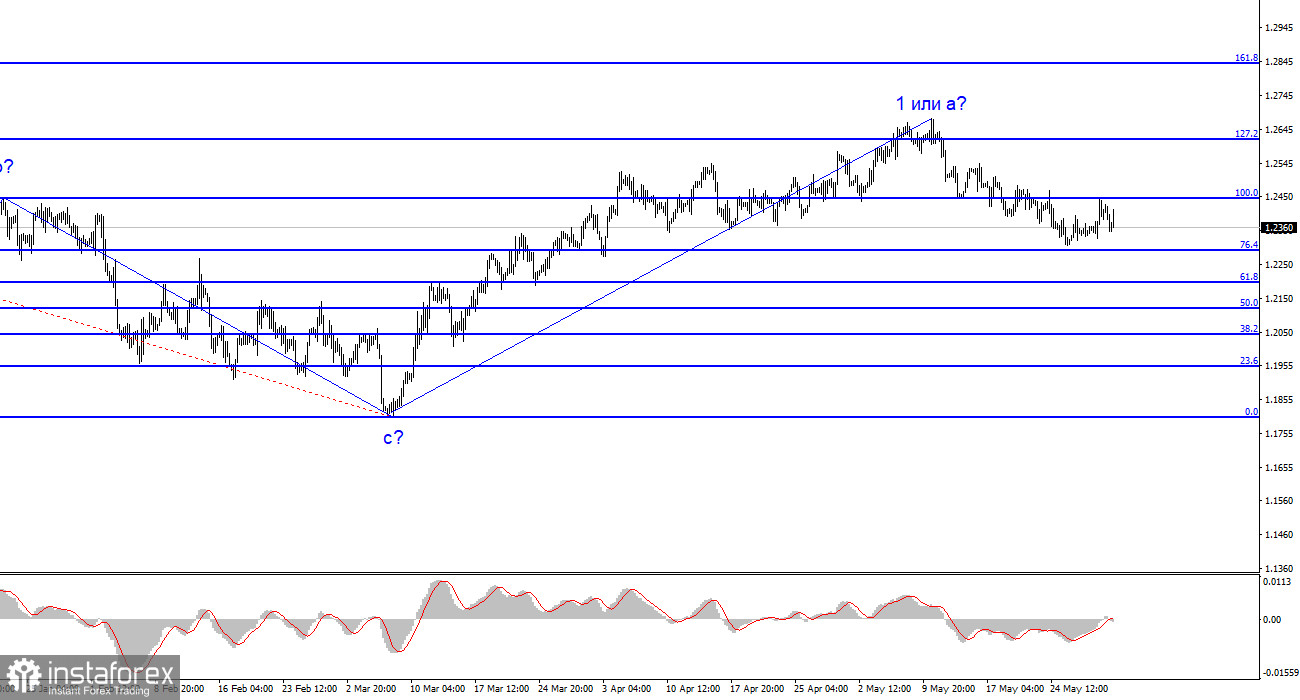

The wave labeling for the GBP/USD pair must still be simplified and clarified. It does not resemble a classical corrective or impulsive segment of the trend. Currently, the formation of an upward trend segment in the pound continues, and from March 8 to May 10, I can identify only one wave of the current scale. Therefore, forming a new trend segment will take a lot of time and will be very elongated.

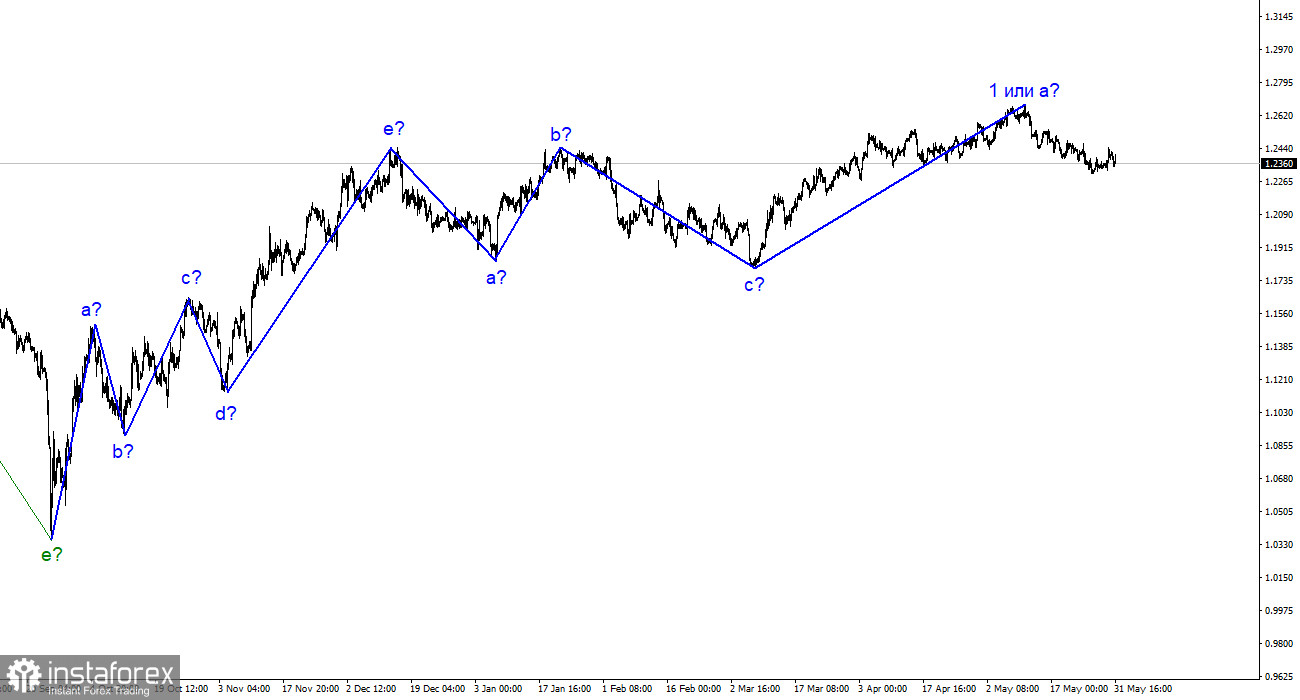

Both pairs should form similar wave formations. If true, wave 2 or b in the pound may be elongated, while a downward three-wave structure may be formed in the euro. Thus, I expect a deep wave b, similar to the formation of the previous three-wave structure where wave b constituted 100% of wave a. Therefore, we can expect a decline in the pair towards the 1.1850 level or slightly higher. At the moment, wave 1 or a has all the necessary grounds to be considered complete. The recent increase in quotes should allow wave b's formation.

Buyers quickly retreated.

The GBP/USD exchange rate decreased by 20 basis points on Wednesday, but there was a significant amplitude during the day. The exchange rate fluctuated both up and down. In the first half of the day, demand for the pound naturally declined as the news background did not drive yesterday's increase. An attempt to break the 1.2445 level indicates market unpreparedness for new purchases and the formation of a new upward wave. After lunch, there was an increased demand for the US dollar, but overall, a downward wave is still being formed, which aligns with the current wave labeling.

In the US, only one report of note was released today. The number of job openings in the US increased to 10.1 million in April from 9.745 million in March. The market was expecting the number to decrease again to 9.2 million. The US labor market continues to show excellent conditions that do not correspond to the current interest rate value. FOMC members have been warning the markets about a possible labor market tightening, but so far, none of their forecasts have come true. Nonfarm Payrolls consistently exceed market expectations, the unemployment rate remains at a half-century low, and the number of job openings is increasing again. The economic statistics in the US remain stronger than in the UK, which is sufficient for the demand for the US dollar to continue to rise. If the Bank of England starts giving unambiguous signals of stronger policy tightening, it could increase the pound. However, for now, I expect a further decline in the pair. Tomorrow and the day after are important days with significant statistics in the US, so there may be high market activity.

General conclusions.

The wave pattern for the GBP/USD pair has long implied the formation of a downward wave. Wave b can be very deep as recent waves have been approximately equal. The unsuccessful attempt to break the 1.2445 level, which corresponds to 100.0% Fibonacci, indicates the market's readiness for new sales. Therefore, I recommend selling the pound with targets around the 23 and 22 figures. The decline in the pair could be even stronger.

The pattern resembles the euro/dollar pair on a higher wave scale, but some differences remain. The downward corrective segment of the trend is complete, but the formation of a downward wave may begin now. This wave can be deep and protracted, and the entire trend segment can be horizontal, similar to the previous one.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română