EUR/USD

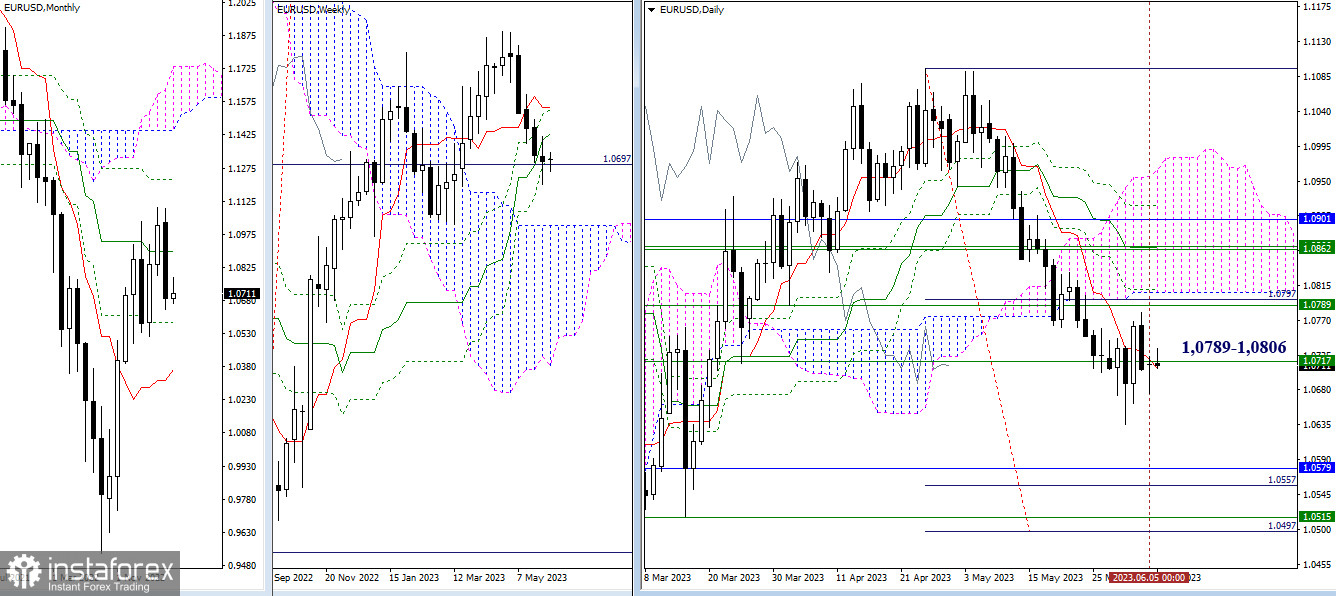

Big time frames

The situation over the past 24 hours has not changed significantly. The pair remains in the zone of influence of important levels of 1.0708-1.0717 (daily short-term trend + final level of the weekly Ichimoku cross). All other important points are located at yesterday's levels. For bears, the support zone of importance is 1.0579-1.0557-1.0515-1.0497 (monthly Fibonacci Kijun + weekly Senkou Span B + downward target for the breakout of the daily cloud). For bulls, the nearest resistance can be noted at 1.0789-1.0806 (weekly medium-term trend + daily Senkou Span B).

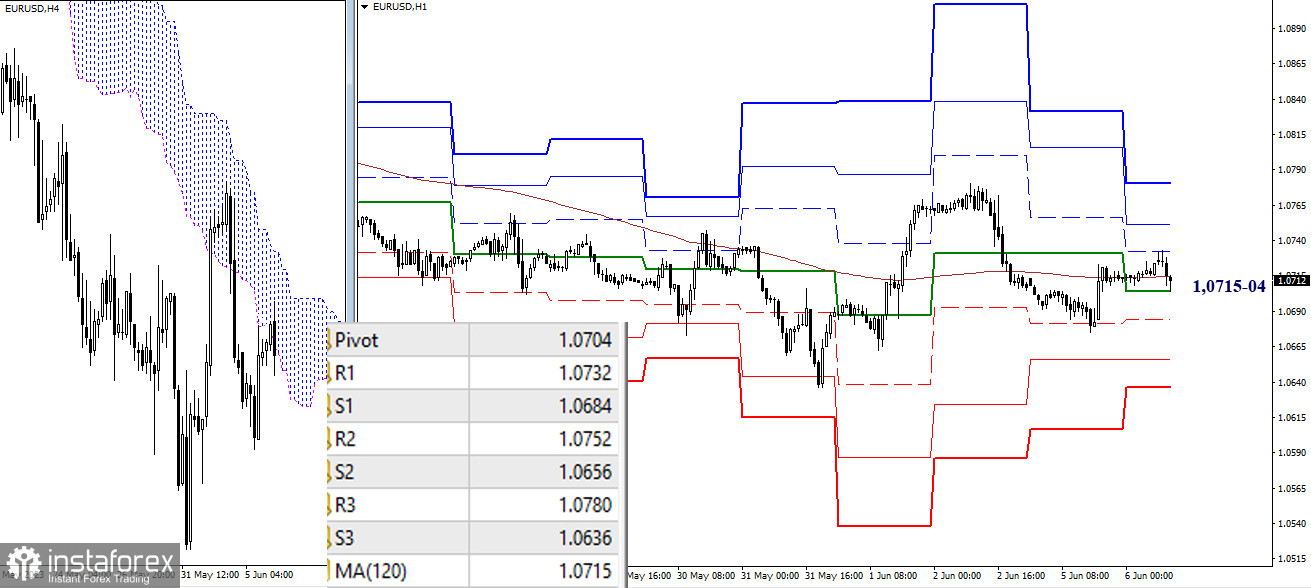

H4 - H1

On the smaller time frames, there is currently uncertainty caused by a struggle for key levels in the range of 1.0715-1.0704 (central Pivot level + weekly long-term trend). Depending on the market situation within the day, either support (1.0684-1.0656-1.0636) or resistance levels (1.0732-1.0752-1.0780) of the classical Pivot levels could be touched.

***

GBP/USD

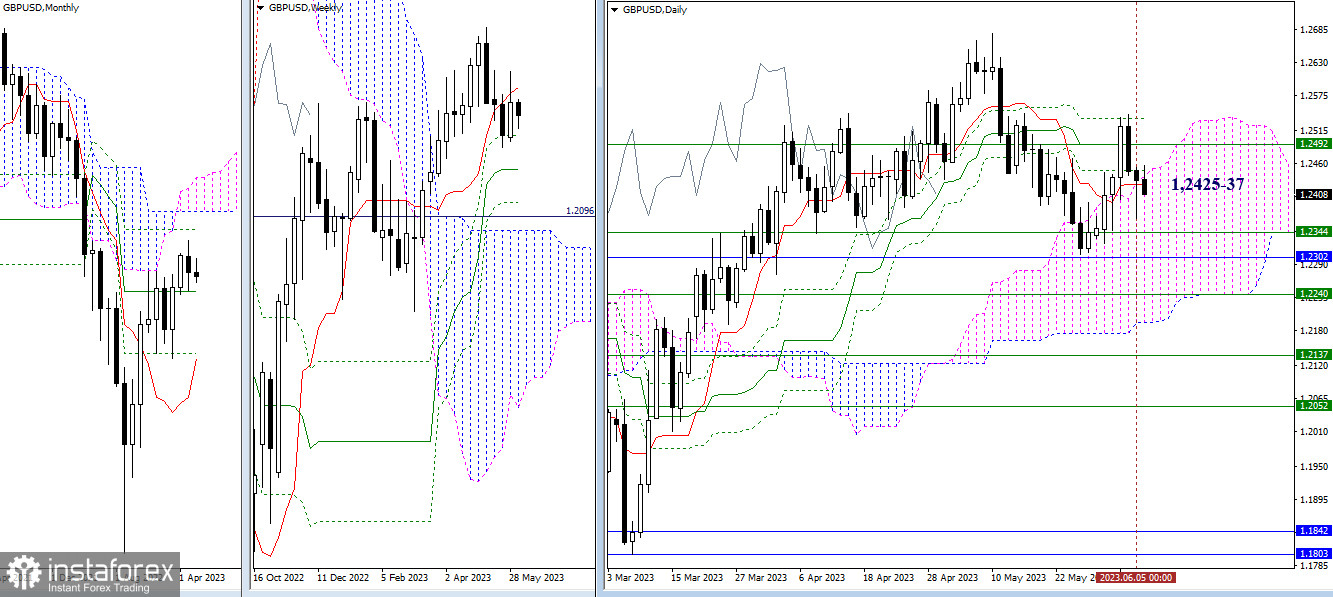

Big time frames

Currently, the pair is hovering within the zone of the daily short-term trend (1.2425) and the upper limit of the daily cloud (1.2437). The nearest important points for bulls are resistance levels at 1.2492-1.2536 (weekly short-term trend + final levels of the daily dead cross of Ichimoku), which were unsuccessfully tested last week. The nearest important points for bears are located around 1.2344-1.2302 (weekly Fibonacci Kijun + monthly medium-term trend).

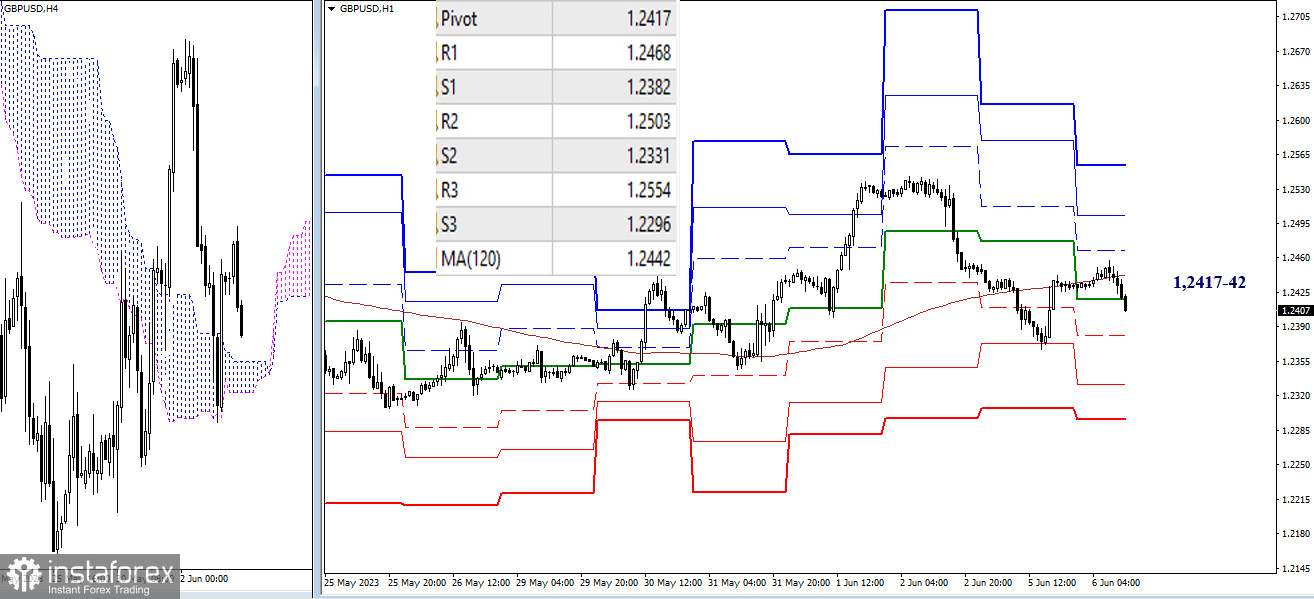

H4 - H1

The pair has once again dropped below the weekly long-term trend, which is currently at 1.2442. We can expect an increase in bearish sentiment. If the decline continues, the classical Pivot support levels at 1.2382-1.2331-1.2296 could be hit today. However, if bulls regain their positions and the level of 1.2442, attention will be shifted towards the resistance levels of the classical Pivot points (1.2468-1.2503-1.2554).

Tools used for technical analysis:

Big time frames - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels;

Small time frames - H1 - Pivot Points (classical) + Moving Average 120 (weekly long-term trend).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română