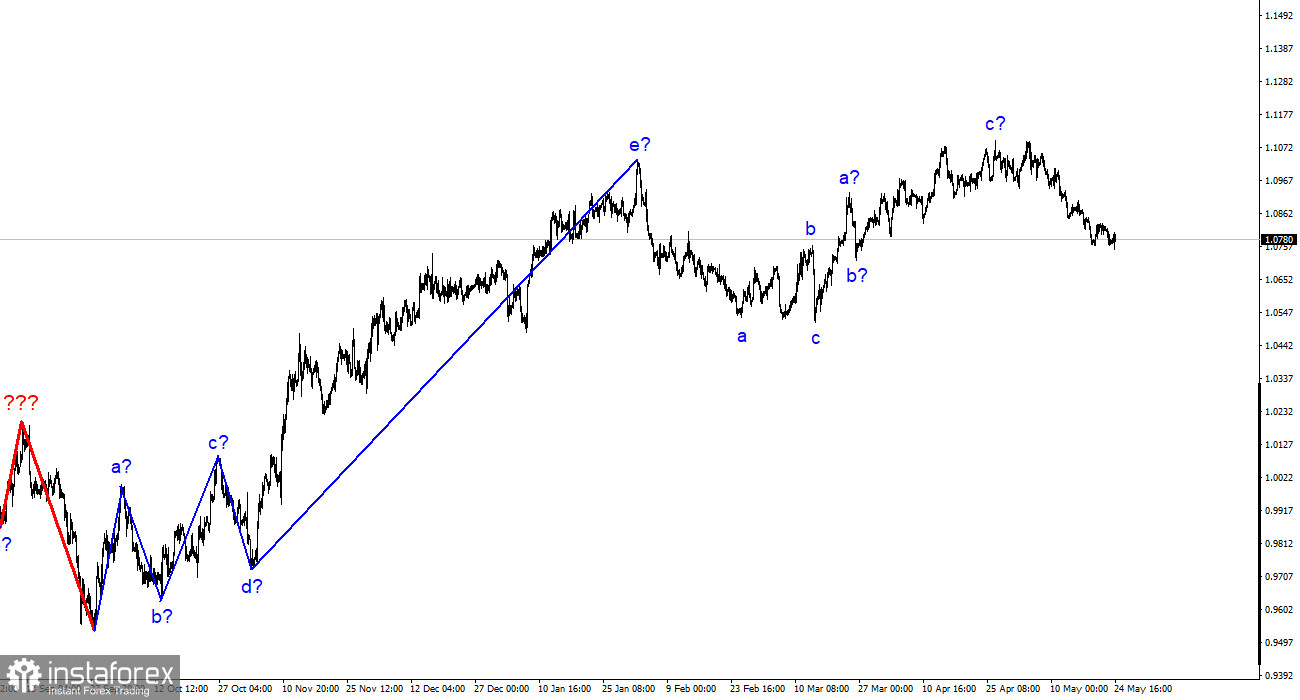

The wave labeling on the 4-hour chart for the euro/dollar pair continues to be somewhat unconventional but has remained relatively unchanged in recent weeks. During these weeks, the quotes started to retreat from the previously reached highs, indicating the completion of a three-wave upward structure. The entire ascending trend segment could form a five-wave corrective pattern. Still, at the moment, I expect the formation of a descending trend segment, which is likely also to be a three-wave structure. Recently, I have consistently mentioned that I expect the pair to be around the 1.5 figure, which is where the increase in the European currency began.

The highest point of the last trend segment was only a few dozen points above the highest point of the previous upward segment. Since December of last year, the pair's movement can be considered horizontal, and such a character of movement will be maintained. Over the past 2–2.5 months, demand for the euro has been consistently rising, but I have repeatedly pointed out that the news background for the euro is not strong enough to support such confident price growth. However, it is now becoming clear that a convincing ascending wave pattern had to be completed to begin a descending one.

The FOMC minutes should support the dollar!

The euro/dollar pair remained unchanged on Wednesday. The amplitude of movements during the day was again very weak, only about 25 basis points. The news background was practically absent, but tonight, the minutes of the May FOMC meeting will be published. Usually, these minutes contain little important information yet to be known to the market. Jerome Powell communicates everything the markets need to know during the press conference, or this information is included in the final communique. Thus, the minutes are more of a formality than an important report or document.

Nevertheless, from time to time, they can influence market sentiment, especially in pivotal moments like now. I want to remind you that with a high probability, the Federal Reserve has completed tightening monetary policy in May. Another interest rate hike in 2023 is possible if inflation gets out of the regulator's control. Based on this, it will be very interesting and important to know the current sentiment in the monetary committee. After all, there is also a possibility that several members support further rate hikes. Almost all FOMC members have spoken over the past two weeks, and some believe a rate hike in June is necessary.

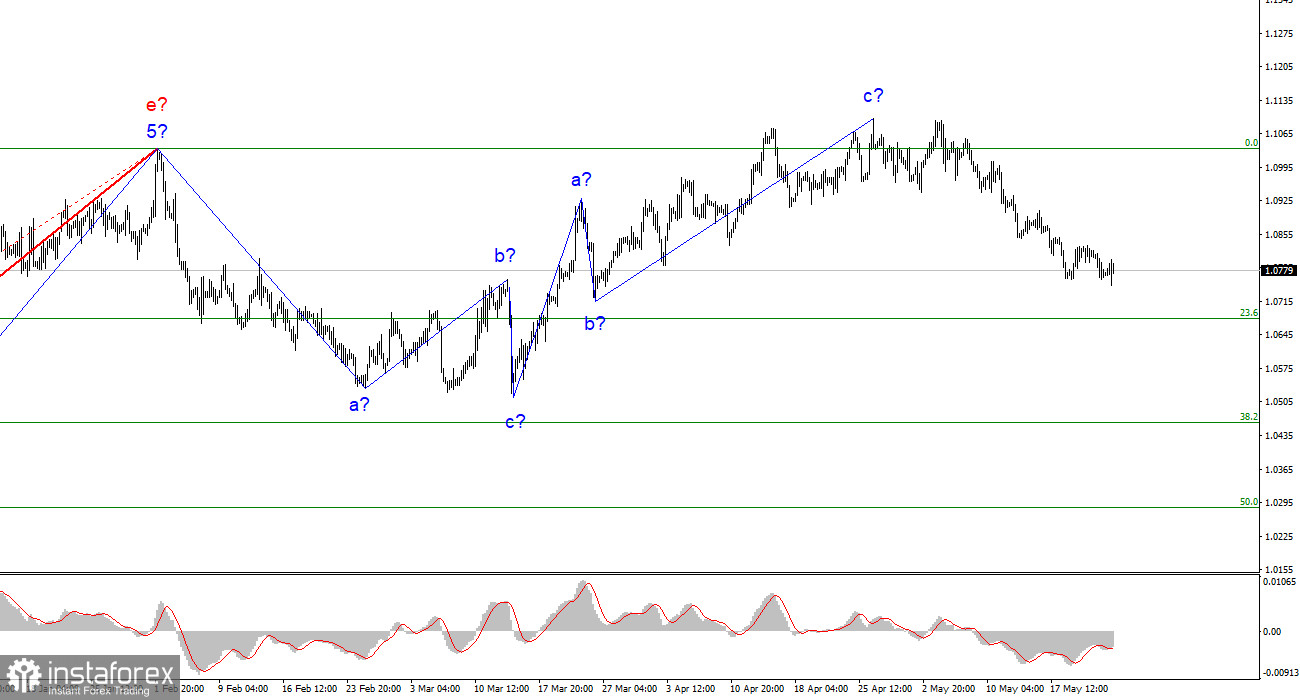

The FOMC minutes can answer the question of the likelihood of a rate hike in June and indicate how many committee members supported the rate hike in May. Analysts at major banks believe that the Federal Reserve is far from starting a rate cut, so the hawkish sentiment will persist. This sentiment can support the demand for the U.S. currency, which, in my view, has high growth potential based on the current labeling wave.

General Conclusions.

Based on the conducted analysis, the formation of the upward trend segment is complete. Therefore, I recommend selling now, as the pair has significant room for decline. Targets around 1.0500-1.0600 can be considered quite realistic. With these targets in mind, I advise selling the pair.

On the higher wave scale, the wave labeling of the upward trend segment has taken an extended form but is likely completed. We have seen five upward waves, most likely a structure of a-b-c-d-e. The formation of the downward trend segment may still need to be completed, and it can take any form in terms of structure and duration.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română