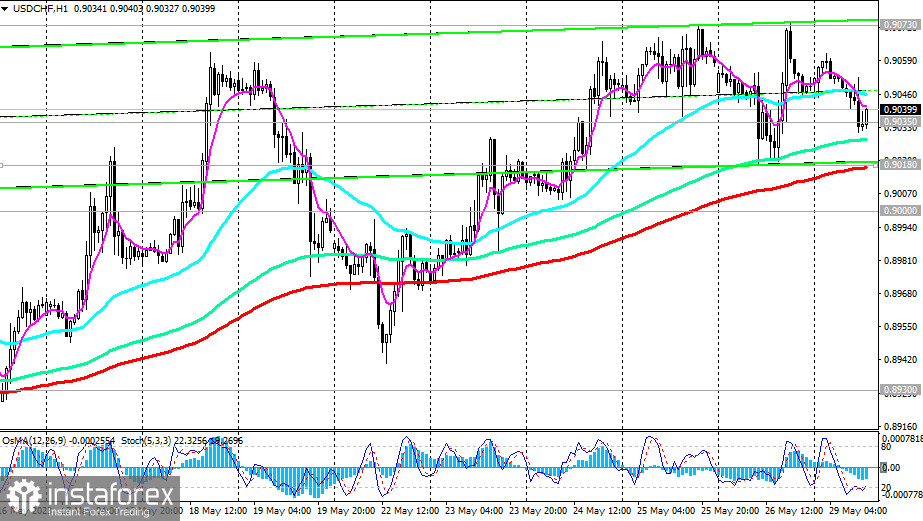

USD/CHF is developing a long-term downward dynamic, trading within the bearish territories of the long-term and medium-term markets, below key resistance levels at 0.9265 (200 EMA on the daily chart), 0.9285 (50 EMA on the weekly chart), 0.9375 (144 EMA on the weekly chart), 0.9410 (200 EMA on the weekly chart).

Today, USD/CHF is declining amid the weakening of the dollar, testing a crucial support level at 0.9030 (50 EMA on the daily chart).

Another important support level is located at 0.9000 (200 EMA on the 1H chart).

A breakdown of the significant short-term support level at 0.9018 (200 EMA on the 1H chart) will be the first signal for resuming short positions, and a breakdown of the 0.9000 support level will confirm it.

In an alternative scenario, the price will break through the resistance levels 0.9073 (local resistance level), 0.9107 (23.6% Fibonacci level of the upward correction wave that started in April 2019 near the 1.0235 mark) and continue to correct towards key resistance levels 0.9205 (144 EMA on the daily chart), 0.9265, 0.9285.

Further growth is currently unlikely, considering the long-term downward dynamic of the pair.

Support levels: 0.9035, 0.9030, 0.9018, 0.9000, 0.8930, 0.8820

Resistance levels: 0.9073, 0.9107, 0.9205, 0.9265, 0.9285, 0.9300, 0.9375, 0.9410

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română