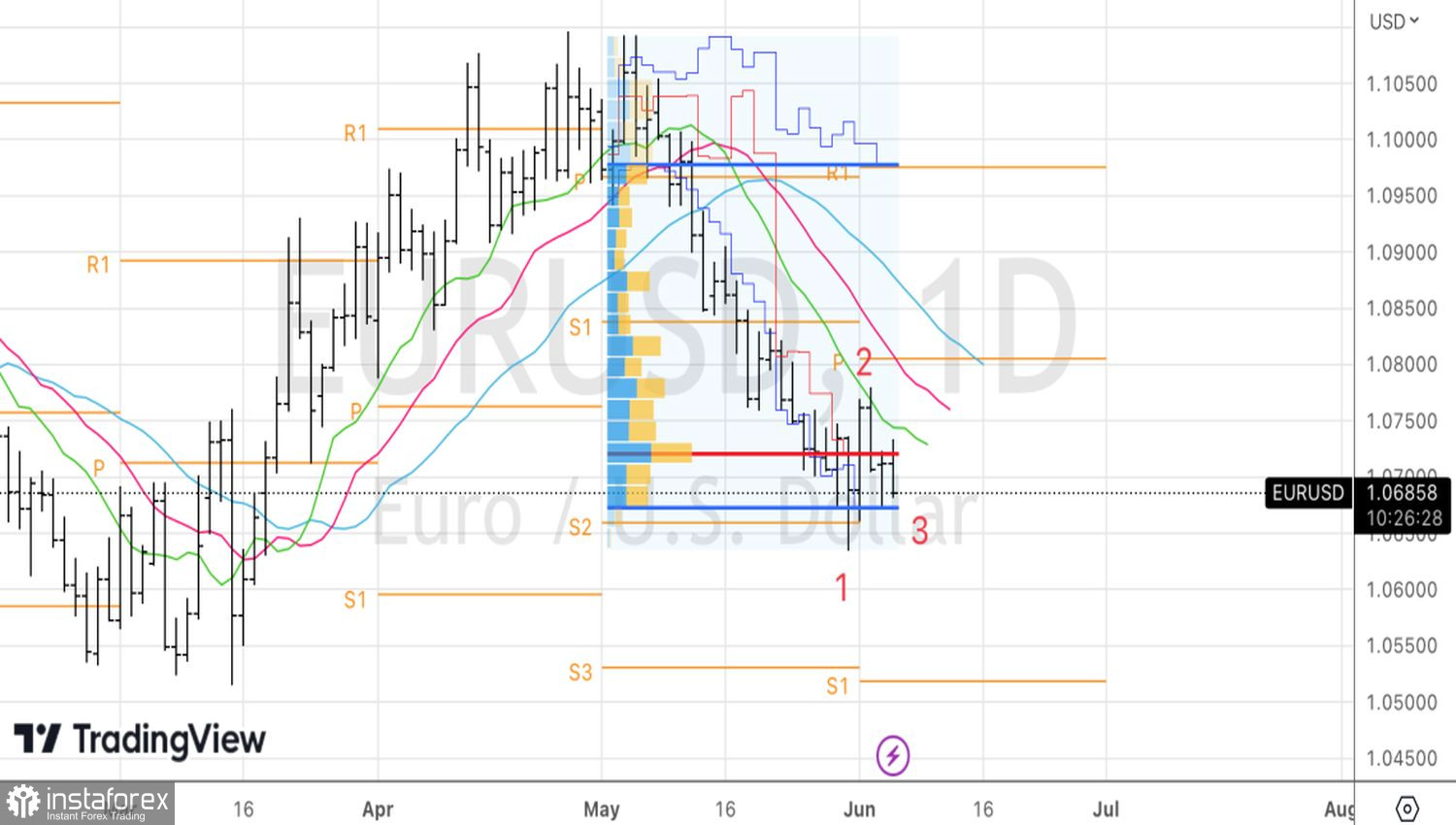

Technically, on the daily chart, EUR/USD may form a reversal pattern of 1-2-3. To activate it, a breakout of the correction high point 2 near 1.077 is required. However, more aggressive buyers may open long positions upon testing the dynamic resistance in the form of a moving average near 1.074. Conversely, a rebound from this level would be a signal of potential recovery in the downward trend and a reason to sell the euro against the U.S. dollar.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română