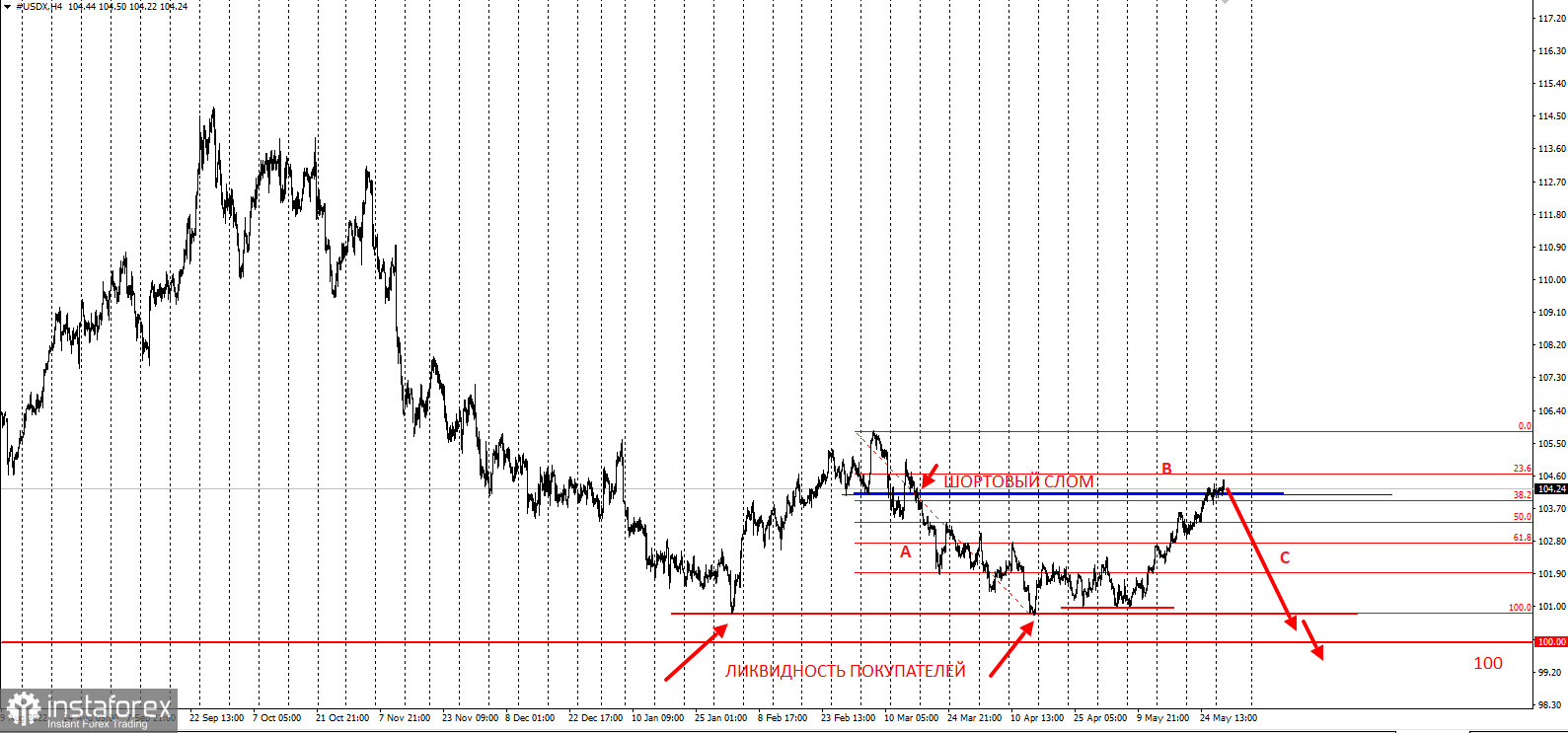

After a prolonged bullish correction that brought the index quotes to 104, where the March breakdown occurred, dollar showed the first signs of weakening, which in turn signal the formation of a third wave.

A three-wave (ABC) pattern could be seen in USD, where wave A represents the selling pressure last March. This opens the opportunity for traders to consider short positions from the 38.2% retracement level. Set stop loss at 105 and take profit upon the breakdown of 100.

The trading idea came from the framework of the "Price Action" and "Stop Hunting" methods.

Good luck in trading and remember to manage your risks!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română