Macroeconomic calendar from June 2

The US Labor Department report showed mixed results on Friday. The US economy unexpectedly added 339K jobs, of which some 283K were added in the private sector. In the services sector, over 200K jobs are added every month. Figures continue to point to a tight labor market. Average hourly earnings grew by 0.5% m/m and by 4.5% y/y.

However, the US unemployment rate unexpectedly rose to 3.7% from 3.4%, the highest since October 2022, and exceeded market expectations of a 3.5% increase.

Financial markets reacted to the report hoping for higher interest rates without a recession. As a result, the US dollar strengthened.

Overview of technical charts from June 2

Buying volumes of EUR/USD decreased on the way to 1.0800 resistance. The bullish movement slowed and a reversal occurred.

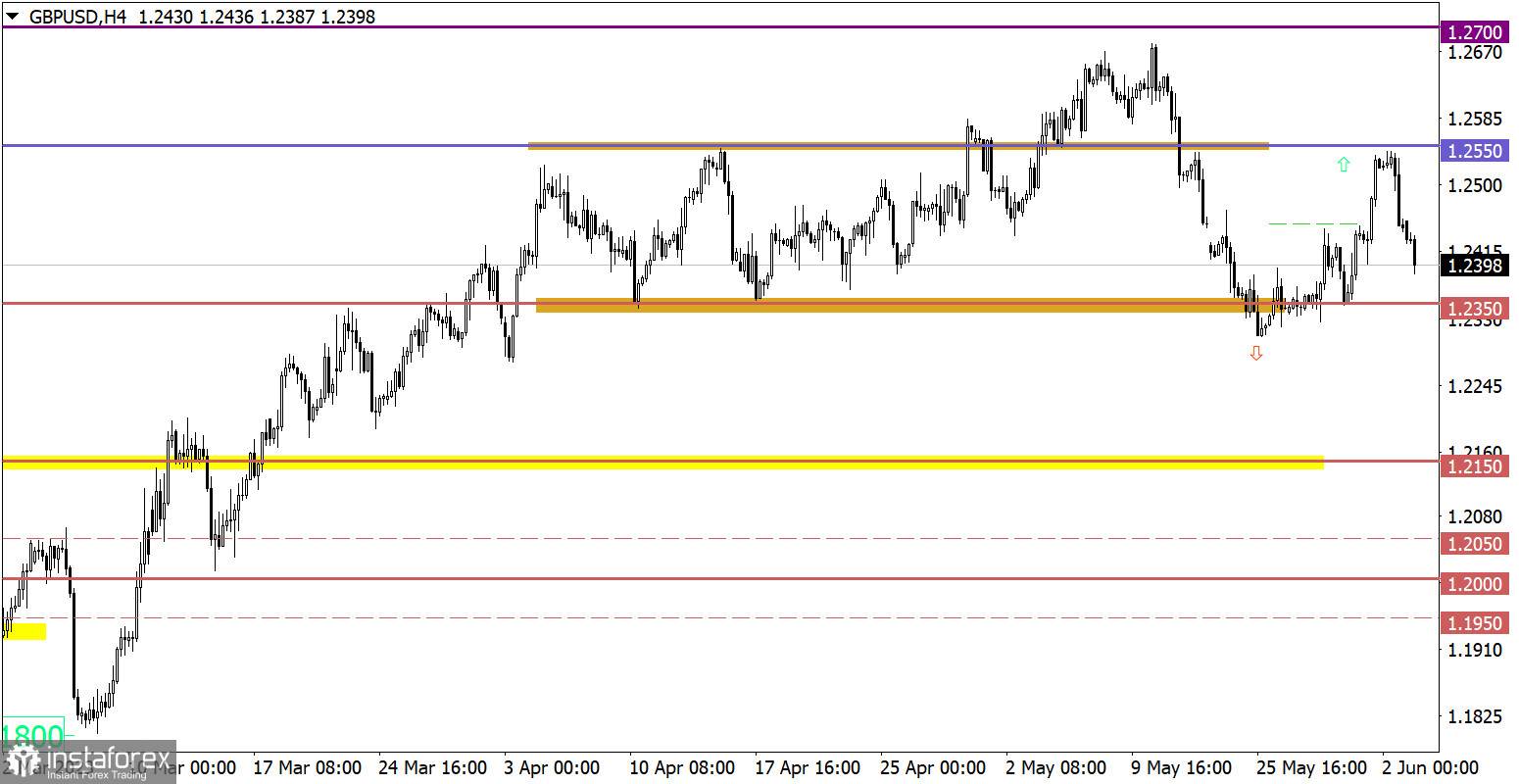

Moving up, GBP/USD touched 1.2550 resistance and pulled back. Selling volumes increased. The pair went below 1.2450.

Macroeconomic calendar on June 5

Final services PMI data will be released in the eurozone, the UK, and the US today. Figures are projected to come in line with preliminary results which have already been priced in by the market. Therefore, they will be of little interest to traders. At the same time, the eurozone PPI will draw their attention as it will reveal further inflation developments. Anyway, figures are estimated to drop to 5.4% from 5.9%, meaning inflation will continue slowing down. So, there is little possibility of further rate hikes by the ECB. In this light, the euro will show weakness.

Trading plan for EUR/USD on June 5

The euro will likely go down and reach a new low if it consolidates below 1.0700. Growth may begin if the pair rises to 1.0800.

Trading plan for GBP/USD on June 5

Currently, an unexpected reversal that stopped growth may lead to a corrective move. It will become possible if quotes settle below 1.2400. The price should go above this mark to return to 1.2500.

What's on technical charts

The candlestick chart shows graphical white and black rectangles with upward and downward lines. While conducting a detailed analysis of each individual candlestick, it is possible to notice its features intrinsic to a particular time frame: the opening price, the closing price, and the highest and lowest price.

Horizontal levels are price levels, in relation to which a stop or reversal of the price may occur. They are called support and resistance levels.

Circles and rectangles are highlighted examples where the price reversed in the course of its history. This color highlighting indicates horizontal lines which can exert pressure on prices in the future.

Upward/downward arrows signal a possible future price direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română