If the dynamics of Bitcoin in the first quarter were exciting to watch, then in April, it lost some of its shine, and in May, it turned into a boring asset. The leader of the cryptocurrency sector is lagging behind the technology companies' index. Nasdaq Composite is growing due to the success in implementing artificial intelligence in corporate activities. Unfortunately, BTC/USD lacks such a driver. However, looking at the token's fluctuation near the $27,000 mark from another perspective is also possible. If despite the negativity, Bitcoin is still being held, it means it has growth potential.

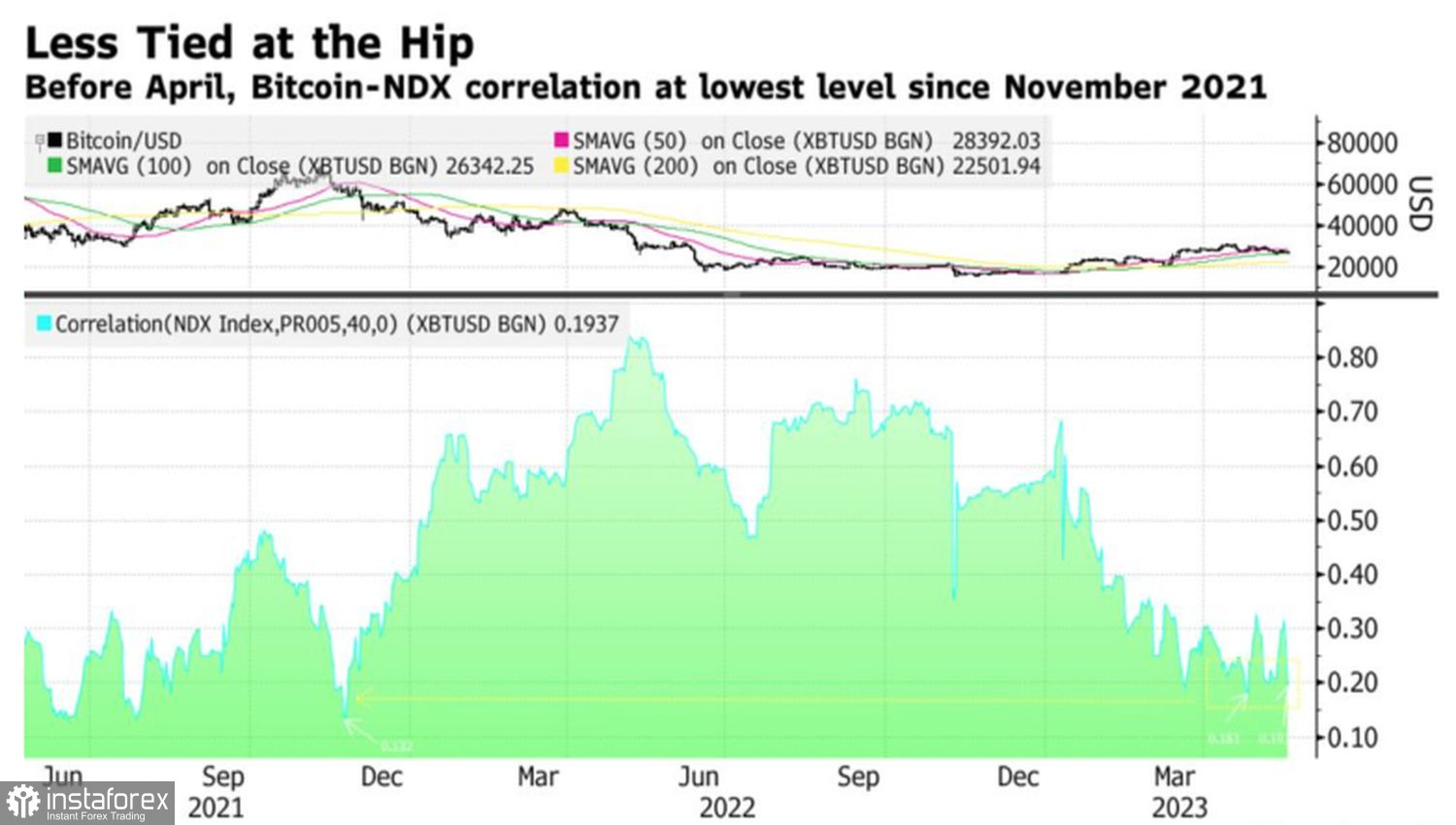

The hallmark of this year is the decrease in correlation between cryptocurrencies and U.S. stock indices. By the end of May, it reached its lowest point since April 25. Prior to this, the indicator dropped even lower only in November 2021. For a long time, Bitcoin was considered a riskier asset than stocks, but the banking crisis changed everything.

Dynamics of Bitcoin Correlation with Nasdaq Composite

Unlike the U.S. stock market, cryptocurrencies benefited from a series of bankruptcies of financial institutions. They initially started functioning as an alternative to fiat money and the centralized banking system. Therefore, banking problems became a catalyst for the BTC/USD rally. On the contrary, stock indices declined due to concerns about the slowdown in lending volumes and a recession in the U.S. economy.

In May, the situation stabilized. Bitcoin no longer has such a strong trump card as the collapse of banks. On the other hand, it receives support due to concerns about default. If the U.S. government fails to repay its debts by mid-June, Fitch and Moody's are likely to announce a credit rating downgrade. Similar to 2011, this will cause panic in financial markets and lead to a rush for safe-haven assets. According to a survey by professional investors MLIV Pulse, the main beneficiaries will be gold and its digital counterpart, Bitcoin. The need to hold this asset as insurance forces BTC/USD to stabilize.

The deal between Democrats and Republicans has not yet been concluded, but its contours are gradually becoming clearer. According to a Wall Street Journal insider, it involves raising the debt ceiling from the current $31.4 trillion to $3.5–4 trillion over a period of about two years. The stumbling block is the magnitude of government spending cuts.

Pressure on the leader of the cryptocurrency sector is created by the decline in daily trading volumes to the lowest levels in the past two years, as well as the decrease in volatility to the lowest point since January. We should also not forget about the rapid strengthening of the U.S. dollar against major world currencies amid the market's abandonment of the idea of a Fed dovish pivot in 2023. Currently, CME derivatives indicate a 66% probability of a rate hike in July.

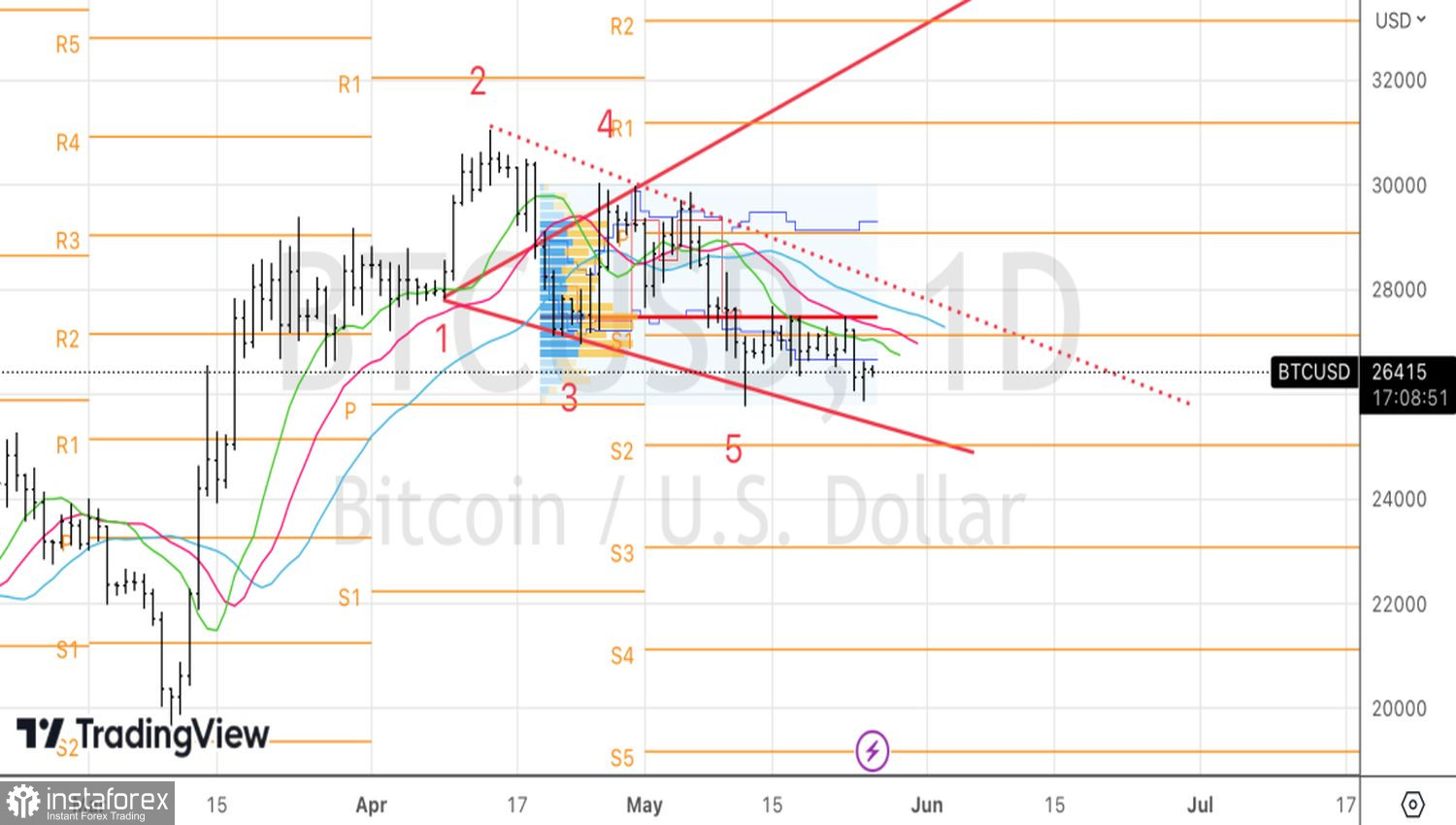

Technically, on the daily chart, BTC/USD has three reversal patterns—Wolfe Waves, Double Bottom, and a pin bar. To enter a long position, a breakthrough of resistance at 26,650 is required.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română