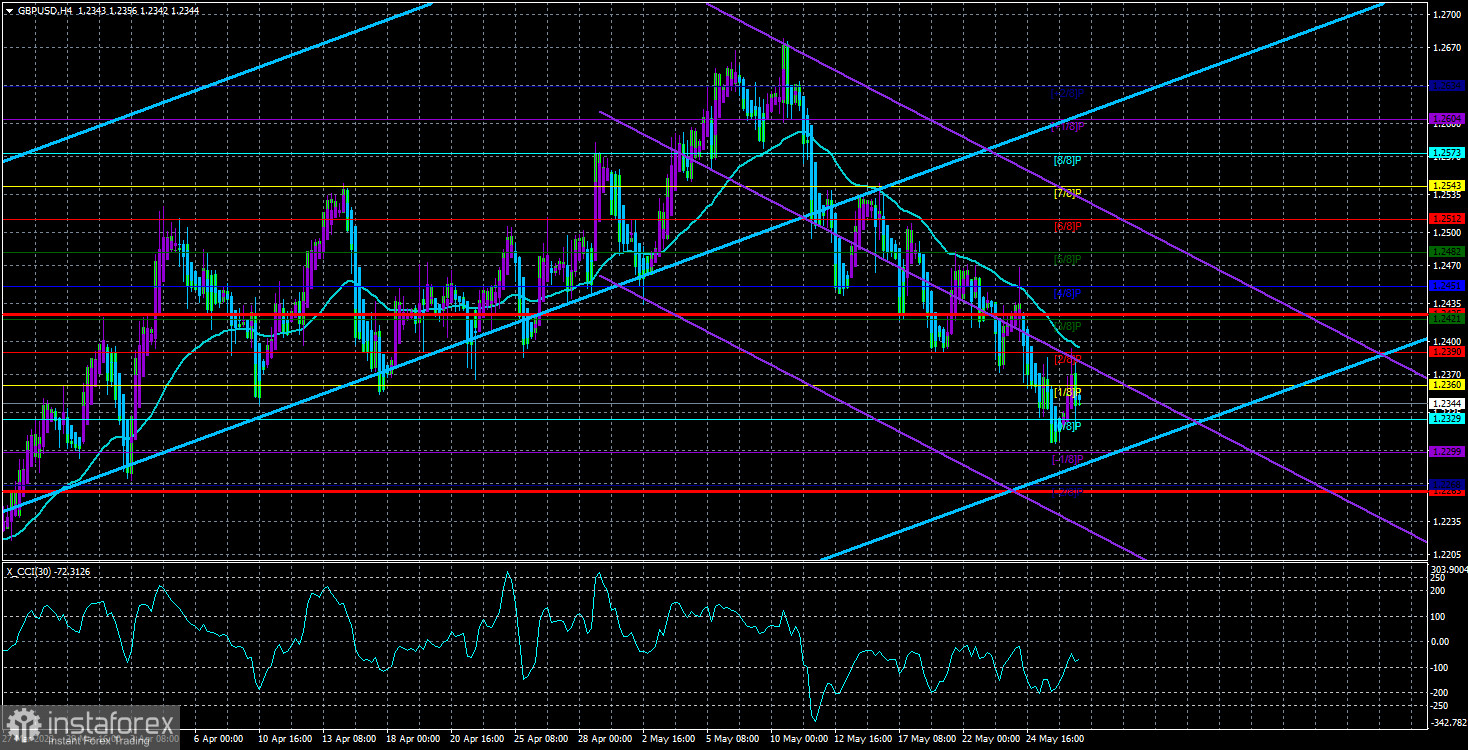

The GBP/USD currency pair made another attempt to correct slightly higher on Friday, but it failed to do so. Once again, the price couldn't even reach the moving average line, so the overall downward movement continues confidently. Unfortunately, as we have already mentioned, trading on the 4-hour time frame is extremely problematic because the movement is not the strongest (although stable). The Heiken Ashi indicator frequently reverses upward. The situation is similar to that of the euro currency. Therefore, the best solution is to trade in the medium term.

What can be said about the technical aspect right now? First, it has significant importance. We have observed for a long time how the pair has been rising practically without fundamental reasons and causes, and now we will see the opposite picture. If that is the case, any macroeconomic events may either be interpreted in favor of the dollar or only lead to minimal upward retracements of the pair. It is worth noting that the pound, like the euro, is heavily overbought. Second, given this situation, it is only possible to trade based on technical analysis. Important news doesn't come into traders' hands daily, but the pair is traded daily. Since volatility is low, trading on lower time frames is not advisable.

In the near future, we can only recommend selling, even if a significant upward correction begins with the moving average line being surpassed. It is difficult to even hypothetically assume that the pound can return to an upward trend after rising by 2300 points. The 24-hour time frame is very helpful, but the current downward movement still needs to be carefully examined. The minimum target for the decline is the level of 1.2170 - the Senkou Span B line.

There will be hardly any important events in the UK in the coming week, so all attention will be on US statistics. There will be no events in the US or UK on Monday.

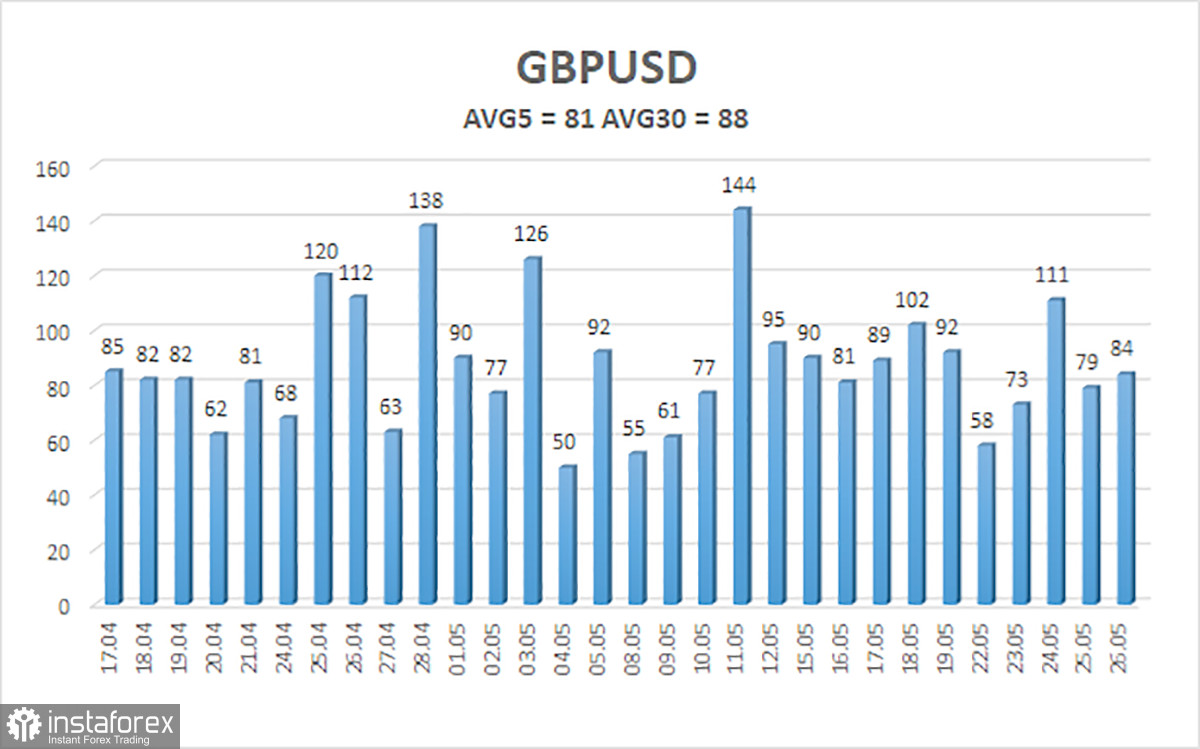

The average volatility of the GBP/USD pair over the last five trading days is 81 points. For the pound/dollar pair, this value is considered "average." Therefore, on Monday, May 29th, we expect movements within the range bounded by the levels of 1.2263 and 1.2425. An upward reversal of the Heiken Ashi indicator will signal a new phase of the corrective movement.

Nearest support levels:

S1 - 1.2329

S2 - 1.2299

S3 - 1.2268

Nearest resistance levels:

R1 - 1.2360

R2 - 1.2390

R3 - 1.2421

Trading recommendations:

The GBP/USD pair in the 4-hour timeframe continues its downward movement, so short positions with targets at 1.2299 and 1.2263 remain relevant. These positions should be held until the price consolidates above the moving average. Long positions can be considered if the price consolidates above the moving average with targets of 1.2425 and 1.2451.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both channels are aligned in the same direction, it indicates a strong trend.

Moving average line (settings 20,0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - probable price channel in which the pair will trade in the next 24 hours, based on current volatility indicators.

CCI indicator - its entry into the overbought area (above +250) or oversold area (below -250) indicates an approaching trend reversal in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română