May turned out to be one of the calmest months for cryptocurrencies in 2023. Trading volumes of major assets declined, and on-chain metrics indicated a significant decrease in overall industry interest. The six-week outflow of investments in crypto products, exceeding $320 million, is a direct confirmation of this.

The first month of summer promised a drastic change in the situation due to the resolution of the debt crisis and the launch of cryptocurrencies in the Hong Kong market. Investors and analysts also leaned towards the belief that the Fed would pause interest rate hikes in June. Taken together, all these factors gave hope for a bullish breakout beyond the consolidation range of $26.6k–$27.5k.

SEC wages war on the crypto industry

The SEC filed a lawsuit against the largest cryptocurrency exchange, Binance, for violating securities regulations. Concurrently, the regulator stated that it considers cryptocurrencies such as SOL, ADA, MATIC, FIL, ATOM, SAND, MANA, ALGO, AXS, and COTI as securities. The market's reaction did not take long, and panic selling began.

Over the past 24 hours, the cryptocurrency market capitalization has dropped by 3.5% and reached $1 trillion. Most assets have already formed local support areas from which they have experienced a local recovery. However, overall, the situation in the cryptocurrency market has taken on a distinctly bearish tone, and further declines in asset prices can be expected.

BTC/USD Analysis

Bitcoin, as the market flagship, also experienced a painful decline towards the support zone of $25.7k–$26k. Amid the panic selling, the asset easily broke below the $26.5k support level and successfully tested $26k. As a result, BTC came close to the base of the upward trend structure.

At the end of yesterday's trading day, Bitcoin formed a "bearish engulfing" pattern, with trading volumes surging to $20 billion. The nearest targets for the bears will be the range of $24.6k–$25k, where the base of the bullish trend lies. If the bears successfully establish prices below this zone, the path to $23k will open.

As of 08:00 UTC on the daily chart, bullish signals are emerging. Technical indicators are turning upwards, but it is still too early to talk about the likelihood of a full recovery. Moreover, a bearish crossover has formed on the MACD, indicating further development of the downward trend.

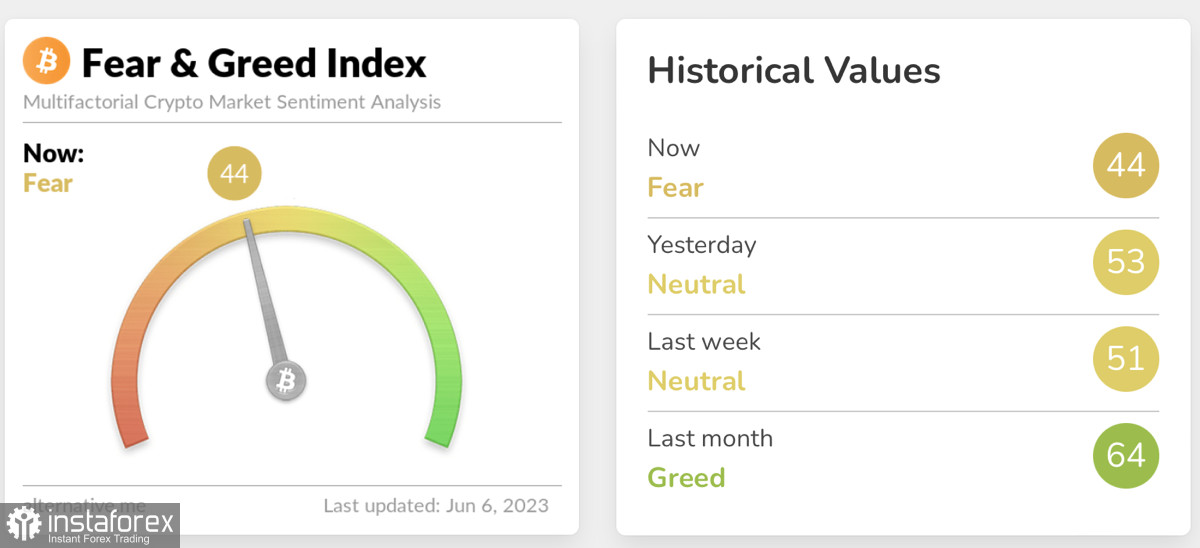

At the same time, it is quite likely that such a powerful downward movement is necessary for large players to absorb liquidity from "weak hands." This is a classic stage of preparation within capital redistribution before a strong upward movement. The Fear and Greed Index has already shifted to the fear side, indicating an increasing probability of an upward impulse.

Considering buyers' targets, it is worth highlighting the $26.6k level, which would bring the asset back within the $26.6k–$27.5k range. To achieve this short-term target, Bitcoin needs to successfully break above the $26k level, which is a challenging target given the market sentiments.

Conclusion

Similar movements in the cryptocurrency market resemble an increase in trading activity preceding powerful price movements. In most cases, a decrease in trading activity has led to the start of a strong bullish trend. Fundamentally, the current situation is no different from previous cycles, so it is not advisable to abandon the bullish idea until the area of $24.6k–$25k is definitively broken.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română