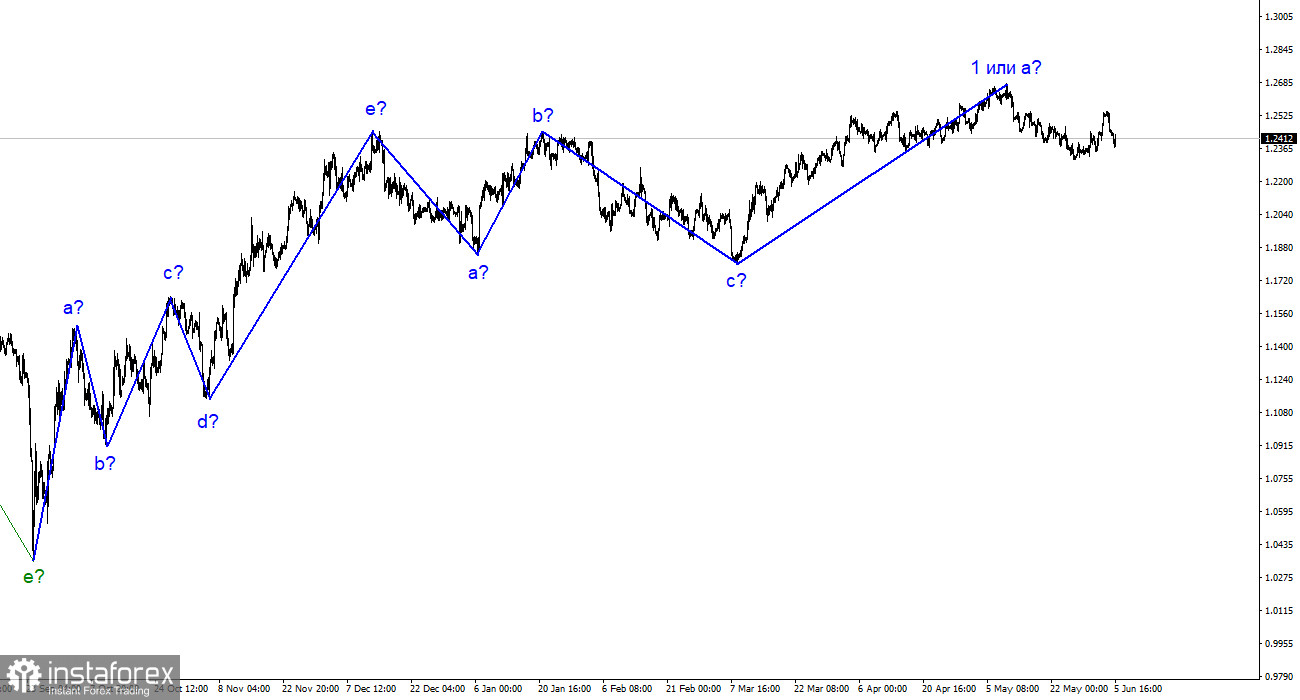

The wave analysis of the pound/dollar pair must still be more complex and clear. After a horizontal corrective phase, I expected a similar downward slope. Still, the recent increase in quotes suggests that the market is ready to build a full-fledged, upward impulse trend segment. The presumed wave 2 or b could have completed its formation this week (although I am still skeptical about it). If that is the case, forming an ascending wave 3 or c has already begun. And the British pound has an excellent opportunity to rise to the 26-30 figure range. Given the current news background, it is up to you to decide whether it is justified.

In this case, the wave analysis of the EUR/USD pair will differ significantly from that of GBP/USD. A downward wave structure is expected for the euro, while the hypothetical complexity of the upward trend segment is currently not on the agenda. On the other hand, everything looks like a new ascending trend segment for the British pound. The news background for the pound sterling has remained almost unchanged recently, so I need help determining what is driving the market to increase demand for the pound.

Business activity is declining in all sectors of the UK

The exchange rate of the pound/dollar pair decreased by 35 basis points on Monday. Thus, even the ISM index in the USA, which turned out to be worse than expected, did not help the British pound avoid losses. On Friday, the pair decreased by 80 points due to strong labor market statistics in the US. In addition to a good Nonfarm Payrolls report, there was a fairly average unemployment report. Still, the market did not consider it the key indicator of the US economy. The demand for the British pound decreased for two days following these reports, casting doubt on the further formation of the ascending wave 3, the formation of which could be more obvious too. And today, the ISM index added a little chaos to the pair's movements.

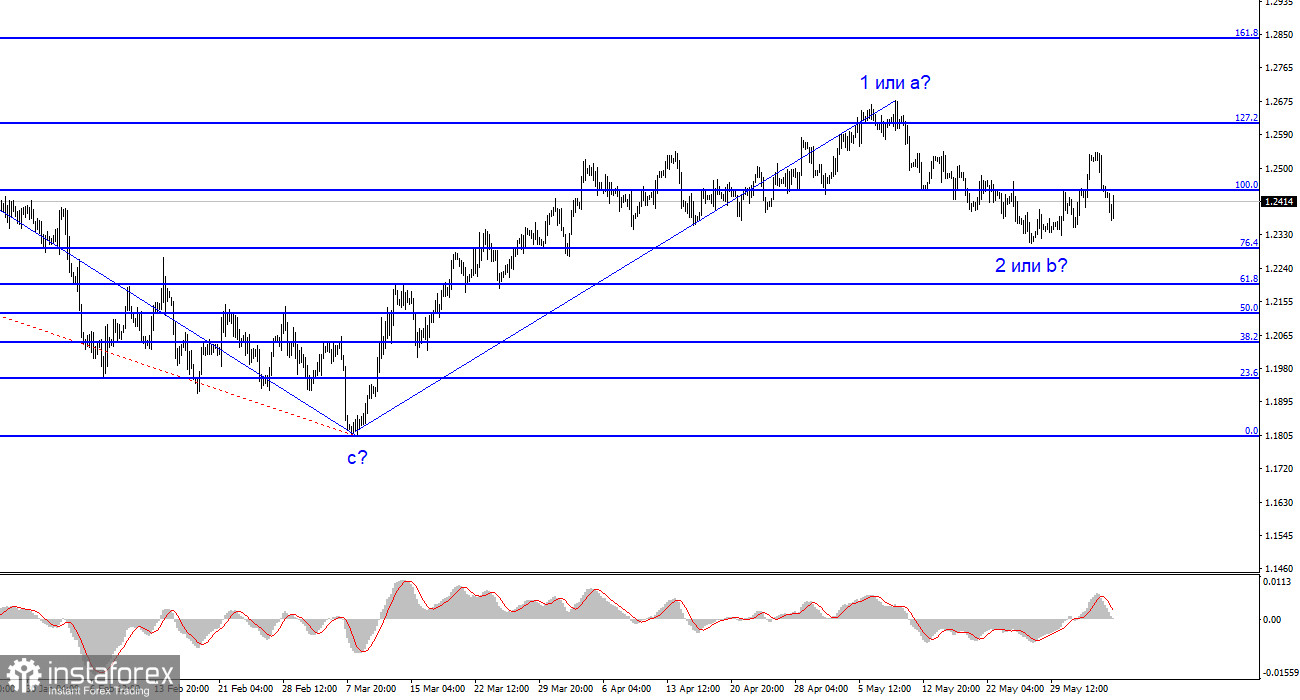

If we only look at the news background, I prefer to see the continuation of wave 2 or b. This wave has not yet reached its full extent, and the current news background is not conducive to an increase in the pair. However, we can see occasional weak statistics coming from America. The British pound is currently a "dark horse," and it is difficult to predict what to expect.

This week, the news background in the UK and the US will be weak, so resolving the situation regarding the current wave being constructed may extend until the next meetings of the Bank of England and the Federal Reserve, which are scheduled for mid-month.

General conclusions.

The wave pattern of the pound/dollar pair has long suggested the formation of a downward wave. Wave b could be very deep, as all recent waves have been approximately equal in length. However, a successful attempt to break the 1.2445 mark, corresponding to the 100.0% Fibonacci level, indicates the market's readiness for buying, which could disrupt the current scenario. Therefore, I recommend selling the British pound with targets around the 23 and 22 figures, but now we need to wait for signals to resume the formation of the downward wave.

The picture is similar to the euro/dollar pair on a larger wave scale, but some differences remain. The downward corrective trend segment is complete, but the formation of a downward wave may begin now. This wave could be deep and extensive, and the entire trend segment could be horizontal, similar to the previous one.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română