The UK inflation report was quite contradictory. Some of its components decreased but remained in the "green," while others increased, and some slowed down more than expected.

Initially, GBP/USD bulls reacted optimistically to the latest figures: the pair tested the weekly high, reaching 1.2470. However, the upward momentum quickly faded. Bears took the initiative and offset the bulls' gains within minutes. This indicates that the market has not yet finalized its opinion regarding the consequences of the report. In addition, traders are also keeping an eye on the dollar, which has regained momentum on Wednesday due to growing risk-off sentiment. We can assume that in this case, everything will depend on how members of the Bank of England and BoE Governor Andrew Bailey himself interpret the latest figures. It can be argued that the glass is half full and half empty in this situation.

In terms of dry numbers

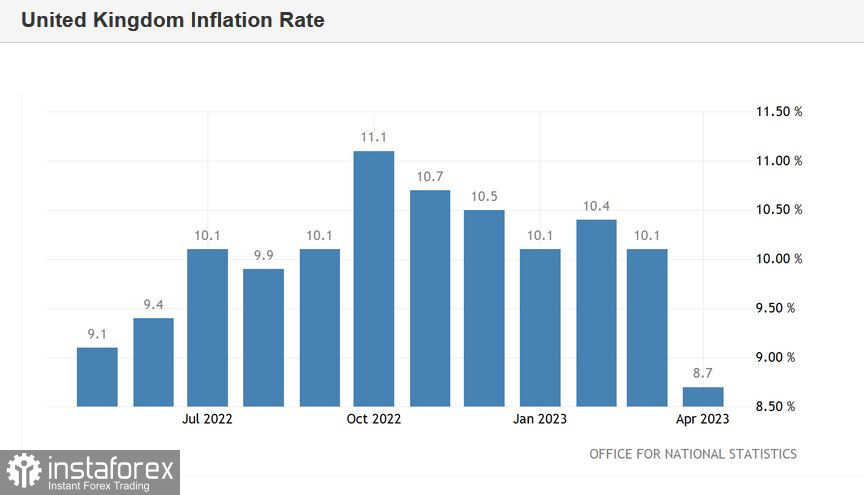

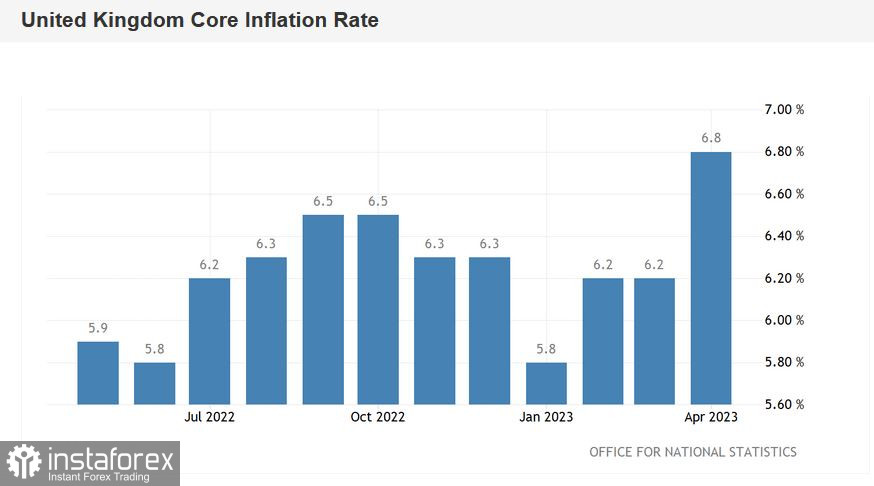

The overall Consumer Price Index (CPI) on a monthly basis rose to 1.2% compared to the forecasted decline of 0.8%. In year-on-year terms, the indicator decreased significantly from the March value of 10.1% to 8.7%. Nevertheless, it still remained in the "green" as most experts predicted a more significant decline to 8.2%. However, the core CPI, which excludes energy and food prices, contrary to expectations of a decrease to 6.1%, jumped to 6.8%. This is perhaps the strongest argument in favor of the British currency, as the BoE has repeatedly expressed concern about the rise in core inflation.

Other inflation indicators also showed contradictory dynamics. For example, the Retail Price Index in April increased by 11.4% on a year-on-year basis. On one hand, the figure decreased compared to the March value (13.5%), but on the other hand, analysts expected a decline to 11.0%. It is important to note that the Retail Price Index is used by employers in the UK during salary negotiations.

As mentioned earlier, not all components of the inflation release entered the "green." For instance, the Producer Price Index (PPI) fell more than expected: while the forecast predicted a decline to 5.4% YoY, it plummeted to 3.9% in April (from the previous value of 7.3%). The Output Price Index (OPI) also fell into the "red": after rising to 8.5% in March, it decreased to 5.4% in April (despite the forecasted decline to 5.8%).

Overall, the structure of the report indicates, among other things, that the growth in prices for food and non-alcoholic beverages in April slowed down to 19.1% (compared to the March value of 19.2%). The cost of utilities increased by 12.3%, while transportation prices increased by 1.5%. Prices in restaurants and hotels rose by 10.2%.

Consequences of the report:

It is worth recalling that on Tuesday, Bailey said that further tightening of monetary policy would only be necessary if there are signs of more sustained price pressure. According to Bailey, inflation has already passed a turning point. In this context, the April CPI report raises more questions than answers. On one hand, the CPI decreased to 8.7% YoY, marking the slowest growth rate since March 2022. On the other hand, the core CPI surged again, reaching a multi-year record. This suggests that the balance could swing in either direction: the BoE may be concerned about the rise in the core index and announce another 25-basis-point rate hike. Alternatively, they may adopt a wait-and-see stance, pointing to the actual decline in the overall CPI and several other inflation indicators.

In other words, the inflation report can bring about some challenges. It can either strengthen the position of the pound (if BoE representatives tighten their rhetoric, focusing on the rise in core inflation) or weaken it (if members of the central bank maintain a cautious tone despite the "green color" of the report). Therefore, a lot depends on the subsequent comments from central bank officials.

Conclusions:

The short-term upward momentum in the GBP/USD pair was promptly extinguished not only due to discrepancies in the inflation report but also due to the strengthening of the greenback. The US Dollar Index reached a two-month high on Wednesday amid reports that the latest negotiations in the White House ended without an agreement to raise the debt limit. Following the meeting with Biden, House Speaker Kevin McCarthy said that Republicans will not agree to any tax changes as part of the agreement. The US president, on the other hand, previously stated that the deal will not happen "on Republican terms alone." As a result, the situation remains uncertain, with only a few days left until the deadline set by the US Treasury (June 1st), as announced.

From a technical standpoint, the GBP/USD pair is approaching the support level of 1.2350, where the lower line of the Bollinger Bands indicator coincides with the upper limit of the Kumo cloud on the daily chart. If the bears overcome this target and establish themselves below it, the next bearish target will be the level of 1.2260, which is the middle line of the Bollinger Bands on the 1W chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română