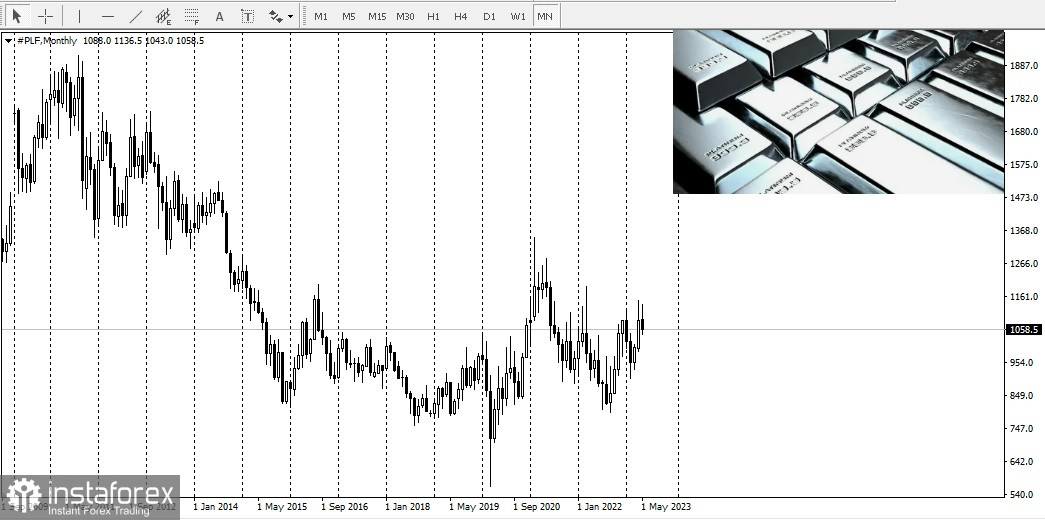

World Platinum Investment Council reported an increase in platinum demand. However, supply continues to be limited, so a deficit of nearly one million ounces threatens the market.

Updated data said the shortage could be as much as 983,000 ounces in 2023, 77% higher than in 2022. Research Director Edward Sterck reported that the total supply will decrease to 7.2 million ounces, while demand will reach 8.2 million ounces.

Accordingly, ETFs saw an inflow of funds following the significant deficits over the past couple of years, gaining about 240,000 ounces since the beginning of 2023.

Although production at mines did not change, compared to the long-term rates, it decreased by 6%. Forecasts suggest that secondary processing supply will also remain unchanged throughout 2023, but will decrease compared to previous years. The electricity supply issues in South Africa could also exacerbate the deficit.

Only an excess in supply will push prices down until the supply begins to shrink. Accordingly, a deficit will bring prices up until demand goes down.

For now, both industrial and investment demand for platinum continues to rise.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română