So, the main event of today is the preliminary data on eurozone inflation, and according to forecasts, the pace of consumer price growth is expected to slow down from 7.0% to 6.5%. However, similar data for Germany and France were published yesterday, which caused the euro to fall. At least that was the case until the opening of the US trading session. The fact is that inflation in France slowed down from 5.9% to 5.1%, with a forecast of 5.7%, while in Germany, instead of falling from 7.2% to 6.7%, it dropped to 6.1%. Therefore, inflation in the entire euro area is likely to slow down even more. Consequently, the European Central Bank is expected to halt the process of raising interest rates in the near future.

However, after the opening of the US trading session, the euro was able to fully recover its losses, thanks to Federal Reserve representatives, who explicitly stated that the central bank is pausing the rate hike. They also added that this would mean reaching the peak level of interest rates, indicating a gradual easing of monetary policy.

But as mentioned earlier, inflation in Europe will slow down slightly faster than forecasts, and the euro will fall again. At the very least, it will fall to Wednesday's lows.

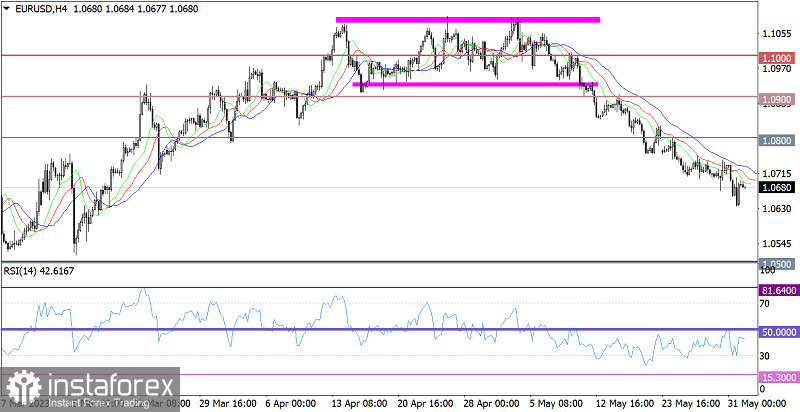

The EUR/USD pair reached 1.0635 during the downward movement, triggering a technical signal of the euro being oversold in the short-term time frames.

On the four-hour chart, the RSI hit the 30 level, which became the starting point for reducing the volume of short positions on the euro.

On the same time frame, the Alligator's MAs are headed downwards, indicating a corrective trend.

Outlook

The downward cycle from the peak of the medium-term trend remains relevant in the market. For this reason, returning to the price low could potentially lead to a new wave of decline, disregarding the technical signals of an oversold euro. However, it is worth noting that the longer the market maintains its momentum, the less stable speculators become. Ultimately, this may lead to a sharp decline in the volume of short positions, which in turn will result in a price reversal.

The comprehensive indicator analysis in the short-term and intraday periods suggests a pullback, while indicators in the medium-term show the corrective move.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română