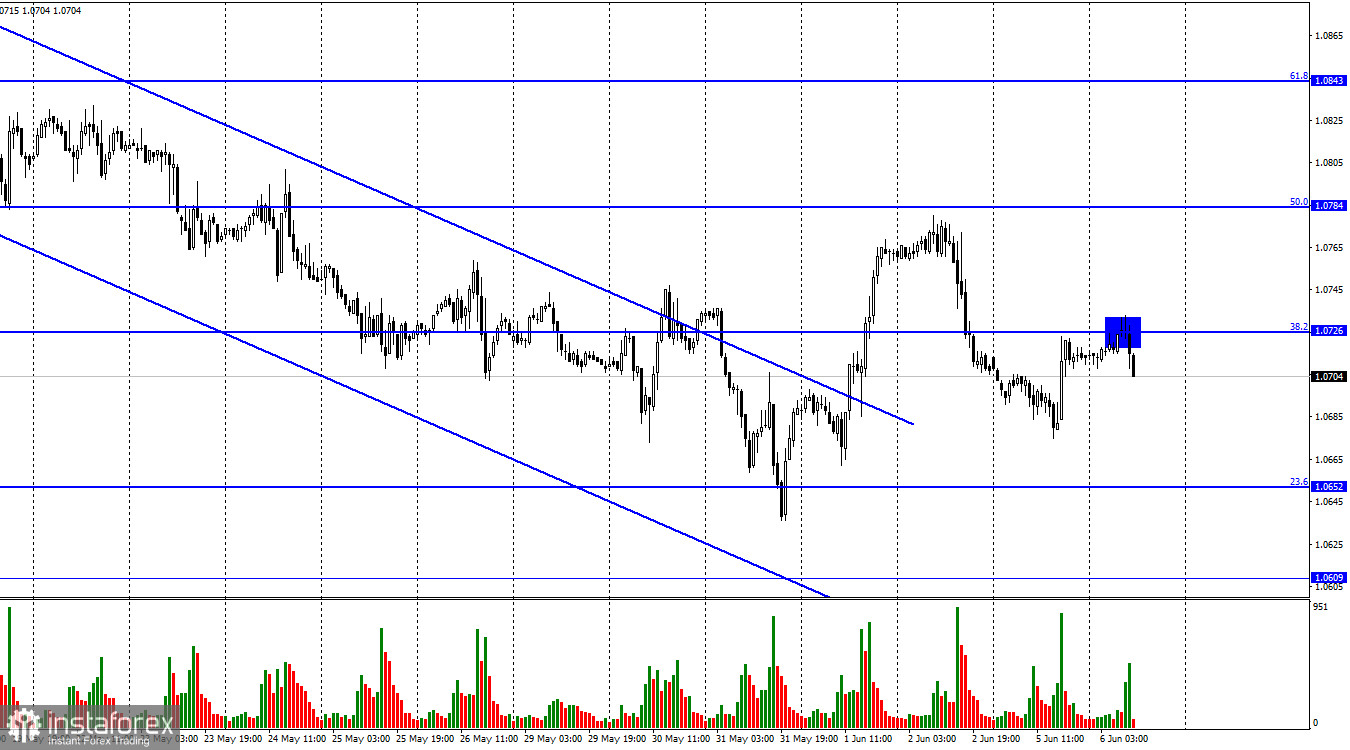

Good day, dear traders! On Monday, EUR/USD extended losses to the 23.6% Fibonacci level of 1.0652. However, by the close of the day, it managed to reverse and return to the 38.2% retracement level of 1.0726. A pullback from this level will likely trigger a fall to the 23.6% Fibonacci level. Meanwhile, consolidation above 1.0726 will indicate further growth to the 50.0% retracement level of 1.0784.

The ISM services PMI was the only important report yesterday. It revealed a drop to 50.3 from 51.9 and thus could disappoint USD buyers. After all, the reading got closer to the boom-or-bust line of 50 that separates expansion from contraction. Traders had reasons to sell the greenback yesterday. Day by day, the market is getting closer to the next meetings of the ECB and the Federal Reserve. The market is already contemplating their outcome.

The ECB will highly likely raise rates by 0.25%. This possibility has already been priced in the exchange rate of the euro. As for the Federal Reserve, there has been increasing speculation in the market that the regulator will lift rates for the last time in May before pausing tightening. It is unclear how long this pause will last. According to the latest data, there could be no pause at all or it will be short-lived. Some FOMC members say tightening should continue and rates should be raised once in two months. Some insist on a rate increase in June. All in all, it is now impossible to predict the Federal Reserve's decision.

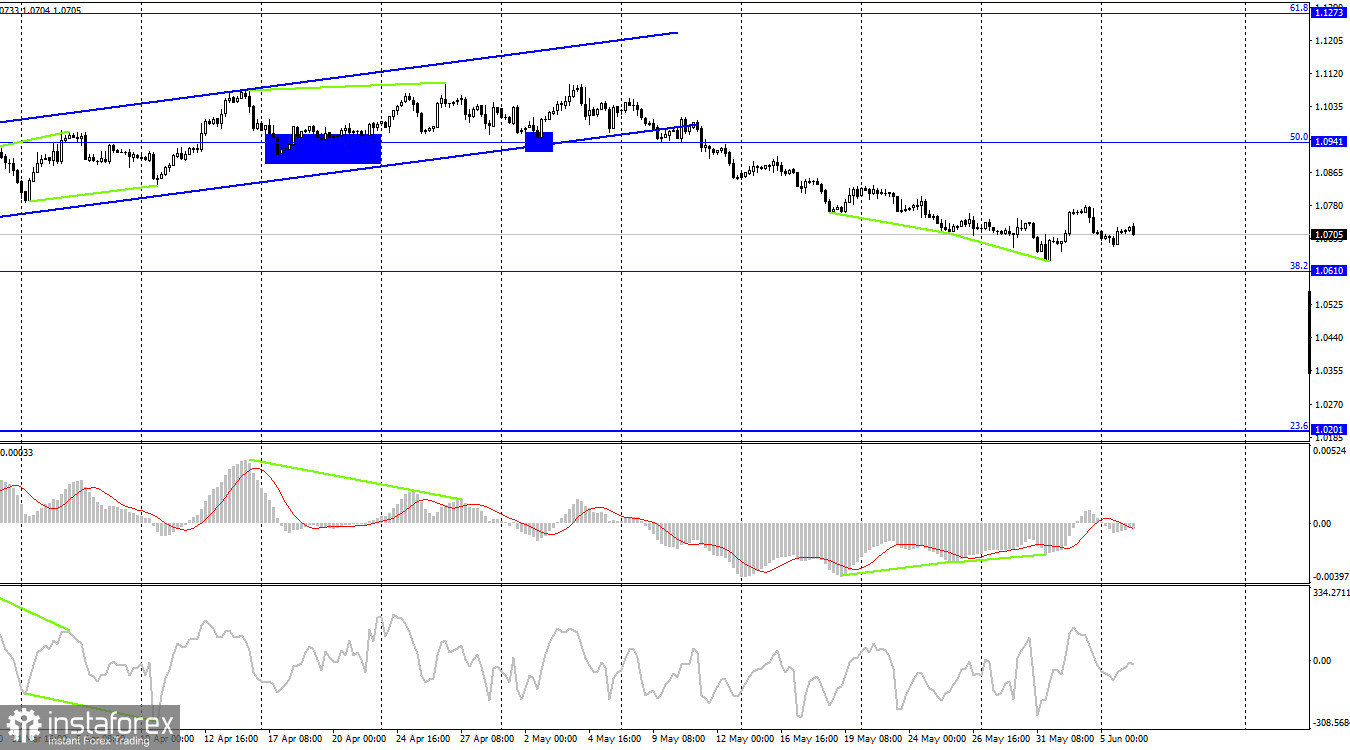

On the 4-hout chart, a bullish reversal briefly occurred. The downtrend may resume to the 38.2% retracement level of 1.0610. A rebound from this level may result in modest growth to the 50.0% Fibonacci level of 1.0941. Consolidation below 1.0610 will increase the likelihood of a bearish continuation to the 23.6% Fibonacci level of 1.0201.

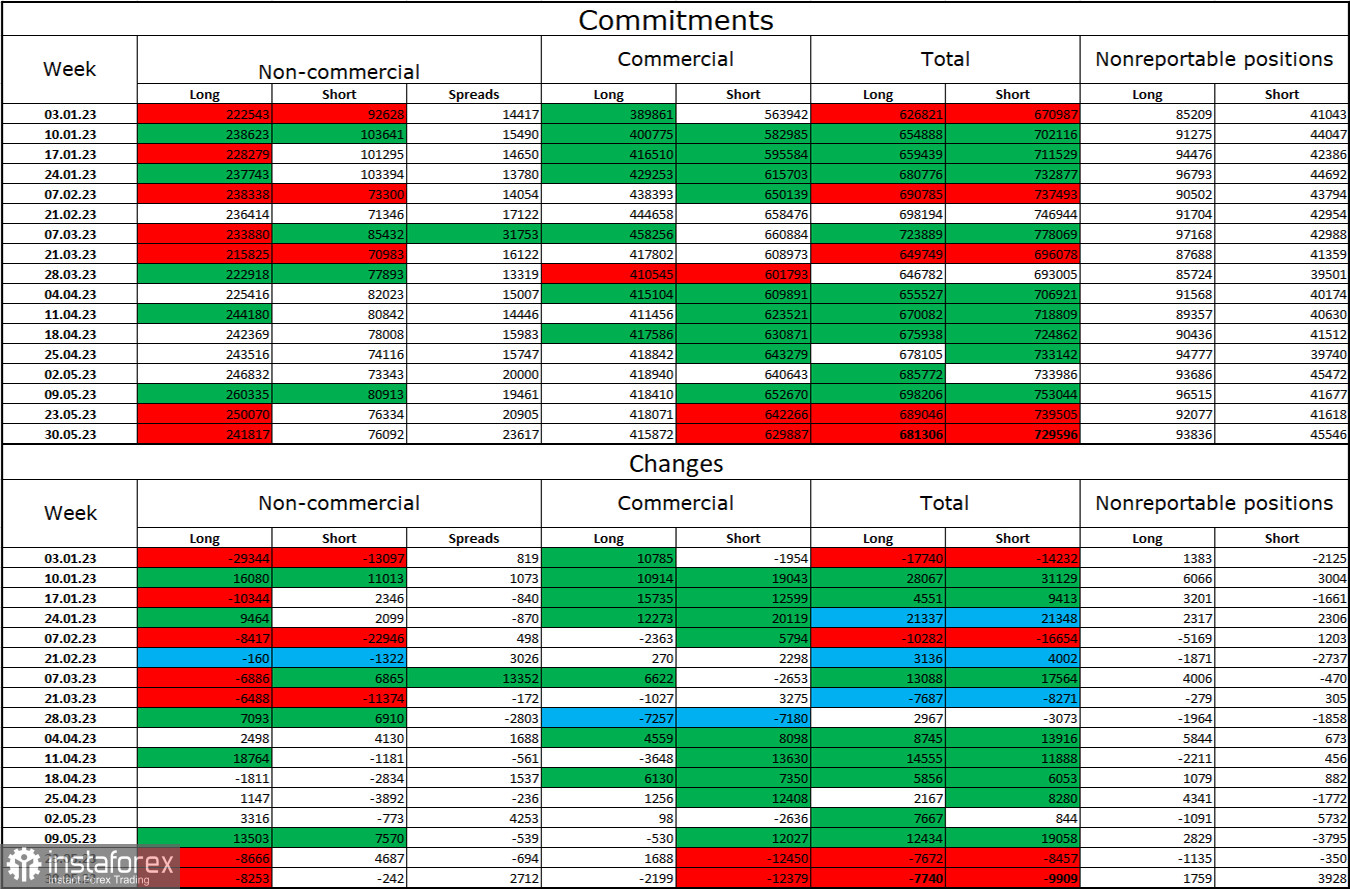

Commitments of Traders:

In the last reporting week, speculators closed 8,253 long positions and 242 short ones. Bullish sentiment has been easing in recent weeks. The total number of long and short positions now held by speculators is 242,000 and 76,000 respectively. Although sentiment remains bullish, it may change soon. The euro has been bearish for two weeks now. There have been too many long positions opened, meaning buyers may start closing them soon or have already begun according to the two latest COT reports. The gap between long and short positions is too wide now, which allows us to assume there will be a bearish continuation in the near term.

Economic calendar:

Eurozone: Retail Sales (09-00 UTC).

On June 6, there is just one report in the economic calendar of the eurozone. The fundamental backdrop will have little influence on trader sentiment today.

Outlook for EUR/USD:

We sell on a rebound from 1.0726 on the 1-hour chart, targeting 1.0652 and 1.0609. We also buy on a rebound from 1.0610 on the 4-hour chart with targets at 1.0726 and 1.0784.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română