The rate of decline in UK retail sales was expected to slow from 3.1% to 2.6%, but it turned out that it fell to 3.0%. Moreover, previous data was revised downward to -3.9%. However, despite the data ending up significantly worse than expected, the pound continued to rise vigorously. The reason is that it still pertains to a slowdown in the pace of decline. That is to say, the situation is improving.

However, immediately after the opening of the US trading session, the pound started losing its positions and essentially returned to the levels it was at before the retail sales data was published. According to forecasts, retail sales were expected to fall by 1.1%, but instead, they increased by the same 1.1%. As a result, the dollar was able to return to its initial position.

Today, both Europe and the United States are observing a holiday, so the market will simply stand still. We can only expect changes in the market tomorrow.

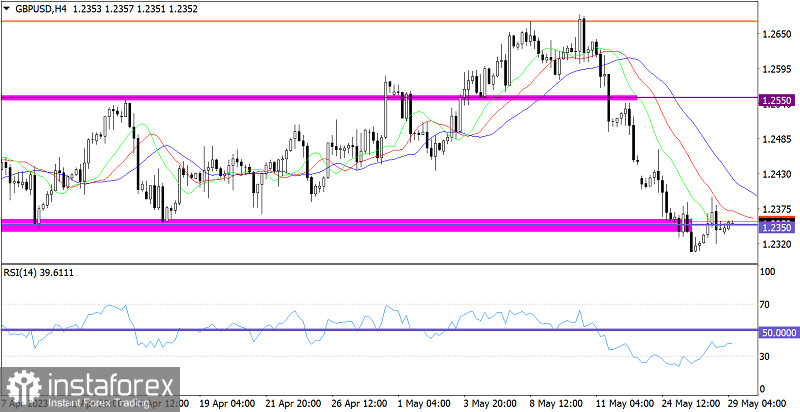

The GBP/USD pair slowed its downward cycle around the 1.2350 level, which points to the decline in the volume of short positions. This resulted in a rebound and subsequently, a period of stagnation along the control level.

The RSI has left the oversold zone on the 4-hour chart during the price rebound but still remains in the lower 30/50 area.

The Alligator moving averages are headed down in the 4-hour chart, indicating the direction of the corrective movement.

Outlook:

Given the absence of major players in the market, we can assume that the price will likely trade along the 1.2350 level and this will persist for some time. This consolidation movement will eventually lead to an accumulation of trading forces and, as a result, new speculative price jumps.

The comprehensive indicator analysis in the short-term and intraday periods points to a rebound.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română