Analysis of macro data:

Few macro data scheduled for release on Wednesday. The most notable report is the JOLTS (Job Openings and Labor Turnover Survey) in the United States. It recently triggered a strong market reaction as its value was significantly below expectations. The forecasts suggest a decline in job openings from 9.59 million to 9.2-9.375 million in April. If the value is even lower, the dollar may face selling pressure again. However, based on Monday and Tuesday, it cannot be said that the dollar is under market pressure. There has only been a slight decline, nothing more.

Fundamental events:

There are several fundamental events on Wednesday. The most significant one is European Central Bank President Christine Lagarde's speech. She has not spoken since last week, and nothing has changed in the macroeconomic landscape since then. There haven't been any new important reports reflecting changes in the economy. Therefore, we don't expect her to say anything new.

In the United States, representatives of the Federal Reserve (Fed), Michelle Bowman, Patrick Harker, and Thomas Jefferson, will deliver speeches. Lately, we have been hearing more and more rumors from the Fed about a possible further rate hike in 2023. However, at the moment, the market is confident that there will be no monetary policy tightening in June. If we are getting a rate hike, it will happen much later, and only if inflation stops falling or does so too slowly. Nevertheless, hawkish comments from members of the monetary committee may trigger a slight increase in the US currency.

General conclusions:

The most important events for today will be Lagarde's speech and the US JOLTS report. However, the market may ignore both events due to their lack of significance. Lagarde may not provide any new information to the market, and the US report may turn out to be neutral. Therefore, volatility may remain low, and there may be a lack of trend-driven movement.

Basic rules of the trading system:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored.

3) During the flat trend, any currency pair may form a lot of false signals or do not produce any signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

How to read charts:

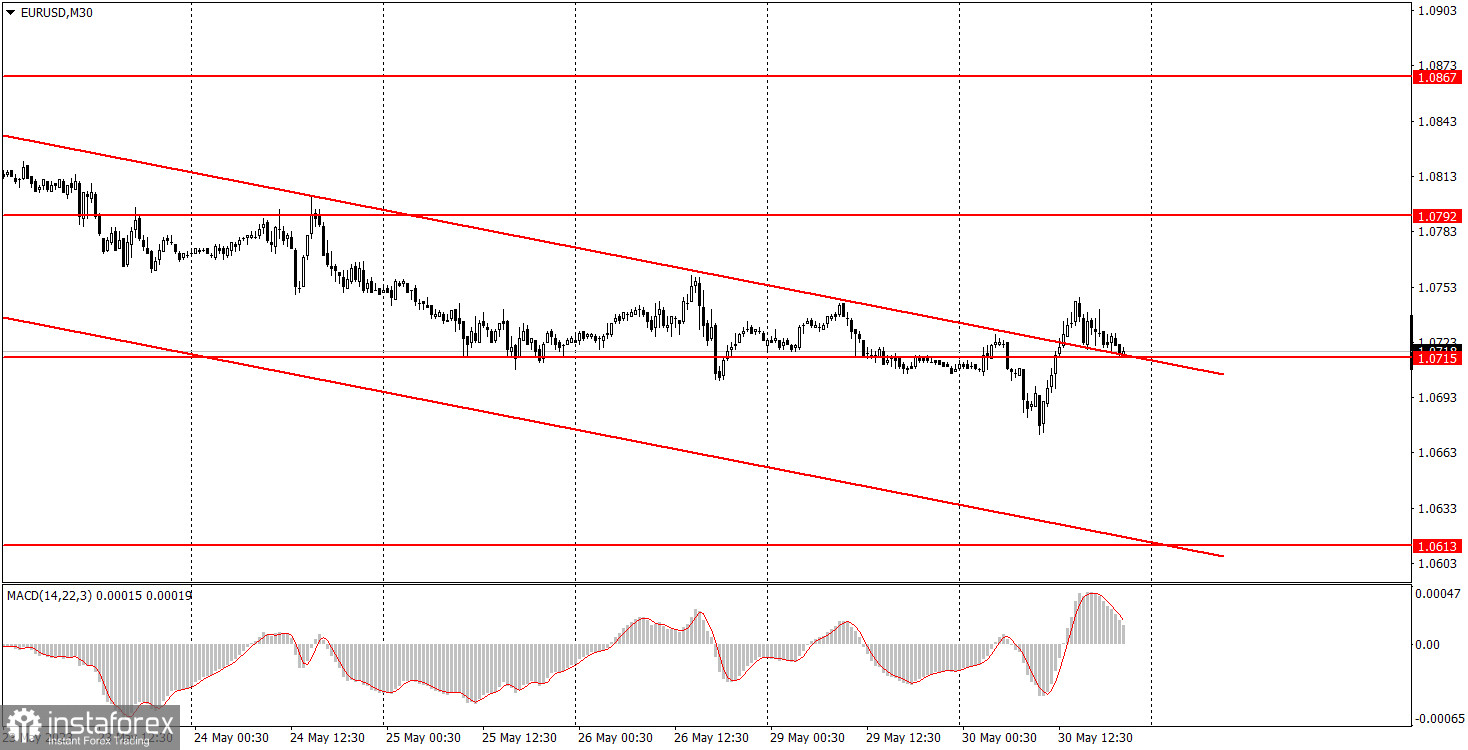

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners should remember that every trade cannot be profitable. The development of a reliable strategy and money management are the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română