EUR/USD

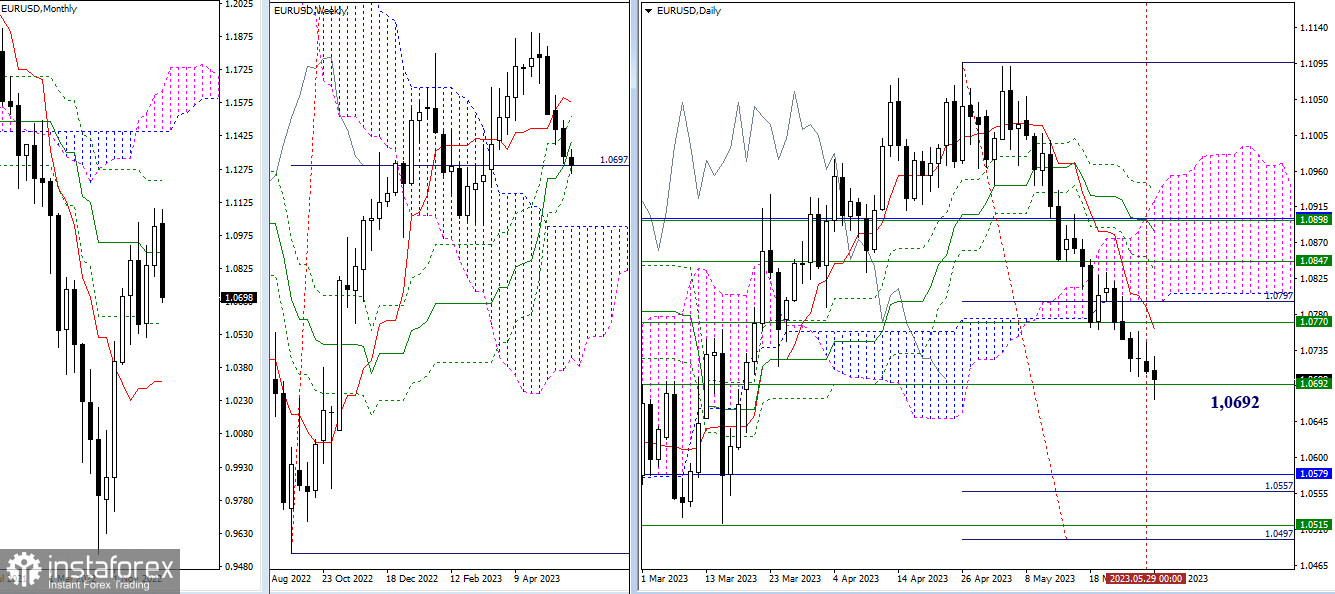

Higher timeframes

The pair has started testing the weekly support at 1.0692. A breakthrough and consolidation below the final level of the weekly golden cross of Ichimoku will allow the cross to be eliminated, opening up new prospects for a decline. The current bearish targets are the monthly support (1.0579), weekly support (1.0515), and the bearish target for breaking the daily cloud (1.0557-1.0497). In case of a rebound and recovery of bullish positions, the immediate resistance level will be the range of 1.0761–1.0770 (daily short-term trend + weekly medium-term trend).

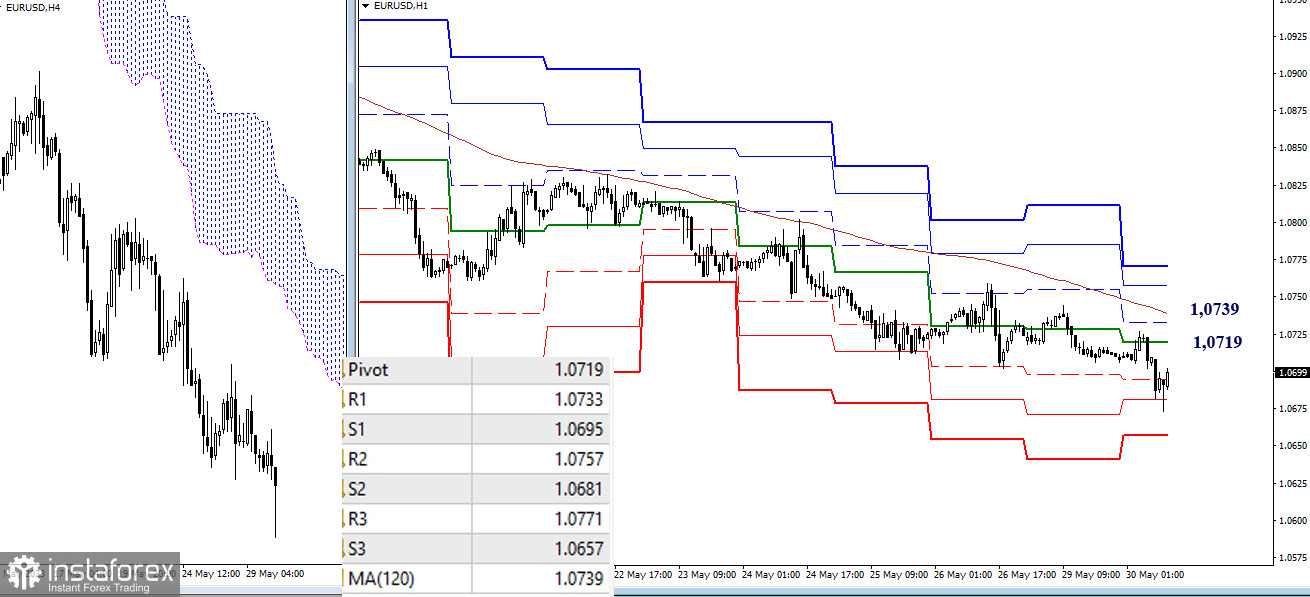

H4 - H1

On lower timeframes, the pair continues to develop a downward trend, which has already encountered support at S2 (1.0681) today, with a possible further meeting with S3 (1.0657). Key levels on the lower timeframes today act as resistances, located at 1.0719 (central pivot point of the day) and 1.0739 (weekly long-term trend). A consolidation above these levels will change the balance of power and bring relevance to bullish targets—the resistances of classic pivot points R2 (1.0757) and R3 (1.0771).

***

GBP/USD

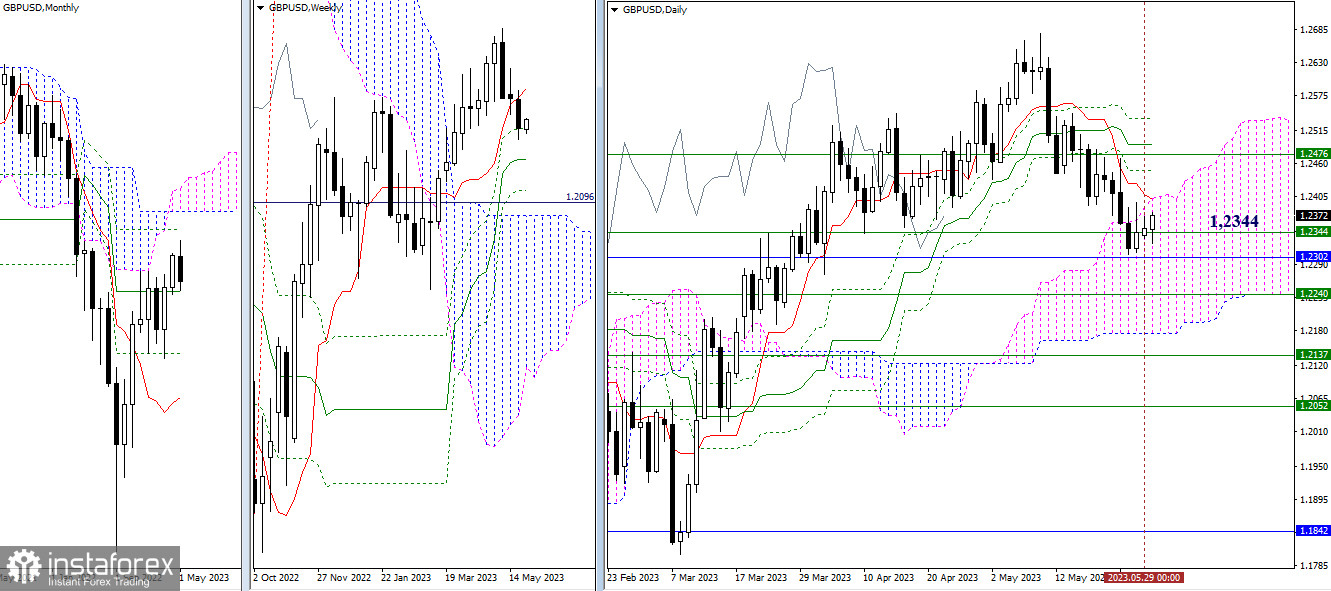

Higher timeframes

The mentioned slowdown, centered around the weekly level (1.2344), continues to develop, so the situation fundamentally has not undergone significant changes in the past trading day. A breakthrough of the monthly support at 1.2302 will pave the way to 1.2240 (weekly medium-term trend) and 1.2173 (lower boundary of the daily cloud). A rise above the resistance at 1.2399 (daily short-term trend + upper boundary of the daily cloud) will shift the focus to the levels of the daily Ichimoku cross (1.2449-1.2492-1.2536), reinforced by the weekly short-term trend (1.2476).

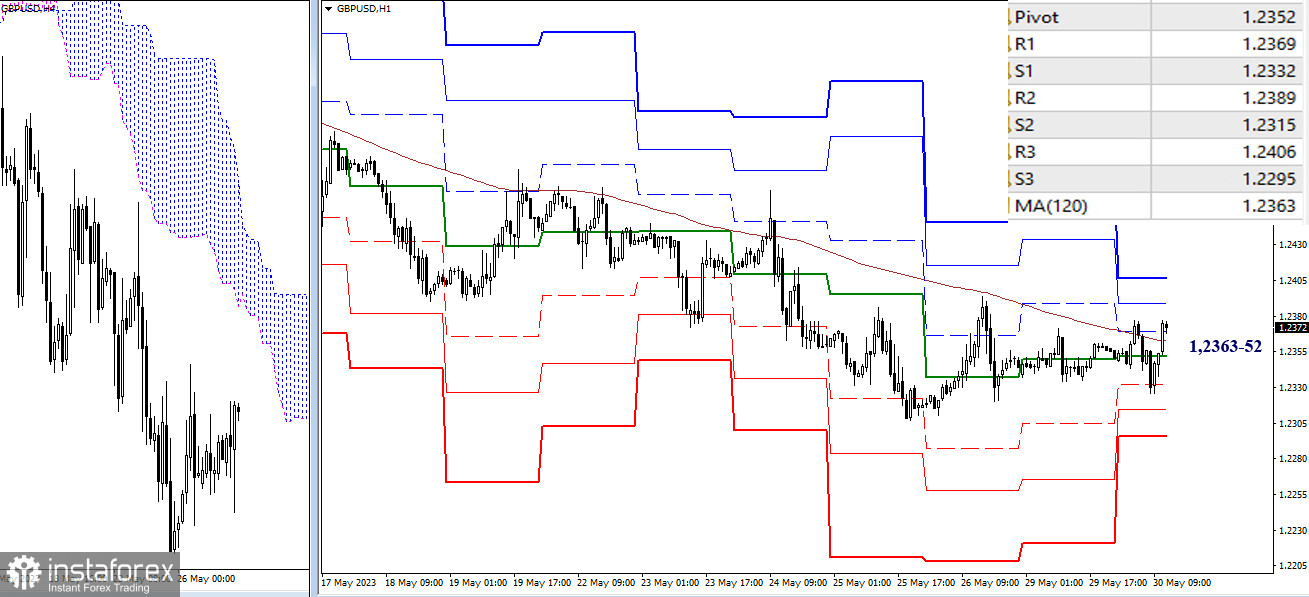

H4 - H1

On lower timeframes, there is currently a struggle for key levels. They are combining their efforts within a relatively narrow range of 1.2363–52 (central pivot point + weekly long-term trend). Working above these levels will strengthen bullish sentiment, with the resistances of classic pivot points (1.2389-1.2406) serving as targets within the day. Working below the key levels will shift market focus to bearish prospects, with the supports of classic pivot points (1.2315-1.2295) serving as targets.

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română