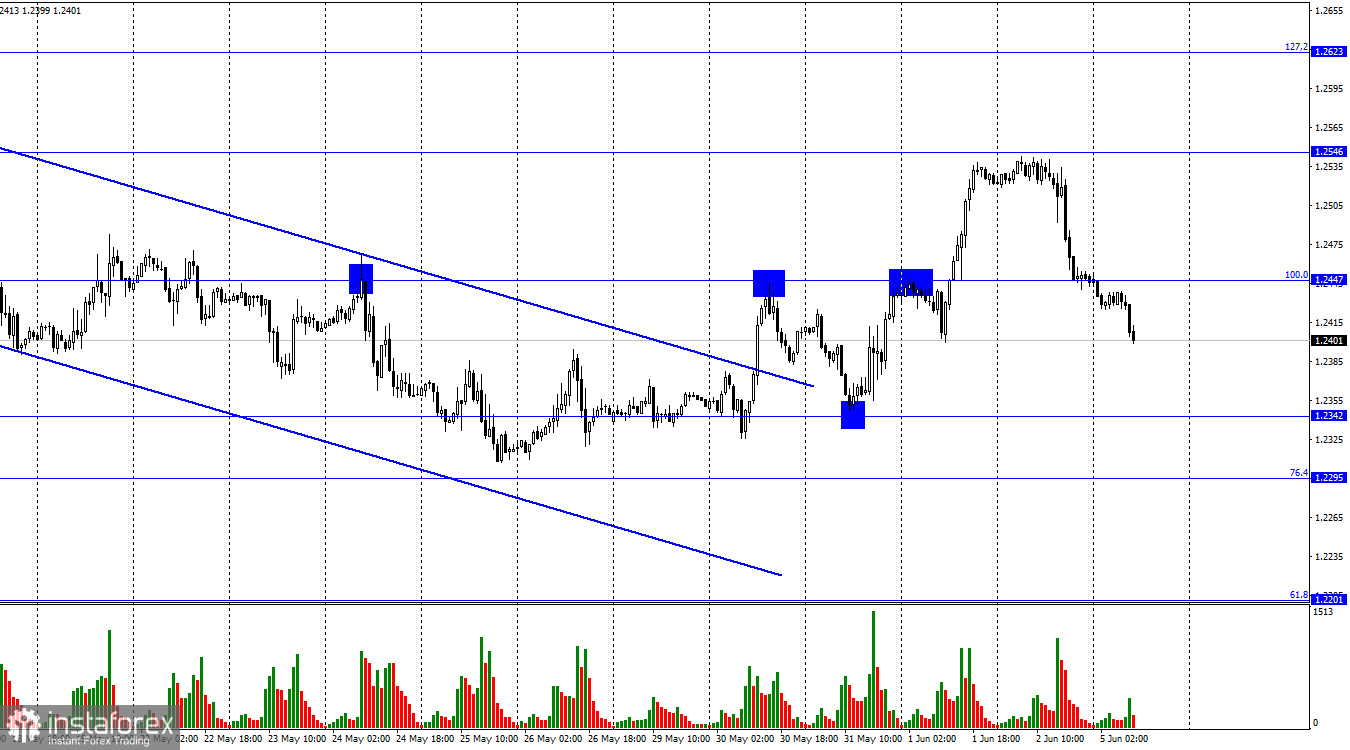

Hi everyone! On the hourly chart, the GBP/USD pair dropped on Friday to 1.2447 the Fibo level of 100.0%. It closed trading below this level. On Monday, it decreased to 1.2342. Thus, the growth of the British pound did not last long.

On Friday, the main driver for the US currency was the NonFarm Payrolls report. The indicator exceeded market expectations. The unemployment report, which turned out to be worse than market expectations, was of little importance as well as the average hourly wages. Today, traders are still digesting NFP figures. In addition, the UK Services PMI Index for May was released in the UK. The figure totaled 55.2, which was slightly higher than forecasts, but below the April reading. The Composite PMI Index showed a slight decline. Since both indices remained above the 50 level, I believe that they did not affect market sentiment. The pound sterling started falling before the release of these indices.

In the afternoon, there will be reports that could impact the trajectory of the pair, e.g. the US Services PMI Index. Traders expect it to grow slightly in May and move away from the 50.0 level. If this happens, the US currency may rise higher as the ISM indices are important indicators. However, the US dollar is climbing ahead of fresh economic reports.

This week, the economic calendar will be rather empty. In a week and a half, several central banks will announce their rate decisions. It means that there will be very few or no new comments from policymakers.

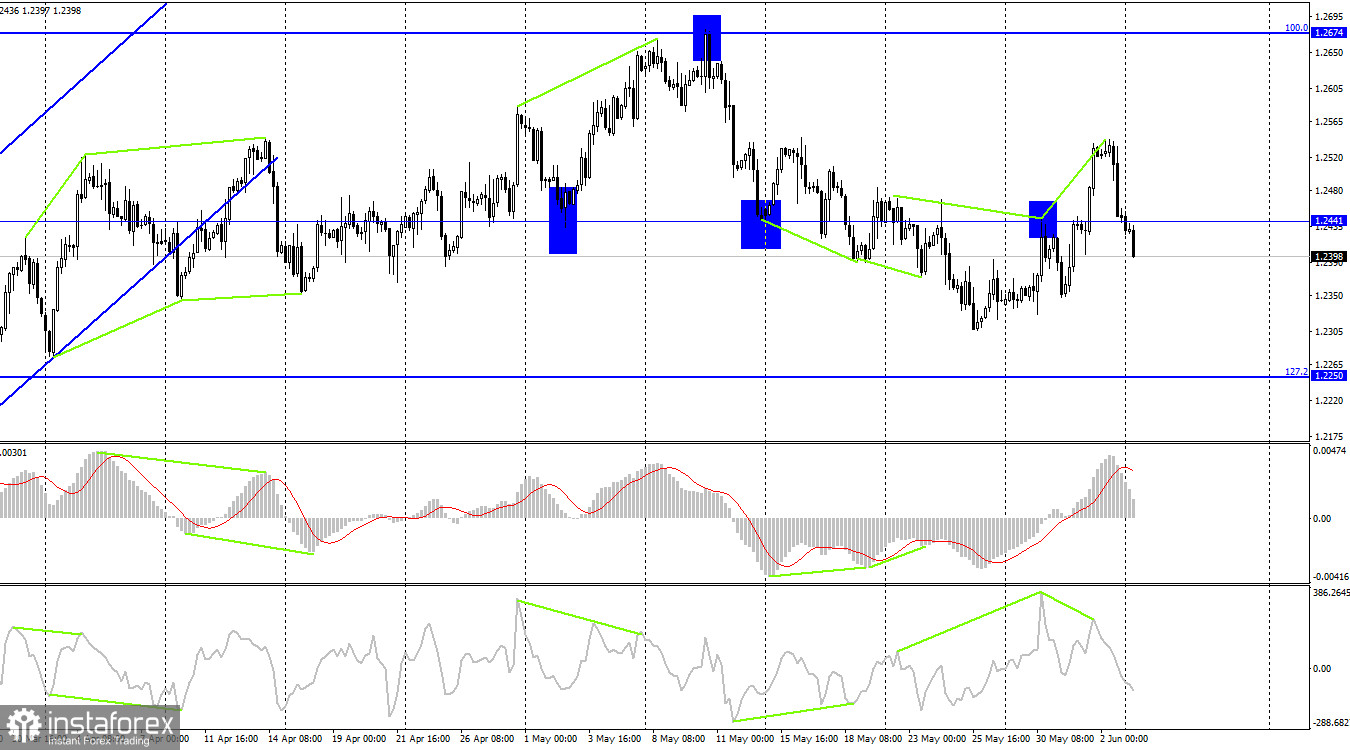

On the 4-hour chart, the pair declined after the formation of a bearish divergence at the CCI indicator. After that, the pair closed at 1.2441 and lost 150 pips. The pair could reach 1.2250, the next Fibo correction level of 127.2%. No divergences are seen in any indicator today.

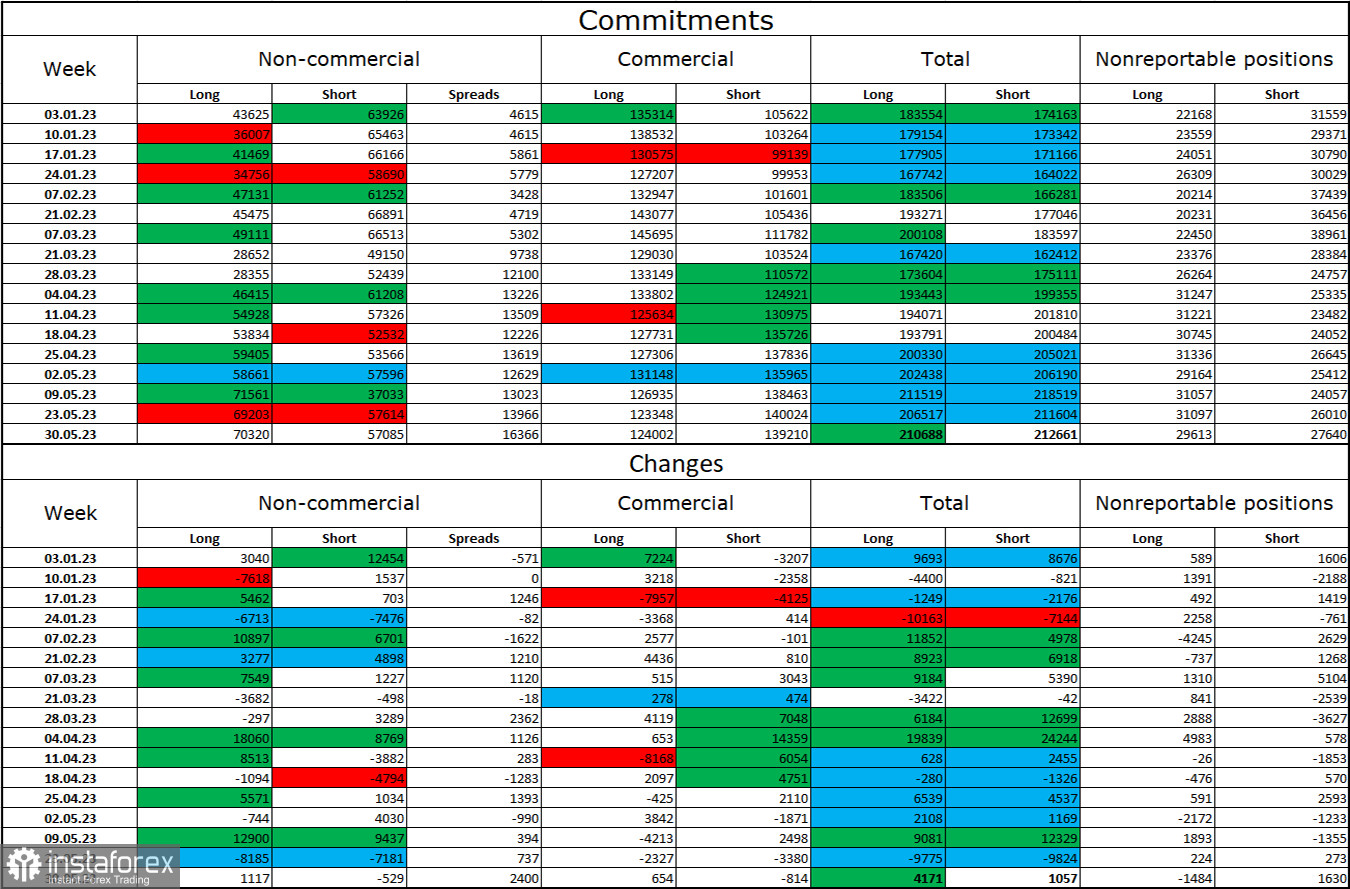

Commitments of Traders (COT):

The mood of the "Non-commercial" category of traders has become a little more bullish over the last reporting week. The number of Long positions increased by 1,117 and the number of Short ones declined by 529. The overall mood of large traders remains bullish. For a long time, it has been bearish. The number of Long and Short contracts is now almost equal – 70,000 and 57,000 respectively. In my opinion, the pound sterling has good prospects for resuming growth but the fundamental background is not favorable either for the US dollar or the pound sterling. The latter has been growing for a long time. The net position of non-commercial traders has been rising for a long time. Everything depends on whether the British currency will be able to climb on the same drivers. I believe that at this time we should not expect the resumption of an upward movement.

Economic calendar for US and UK:

UK– PMI Services Index (08:30 UTC).

US – PMI Services PMI (13:45 UTC).

US – Factory orders (14:00 UTC).

US – ISM Non-Manufacturing Index (14:00 UTC).

On Monday, ISM PMI indices and several secondary reports are on tap. The impact of the fundamental background on the pair in the afternoon may be neutral.

Outlook for GBP/USD and recommendations:

It is better to open long positions after a rollback from 1.2546 on the hourly chart with targets of 1.2447 and 1.2342. The pair has already reached the first level. It is recommended to open long positions if the pair rebounds from 1.2342 or 1.2295 with the target level of 1.2447.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română