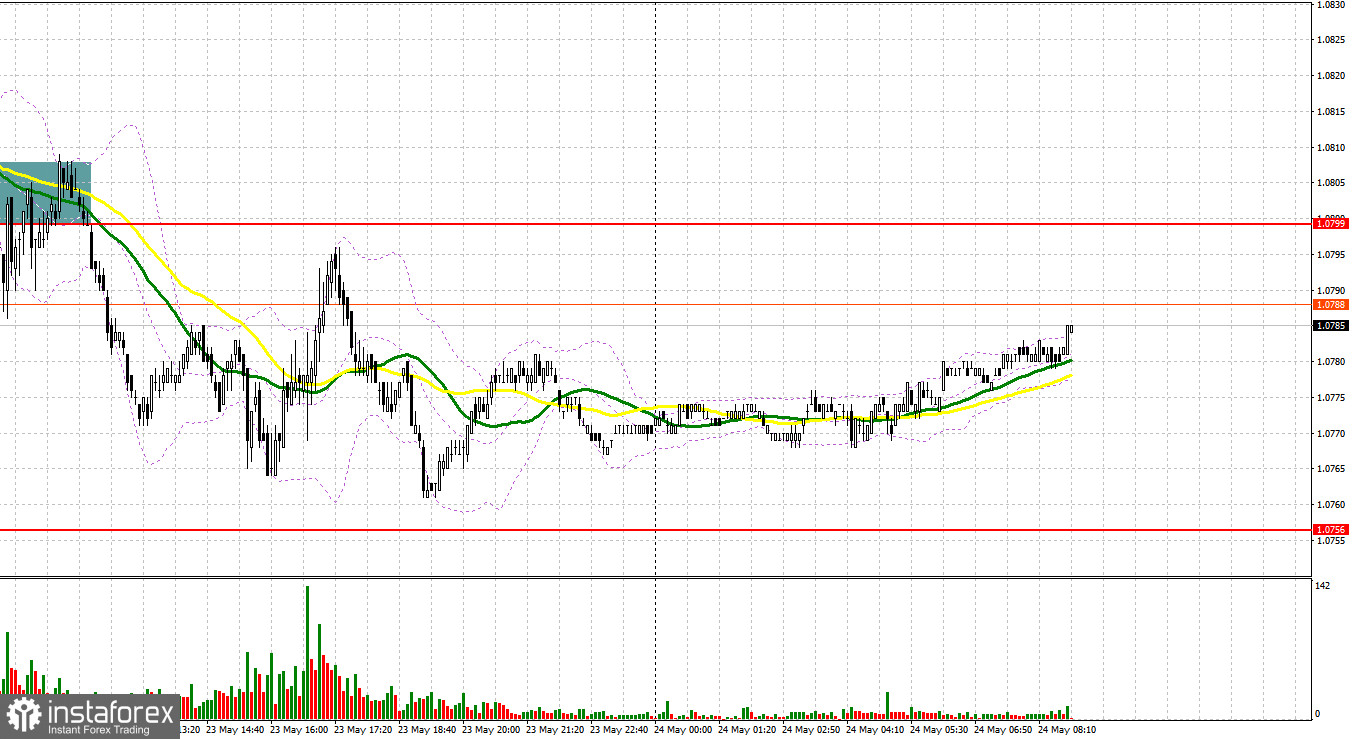

Yesterday only one signal was formed to enter the market. Let's look at the 5-minute chart and see what happened. In my yesterday's forecast, I paid attention to the level of 1.0799 and recommended to make decisions on entering the market from it. A break and reverse test from the bottom-up of this range generated a sell signal. As a result, the pair fell by more than 25 pips. In the second half of the day, the instrument did not reach the projected levels.

What is needed to open long positions on EUR/USD

Business activity indicators in the US, where the PMI dropped for the manufacturing sector and rose for the service sector, led to a slight correction in the euro on Tuesday, but this did not really affect the situation. It is obvious that the failure in the negotiations on the US government debt limit keeps the pressure on risky assets. Today I'm waiting for reports on the business environment indicator, the current situation assessment indicator and the German economic expectations indicator from the IFO, as well as a speech by ECB President Christine Lagarde. A decline of indicators will certainly keep the pressure on the euro under the current conditions, so I will obviously not rush to go long today.

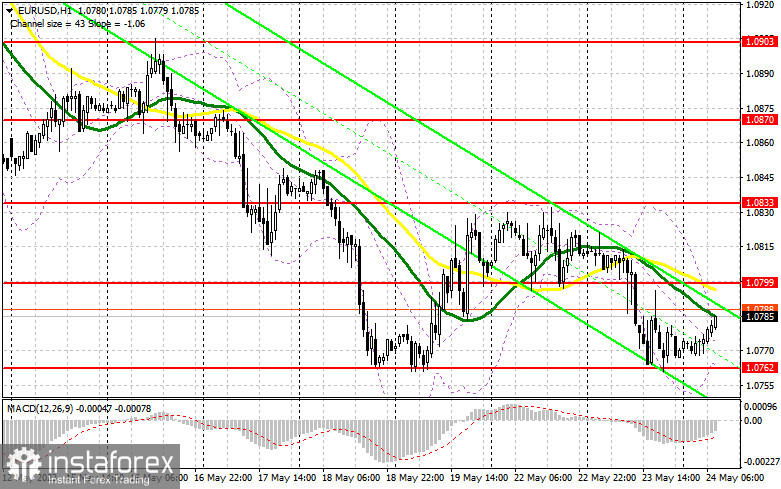

I expect EUR/USD to remain under pressure and I plan to act only after the decline and the formation of a false breakdown in the area of 1.0762. This will make sure that there are real people in the market who want to push the euro up, which will give them a chance to enter long positions with the aim of rising to the nearest resistance 1.0799, where the moving averages play on the side of the bears. A break and test from top to bottom of this range after good news from the IFO and negotiations to raise the US government debt limit will strengthen the demand for the euro, creating an additional entry point for increasing long positions with a new high at about 1.0833. The area of 1.0870 remains the farthest target, where I will take profits.

With the option of further decline in EUR/USD and no buyers at 1.0762, which is more likely in the current bear market, we can expect further development of the downtrend. Therefore, only the formation of a false breakdown in the area of the next support at 1.0716 will give a signal to buy the euro. I will open long positions immediately at a dip from the low of 1.0674 with the aim of an upward correction of 30-35 points intraday.

What is needed to open short positions on EUR/USD

The bears are still holding the upper hand in the market. Protection of the nearest resistance level of 1.0799 remains a priority and a suitable scenario for increasing short positions with a view to a further downtrend. A false break at this level would give a sell signal that could push the pair to a monthly low of 1.0762. Fixation below this range as well as a reverse test from the bottom up opens a straight road to 1.0716. The lowest target will be at least 1.0674, where traders could take profits. If EUR/USD moves up during the European session and there are no bears at 1.0799, we can predict an upward correction. In this case, I will postpone short positions until the level of 1.0833. You can also sell there, but only after an unsuccessful consolidation. I'm going to open short positions immediately at a rebound from the high of 1.0870 bearing in mind a downward intraday correction of 30-35 pips.

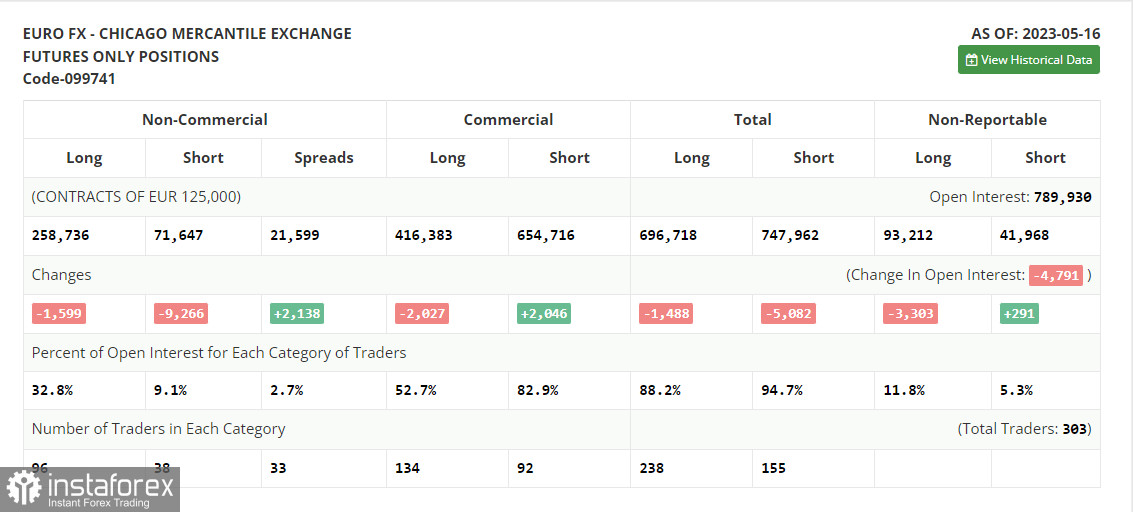

In the COT report (Commitment of Traders) for May 16, we see a decrease both in long and short positions, but the latter turned out to be much larger. The downward correction of EUR/USD observed last week still provides an excellent opportunity to build up long positions. However, until the problem with the US government debt is resolved, we are unlikely to see serious demand for risky assets. Traders are even ignoring the statements of representatives of the Federal Reserve System, who unanimously insist that at the next meeting the committee will pause the rate hike cycle, which is quite a bullish signal for the euro. Hence, as soon as the problem with the debt limit is settled, the buyers will return to the market, so that you need to wait a bit. The COT report indicates that long non-commercial positions decreased by only 1,599 to the level of 258,736, while short non-commercial positions immediately declined by 9,266, to the level of 71,647. At the end of the week, the total non-commercial net position increased and amounted to 187,089 against 179,422. EUR/USD closed last week a lower at 1.0889 against 1.0992 a week ago.

Indicators' signals

Moving Averages

The instrument is trading below the 30 and 50-day moving averages. It indicates a further decline in the instrument.

Note: The period and prices of the moving averages are considered by the analyst on the 1-hour chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case EUR/USD goes down, the lower indicator's border around 1.0762 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română