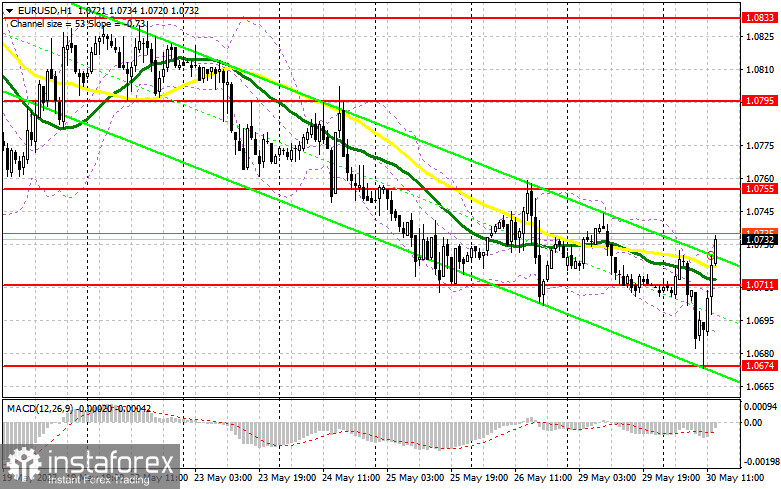

In the previous review, I drew your attention to the level of 1.0674 and recommended making entry decisions from it. Let's have a look at the 5-minute chart and analyze the situation in the market. The euro/dollar pair declined and formed a false breakout. This created an entry point into long positions, which pushed the price higher by over 50 pips. The technical picture has completely changed in the second half of the day.

Long positions on EUR/USD:

Disappointing news on lending in the eurozone blew speculative euro buyers, leading to new monthly lows. After that, traders started to take profits, causing a sharp rebound in the pair, as was expected yesterday amid news of an agreement on the US debt limit. In the second half of the day, a report on US consumer confidence will be released, capable of further strengthening the positions of euro buyers. Even if data appears to be strong, any plunge is likely to be short-lived, which major players will take advantage of.

For this reason, a decline and the formation of a false breakout near the new support level of 1.0711, formed during the first half of the day, will confirm the presence of real market participants willing to push the euro upwards against the bearish trend. This will provide an opportunity to enter long positions with the target of reaching the nearest resistance at 1.0755. A breakthrough and a downward test of 1.0755 in the second half of the day may strengthen the demand for the euro, creating an additional entry point into long positions with the target at a new high near 1.0795. The next target is located in the area of 1.0833, where traders may take profits. If the euro/dollar pair declines and we see weak bullish activity at 1.0744, which is less likely, especially after such a sharp rally during the European session, a return to a downtrend can be expected. Therefore, only a false breakout near the new monthly low of 1.0674 may give a signal to buy the euro. One may open long positions from 1.0634, allowing an upward intraday correction of 30-35 pips.

Short positions on EUR/USD:

Currently, bears need to protect the new resistance at 1.0755 and open more short positions to continue the downtrend. A false breakout at this level will signal a sell-off, pushing the pair to 1.0711. A sustained move below this range, as well as a test from above, may drag the price to 1.0674, the monthly low. The next target will be in the area of 1.0634, where profits can be taken. If the pair increases during the American session and bears show weak activity at 1.0755, we can expect a continuation of the upward correction. In that case, it would be better to postpone opening short positions until the pair reaches 1.0795. One may also open short positions at this level after an unsuccessful confirmation. Short positions can also be opened on a rebound from 1.0833, allowing a downward correction of 30-35 pips.

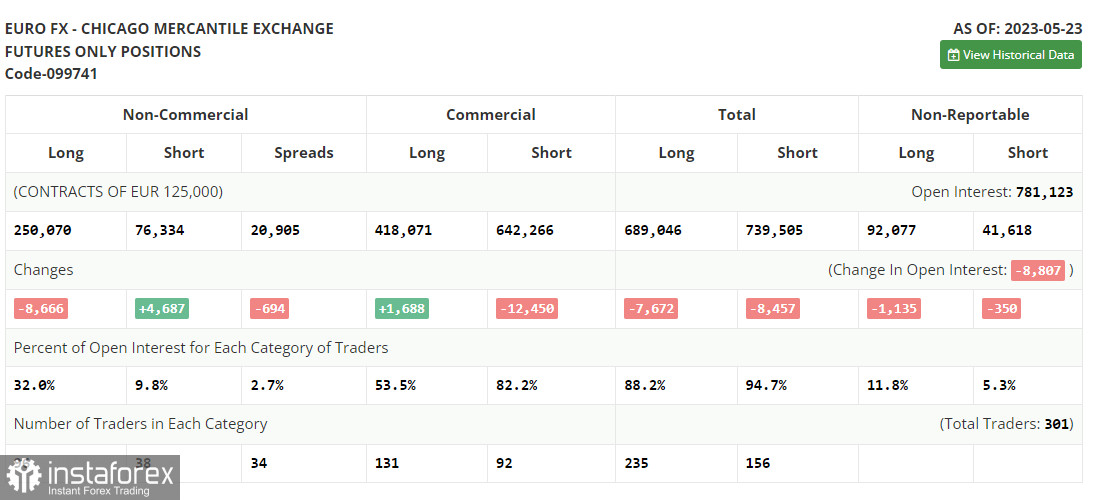

The COT report for May 23 logged a reduction in long positions and an increase in short positions. The decline in the euro continued as the debt situation had not yet been resolved, and the risks of a more severe recession in the US remained. However, even after the news of reaching an agreement and avoiding a US default, the US dollar continued to be in demand. The latest inflation data confirmed the need for further rate hikes by the Federal Reserve, so investors are no longer counting on a summer lull. The COT report indicates that non-commercial long positions decreased by 8,666 to 250,070, while non-commercial short positions jumped by 4,687 to 76,334. As a result, the total non-commercial net position increased to 185,045 from 187,089. The weekly closing price declined to 1.0793 from 1.0889.

Signals of indicators:

Moving Averages

The pair is trading near the 30- and 50-day moving averages, indicating market uncertainty.

Note: The author considers the period and prices of moving averages on the hourly chart (H1) and they differ from the general definition of classic daily moving averages on the daily chart (D1).

Bollinger Bands

If the pair increases, the upper boundary of the indicator around 1.0733 will offer resistance.

Descriptions of indicators:

- Moving Average determines the current trend by smoothing volatility and noise. Marked in yellow on the chart. Period 50.

- Moving Average determines the current trend by smoothing volatility and noise. Marked in green on the chart. Period 30.

- MACD Indicator. Fast EMA (Exponential Moving Average) with a period of 12, slow EMA with a period of 26, and SMA (Simple Moving Average) with a period of 9.

- Bollinger Bands. Period 20.

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Non-commercial long positions represent the total long open position of non-commercial traders.

- Non-commercial short positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between non-commercial short and long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română