The euro/dollar pair declined in the first half of Monday due to the inertia of Friday's trading, when Nonfarm Payrolls strengthened the position of the American currency. And although the May labor market report in the USA was quite contradictory, the market interpreted it in favor of the greenback. Despite the actual increase in unemployment and a weakening of hawkish expectations regarding further actions of the Federal Reserve, the dollar remains afloat.

However, the situation is ambiguous and further complicated by the so-called "quiet period" - a 10-day period before the Federal Reserve meeting during which members of the American regulator are not allowed to express their positions publicly. Therefore, any attempts at a decline in EUR/USD should be approached with caution and prudence, especially if the pair approaches the support level of 1.0640 (the lower line of the Bollinger Bands indicator on the four-hour chart). The price is declining on fragile grounds that are insufficient to develop a sustainable downward trend.

Recall that the Nonfarm Payrolls released last Friday had a "red-green" color. Some components of the release were better than forecast, while others were worse. After some fluctuations, traders concluded that "the glass is half full, not empty," and the dollar began to enjoy increased demand. The EUR/USD pair initially rose to the target of 1.0772 but then headed south, ending the week at 1.0707.

Undoubtedly, the Friday release has strong points. First, the increase in the number of employed individuals in the nonfarm sector was impressive. The indicator jumped by 339,000, nearly twice the forecast value (180,000). Second, a significant increase in the indicator occurred in the economy's private sector, with employment here growing by 283,000 (compared to a forecasted growth of 160,000). The labor force participation rate remained unchanged in May compared to April (62.6%), while experts predicted a slight decline.

At the same time, the unemployment rate increased more than expected, rising to 3.7% compared to a forecasted increase of 3.5%. The inflationary indicator also fell into the "red zone": the average hourly earnings growth rate decreased to 4.3% y/y, while most experts expected the indicator to remain at the April level (4.4%).

Notably, despite traders interpreting the report in favor of the dollar, hawkish expectations for the June Federal Reserve meeting weakened. According to the CME FedWatch Tool data, the probability of a 25 basis point rate hike at the June meeting is currently only 24%. Consequently, the probability of maintaining the status quo is 76%. As for the prospects of the July meeting, the market does not hold "hawkish illusions": the chances of maintaining a wait-and-see position are over 40%.

Recall that at the end of May, Jerome Powell unexpectedly voiced dovish views, essentially speaking against a further tightening monetary policy. The head of the Federal Reserve once again highlighted the relevance of the banking crisis in the United States, stating that the banking stress "diminished the need for an interest rate hike." Powell's statement has capitulated against spring bankruptcies (Silvergate, Signature Bank, Silicon Valley Bank). Some of his colleagues publicly supported the position of the Federal Reserve Chair. In particular, the head of the Federal Reserve Bank of Philadelphia, Patrick Harker, and Federal Reserve Board Governor Philip Jefferson stated in May that they would oppose a rate hike at the next meeting.

Against the backdrop of such rhetoric, any significant macroeconomic release published in the USA is considered in terms of the prospects for the summer meetings of the Federal Reserve.

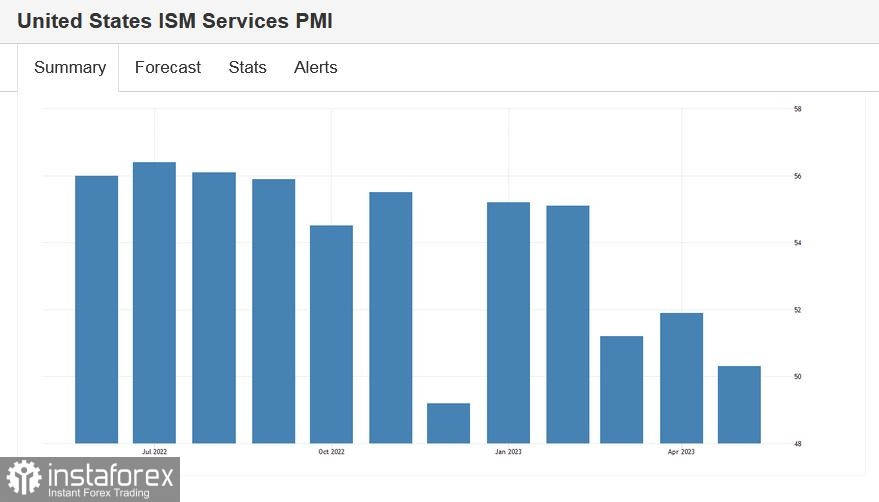

Therefore, it is not surprising that traders reacted sharply to today's published ISM Non-Manufacturing Purchasing Managers' Index (PMI), which turned out to be in the "red zone." Instead of the expected growth of 52.6 points, the indicator sharply declined to 50.3. This is the weakest result since December of last year. It is worth noting that the ISM Manufacturing PMI, published last week, also fell into the "red zone," decreasing to 46.9. The indicator has been below the key 50-point mark for the seventh consecutive month.

Today, the EUR/USD pair sharply reversed and returned to 1.07. Although the northward momentum did not continue, the situation itself is indicative. It speaks to the fragility of bearish positions. Can we talk about the prospects of a significant downward trend now if sellers got "scared" by just one, albeit important, report? By locking in profits, EUR/USD bears extinguished the downward momentum, allowing the bulls to take the initiative.

However, buyers will also be cautious of any disturbance as the pair approaches the 1.08 level. In anticipation of the June Federal Reserve meeting, traders, sellers, and buyers will likely exercise caution.

Conclusion

Speculating on the prospects of a southern or northern scenario is not advisable. Most likely, ahead of the Federal Reserve meeting, the pair will continue to fluctuate within the price range of 1.0640 - 1.0770, with the lower boundary corresponding to the lower line of the Bollinger Bands indicator on the four-hour chart and the upper boundary corresponding to the upper line of the Bollinger Bands on the same timeframe.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română