The British pound experienced a significant bounce on Tuesday. Much of this is purely an emotional reaction. Over the weekend, US President Joe Biden announced that the vote on the debt ceiling would take place on May 30th. However, it turned out that yesterday was only a committee vote, while the House of Representatives will consider the matter today. But if it passes successfully, the Senate vote will only take place on June 2nd. According to Janet Yellen, the Treasury Department will run out of funds by June 5th. Moreover, several Republican representatives have already said that they will vote against it. In other words, not only were the expectations not met, but the risk of uncertainty remains. The media can continue publishing materials speculating on what will happen if the United States declares default. Of course, such things do not contribute to the dollar's growth. Although it doesn't have much room to rise anyway, due to its overbought condition.

Even if the pound immediately weakened after it significantly bounced, which resembles a technical retracement, the British currency has good chances to strengthen further. This could be triggered by data on job openings in the United States, which is expected to fall from 9.6 million to 9.2 million. This does not bode well in anticipation of the Labor Department's report. Any signs of deterioration in the labor market are always perceived unequivocally as a weakening of the national currency.

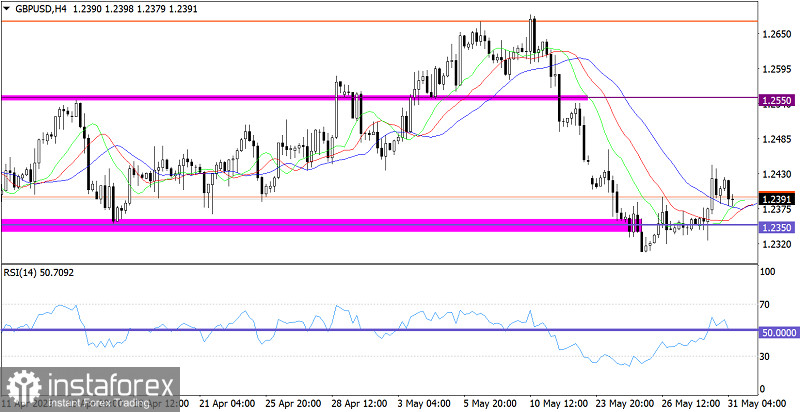

The consolidation along the 1.2350 level was ended by an upward movement. This was the first technical sign of a possible end to the two-week corrective cycle from the medium-term uptrend.

On the four-hour chart, the RSI upwardly crossed the 50 middle line. Meanwhile, the Alligator moving averages (MA) had a crossover. These technical signals indicate the end of the corrective movement.

Outlook:

For the next round of growth in the volume of long positions on the pound, it is necessary for the exchange rate to stay above the 1.2450 level. In this case, a subsequent recovery relative to the recent corrective cycle is possible.

Until then, we shouldn't rule out the possibility of the price returning to the area near the 1.2350 level.

The comprehensive indicator analysis in the short-term and intraday periods implies that the pound looks to recover.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română