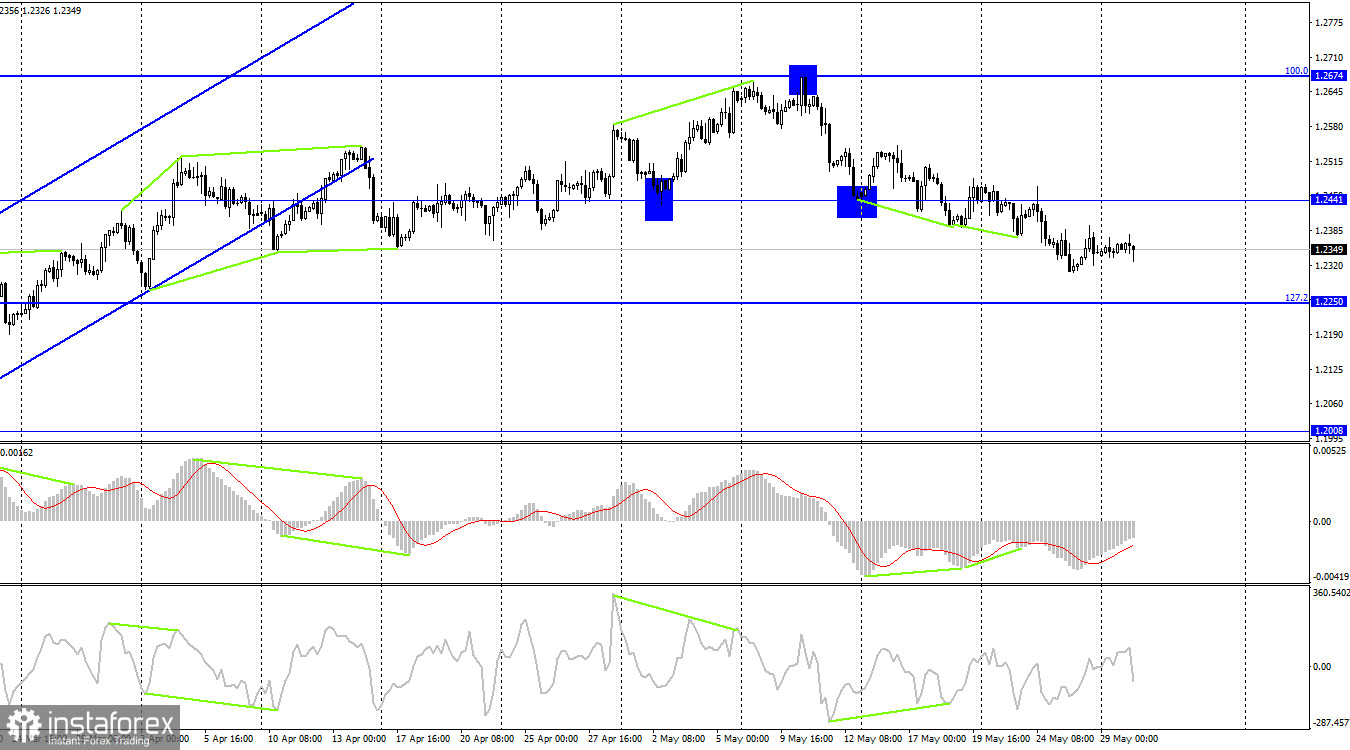

On the hourly chart, the GBP/USD pair moved horizontally on Monday, and the horizontal movement continued on Tuesday. The descending trend corridor characterizes traders' sentiment as "bearish," but today or tomorrow, the pair may establish a foothold above it. Unlike the European currency, the British pound is not interested in further decline.

The information background in the UK and the US was completely absent on Monday and Tuesday, which explains the need for market movements. Yesterday's situation can still be understood as it was a holiday in America. Today, "Europe" is also at a standstill, but I still expect increased trader activity with the awakening of "America."

As we all know, the dollar has risen actively in recent weeks. I can explain this with two factors that may continue to support the US currency. First, the interest rates of the central banks of the UK and the US are approaching their peak values and, therefore, no longer have the same impact on exchange rates as before. Second, inflation in the US is falling much faster than in Britain or Europe, while the interest rate is higher. It is forecasted that inflation in America will continue to slow down at a good pace by the end of the year. At the same time, less significant declines are expected in European or British inflation.

It is noted that wages in the US have started to slow down, and the cost of rent is also slowing down. These two factors will help inflation continue to decline. By the end of the year, the consumer price index may reach levels that warrant considering a reduction in the Federal Reserve's interest rate. Accordingly, by the end of the year, the US currency may lose its advantage in the market. It could happen not by the end of the year but in the autumn. However, in the coming months, I see many more reasons for the dollar to rise than for the British pound.

On the 4-hour chart, the pair has established a foothold below the level of 1.2441, which allows for expectations of further decline toward the next corrective level of 127.2% (1.2250). No emerging divergences are observed today in any indicator, and I am not currently counting on a strong rise in the British pound. A rebound of the pair's rate from the level of 1.2250 will favor the pound and some growth, while closing below this level will increase the probability of a decline toward the next level at 1.2008.

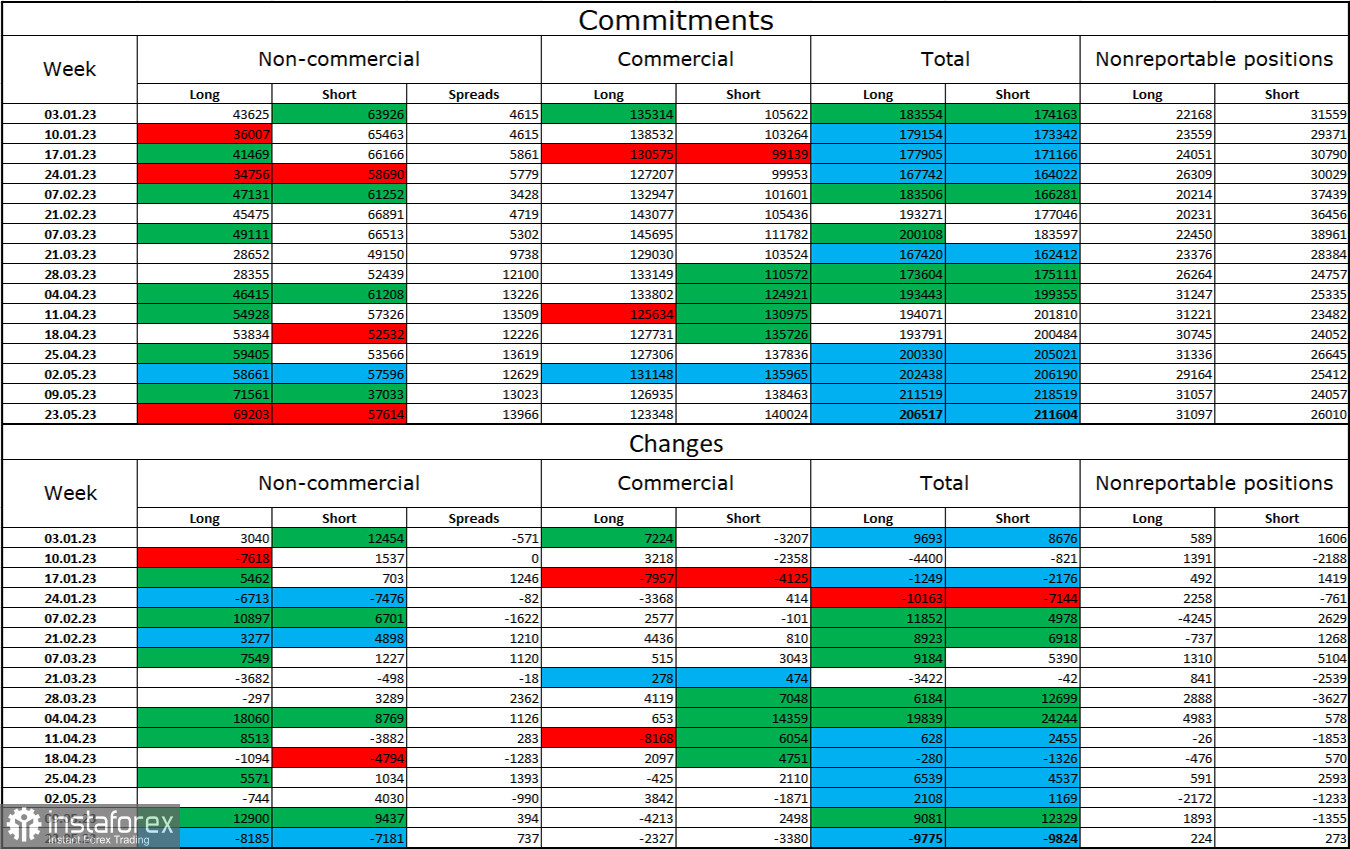

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" trader category has become slightly less bullish over the past reporting week. The number of long contracts held by speculators decreased by 8185 units, while the number of Short contracts decreased by 7181. The overall sentiment of large players remains predominantly bullish (it has been bearish for a long time), but the number of Long and Short contracts is now almost equal - 69 thousand and 57 thousand, respectively. The British pound has good prospects for resuming growth, but the current information background does not favor the dollar or the pound. The pound has been rising for a long time, and the net position of non-commercial traders has been rising for a long time, but it all depends on whether the long-term support for the British currency will be maintained. At this time, expecting a resumption of growth is not advisable.

News calendar for the US and the UK:

US - CB Consumer Confidence Index (14:00 UTC).

On Tuesday, the economic events calendar contains only one entry unlikely to interest traders. The influence of the information background on the pair's movement for the remainder of the day will be absent.

Forecast for GBP/USD and trader recommendations:

I recommend new pound sales on a bounce from the upper line of the descending channel on the hourly chart, with targets at 1.2295 and 1.2201. I recommend buying the pound on a close above the range on the hourly chart, with targets at 1.2447 and 1.2546.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română