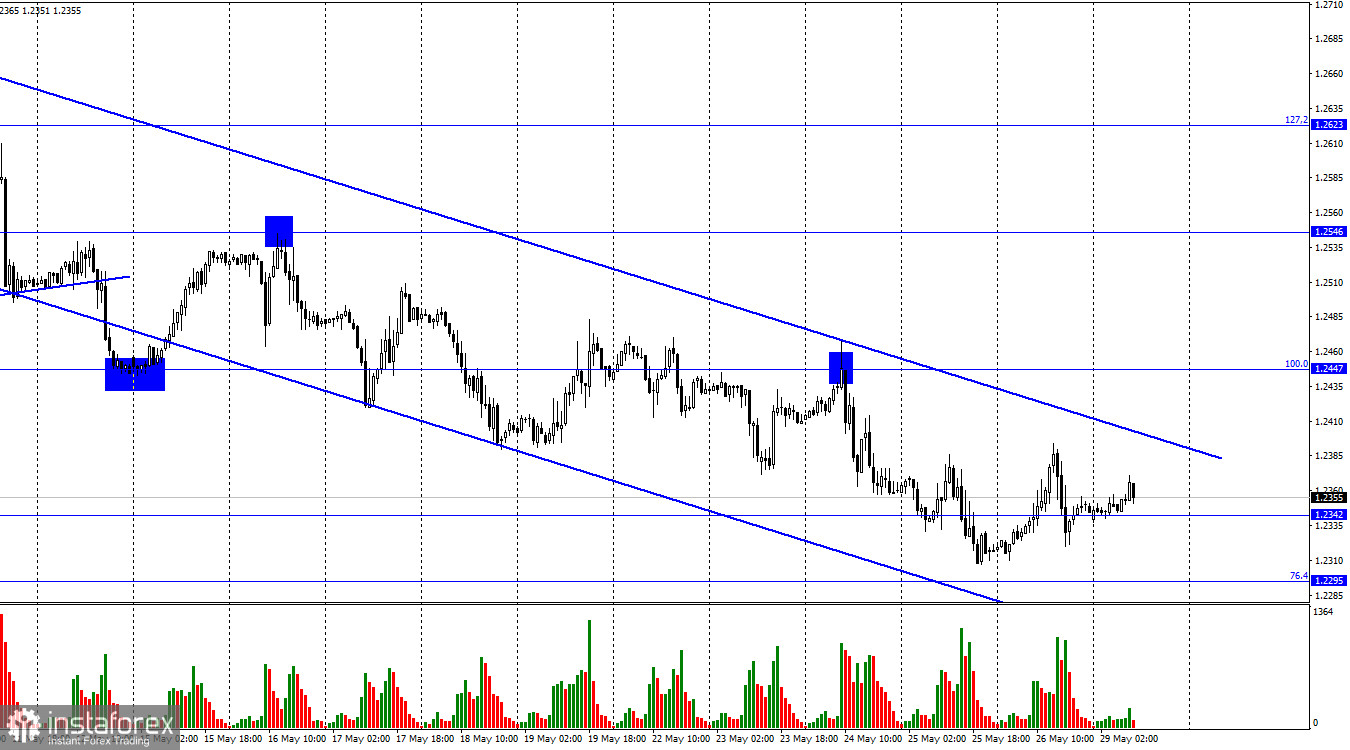

On the hourly chart, the GBP/USD pair on Friday experienced an upward movement towards the upper line of the descending trend corridor, which currently characterizes traders' sentiment as "bearish." Monday morning started with a slight decline. I advise traders to expect a rise in the British pound when the pair closes above the corridor. Until then, a decline toward the 76.4% correction level at 1.2295 remains more likely.

Over the weekend, it became known that the Republican and Democratic parties in the United States have agreed to raise the debt ceiling. Recall that this issue has been a pressing problem in recent months, with many economists even discussing the possibility of a default by the world's largest economy.

However, most experts did not believe in such an outcome, as reaching the debt limit is a recent issue in America. The country has money, and the Federal Reserve is always ready to print the necessary new money. The problem was solely in legislation that does not allow the current government to borrow money. Thus, a classical default could not occur under any circumstances. And after the past weekend, it became clear that there won't even be a technical default.

In light of resolving this problem, dollar buyers may become active again. However, if they have been actively buying the dollar for almost a month, it means that the US debt issue did not initially concern them too much. The rise of the American currency may continue for some time, but a correction is also needed. We have two descending corridors (for the euro and the pound), so it is worth buying the pair once it consolidates above them. This week will bring enough important events for the bulls to "regain their composure." But for now, the initiative remains in the hands of the bears, and they will not give it up without a fight.

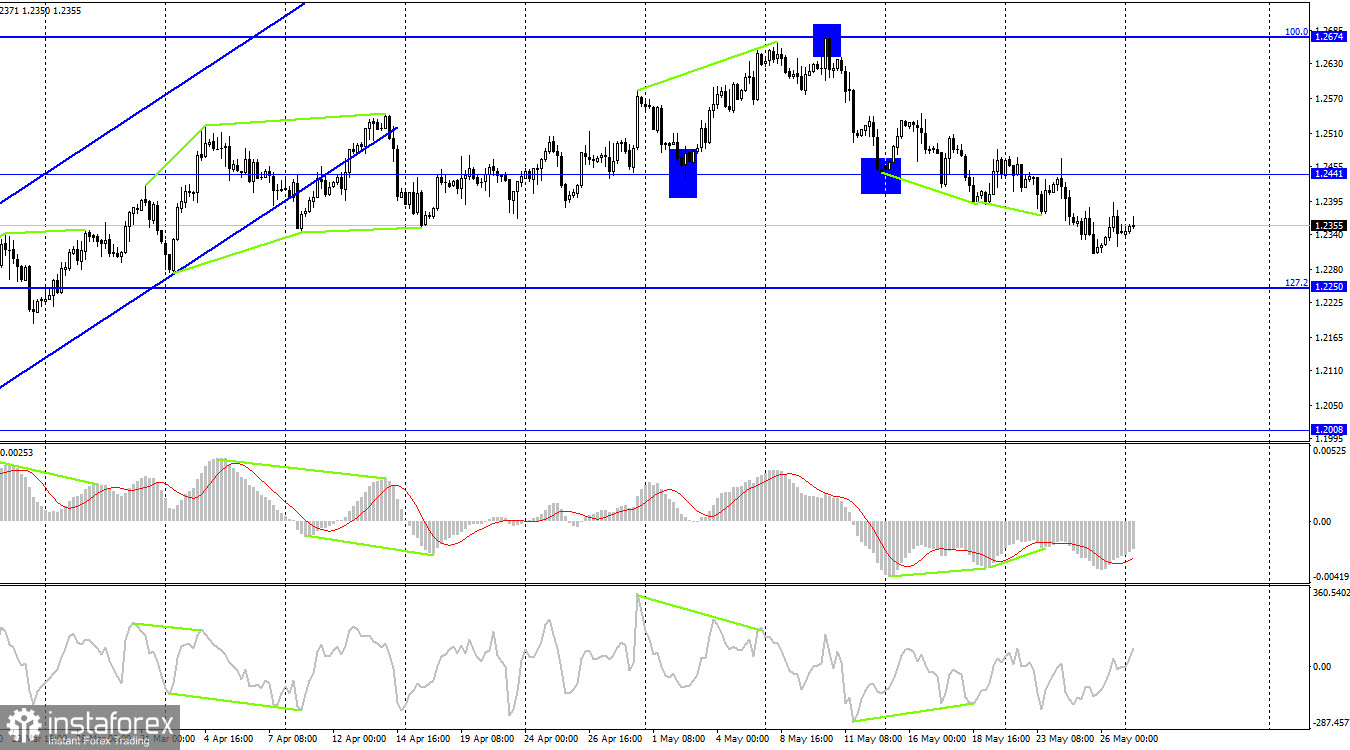

On the 4-hour chart, the pair has consolidated below the level of 1.2441, which allows us to expect further decline toward the next corrective level of 127.2% (1.2250). There are no emerging divergences today in any indicator, and I am not counting on a strong rise in the British pound. A rebound of the pair's exchange rate from the level of 1.2250 will favor the pound and some growth, while a close below this level will increase the probability of a decline towards the next level at 1.2008.

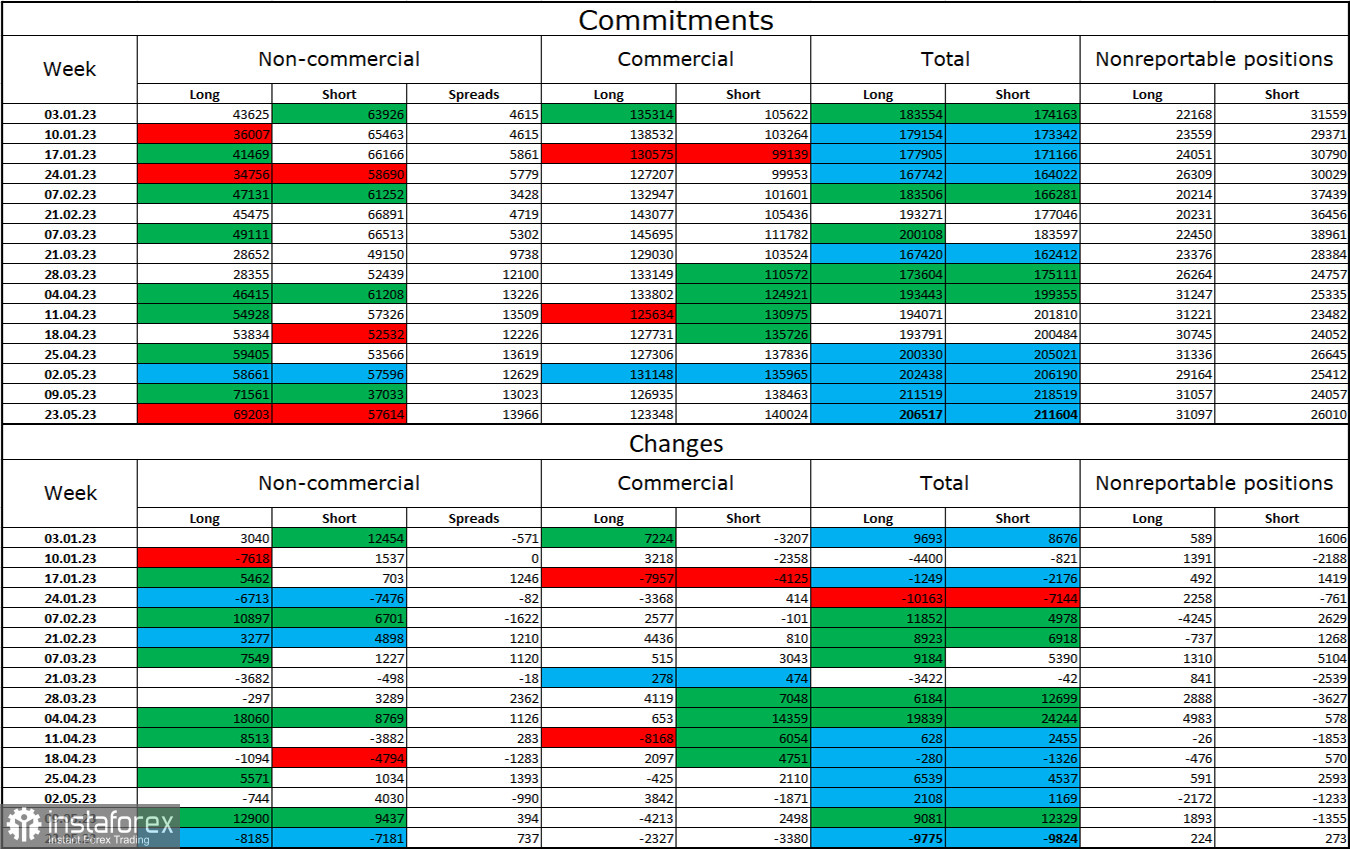

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" trader category has become slightly less bullish during the last reporting week. The number of long contracts held by speculators decreased by 8185 units, while the number of Short contracts decreased by 7181. The overall sentiment of large players remains predominantly bullish (after being bearish for a long time), but the number of Long and Short contracts is now almost equal - 69,000 and 57,000, respectively. The British pound has good prospects for resuming growth, but the current information background does not favor the dollar or the pound. The pound has been rising for a long time, and the net position of non-commercial traders has been increasing for a long time, but it all depends on whether the long-term support for the British currency will be maintained. It is not worth expecting a resumption of growth at this time.

News calendar for the United States and the United Kingdom:

On Monday, the economic events calendar contains only some important entries. The impact of the information background on traders' sentiment for the rest of the day will be absent.

Forecast for GBP/USD and trader advice:

I recommend new pound sales on a rebound from the upper line of the descending channel on the hourly chart, with targets at 1.2295 and 1.2201. I advise buying the pound when it closes above the corridor on the hourly chart, with targets at 1.2447 and 1.2546.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română