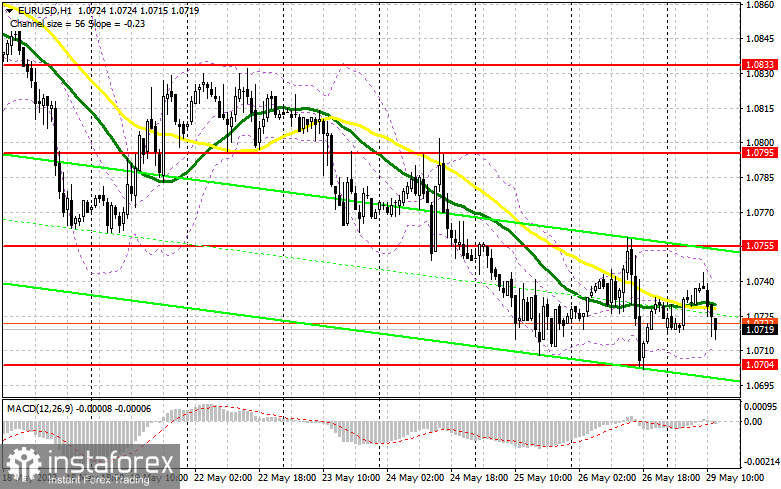

In my morning forecast, I pointed out the level of 1.0704 and recommended making trading decisions based on it. Let's look at the 5-minute chart and analyze what happened there. The price didn't reach this range, and due to low market volatility, no signals were formed. The technical picture remained unchanged for the second half of the day.

To open long positions on EUR/USD, the following is required:

There were no news releases concerning the Eurozone in the first half of the day. There are also no news releases from the US, so volatility will remain at the same level in the second half of the day. Currency traders are not rushing to accumulate long positions in the euro, despite Republicans and Democrats agreeing on the US debt limit. They may be waiting for the document to be approved by Congress and reach Biden's desk, or maybe this news is no longer interesting since it was initially clear that a solution would be found.

Like in the morning, I plan to act only after a decline and the formation of a false breakout near the new monthly low of 1.0704. This will confirm the presence of buyers willing to push the euro higher against the bearish trend, providing an opportunity to enter long positions with a target of 1.0755, the nearest resistance level. A breakthrough and test of 1.0755 from top to bottom in the second half of the day will strengthen the demand for the euro, creating an additional entry point for increasing long positions and targeting a new high of around 1.0795. The ultimate target remains the area of 1.0833, where I will take profits. In the scenario of a decline in EUR/USD and the absence of buyers at 1.0704, which is less likely after positive news about avoiding a US default, we can expect further trend development. Therefore, only the formation of a false breakout near the next support level of 1.0670 will signal to buy the euro. I will open long positions from a rebound at a minimum of 1.0634, aiming for an upward correction of 30-35 pips within the day.

To open short positions on EUR/USD, the following is required:

Bears continue to control the market, and the morning attempt by bulls to reach 1.0755 was unsuccessful. Protecting this resistance level remains a priority and a suitable scenario for increasing short positions, following a trend similar to last Friday. A false breakout at this level will signal a sell-off, capable of pushing the pair to the next monthly low at 1.0704. If the price consolidates below this range and there is a retest from below to above, it will pave the way to 1.0670. The ultimate target will be the minimum of 1.0634, where profits can be taken. We can anticipate a pair correction if EUR/USD moves upward during the US session and bears are absent at 1.0755. In this case, I will postpone short positions until 1.0795. Selling can also be done there, but only after a failed consolidation. I will open short positions from a rebound starting at the maximum of 1.0833, targeting a downward correction of 30-35 points.

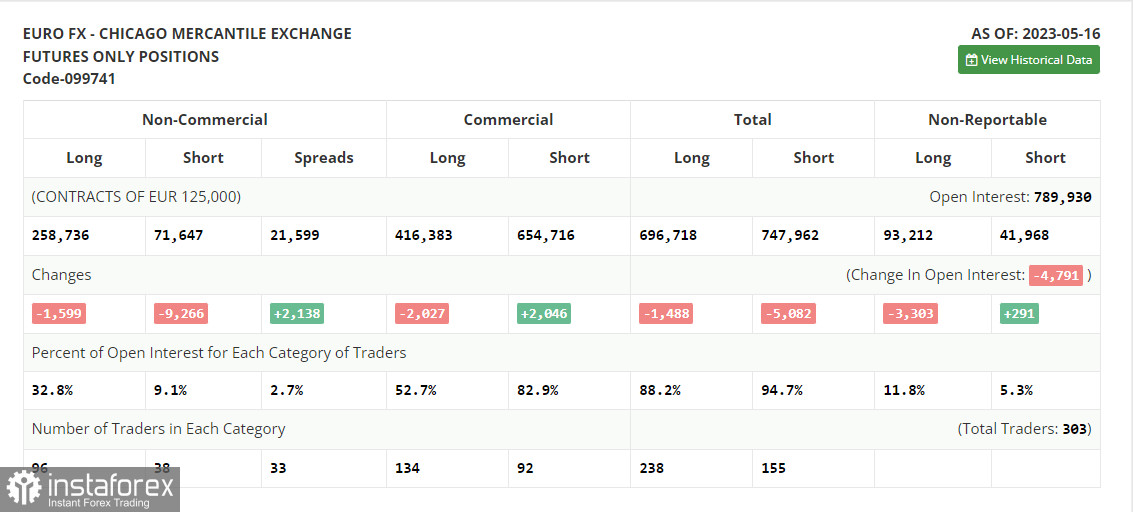

In the COT (Commitment of Traders) report for May 16, there was a reduction in both long and short positions, but the latter were significantly larger. The corrective downward movement of the euro we observed last week remains a good reason to increase long positions. Still, once the issue of the US debt limit is resolved, we are likely to see significant demand for risk assets. Traders even ignore statements from Federal Reserve officials, who unanimously claim that the committee will pause the rate hike cycle at the next meeting, which is a bullish signal for the euro. So, as soon as the debt limit issue is resolved, buyers will return to the market, but it may take some time. According to the COT report, non-commercial long positions decreased by only 1,599 to 258,736, while non-commercial short positions decreased by 9,266 to 71,647. As a result of the week, the overall non-commercial net position increased to 187,089 compared to 179,422. The weekly closing price decreased to 1.0889 from 1.0992.

Indicator signals:

Moving Averages

Trading around the 30-day and 50-day moving averages indicates market uncertainty.

Note: The period and prices of the moving averages considered by the author are on the H1 hourly chart and differ from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands

In case of an uptrend, the upper boundary of the indicator around 1.0740 will act as resistance.

Description of Indicators:

- Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

- Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands. Period 20.

- Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- The total non-commercial net position is the difference between non-commercial traders' short and long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română