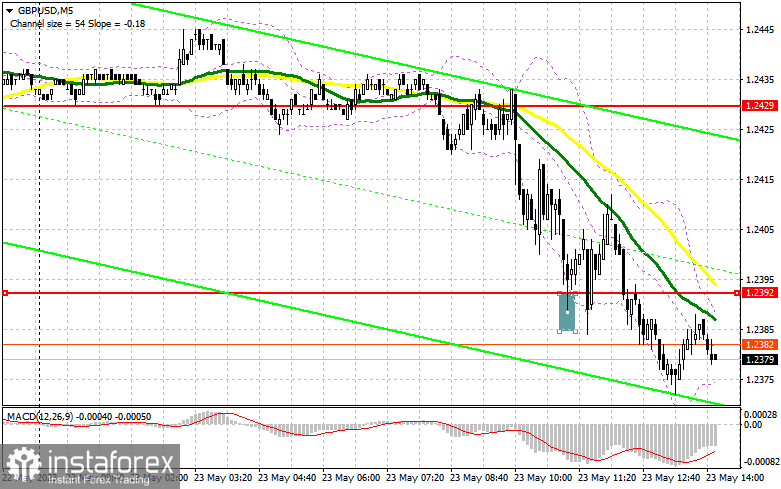

In my morning forecast, I drew attention to the level of 1.2392 and recommended making trading decisions based on it. Let's look at the 5-minute chart and analyze what happened there. The decline and a false breakout formed an excellent buying signal. However, after moving up nearly 20 points, demand sharply decreased. The technical picture has been slightly revised for the second half of the day.

To open long positions on GBP/USD, the following is required:

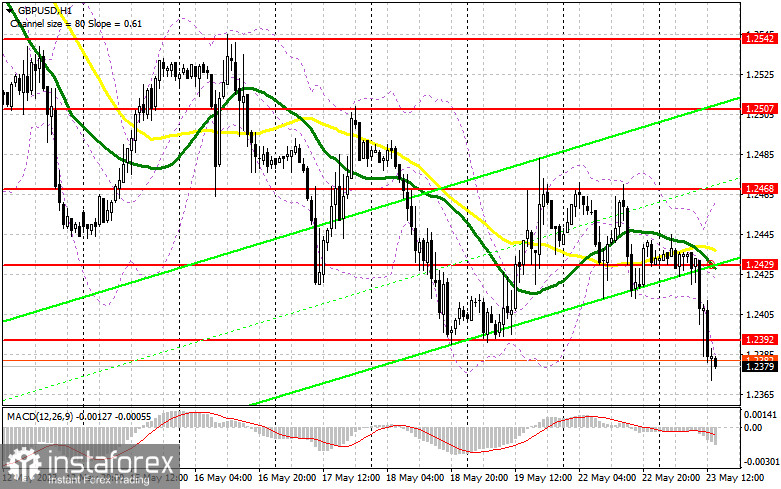

Weak data on activity in the UK, particularly in the manufacturing sector, renewed pressure on the pair. Now, much will depend on how traders behave after releasing similar PMI index reports for the US. The contraction of indicators and poor housing market sales data will lead to an upward correction of the pound. Strong reports will push the pound to a new monthly minimum of around 1.2353. That's the level I will take as a reference. A false breakout formation similar to what I discussed earlier will provide a buying signal and lead to a surge in the pair towards 1.2392, where bears will likely reemerge. A breakthrough and a reverse test of this range from top to bottom will form an additional buying signal and strengthen the presence of bulls in the market with a surge towards 1.2429, where the moving averages are located, favoring bears. The ultimate target will be around 1.2468, where I will take profits.

In the scenario of a decline towards 1.2353 and a lack of activity from buyers in the second half of the day, I will postpone purchases until the next monthly low reaches 1.2310. I will also only open long positions there on a false breakout. I plan to buy GBP/USD immediately on a rebound only from the minimum at 1.2275, aiming for a 30-35 point correction within the day.

To open short positions on GBP/USD, the following is required:

Sellers have completely achieved their goals, and now it's crucial to take advantage of the level of 1.2392, where I expect significant player activity. The attractive selling scenario will only be a false breakout at 1.2392 with a downward target towards the new support at 1.2353. A breakthrough and a reverse test of this range from bottom to top will strengthen the bearish trend, signaling the opening of short positions with a drop towards 1.2310. The ultimate target remains the minimum at 1.2275, where I will take profits.

With GBP/USD rising and a lack of activity at 1.2392, which is likely to happen with weak US data, I will postpone selling until a resistance test at 1.2429, where the moving averages are located. A false breakout there will be the entry point for short positions. If there is no downward movement from 1.2429, I will sell GBP/USD on a rebound immediately from 1.2468, but only with the expectation of a downward correction of the pair by 30-35 pips within the day.

Indicator Signals:

Moving Averages

Trading is below the 30-day and 50-day moving averages, indicating a continuation of the bearish market.

Note: The period and prices of the moving averages mentioned by the author are based on the hourly chart (H1) and differ from the general definition of classical daily moving averages on the daily chart (D1).

Bollinger Bands

In case of an upward movement, the upper boundary of the indicator around 1.2455 will act as resistance.

Description of Indicators:

• Moving average (determines the current trend by smoothing out volatility and noise). Period 50. Marked in yellow on the chart.

• Moving average (determines the current trend by smoothing out volatility and noise). Period 30. Marked in green on the chart.

• MACD (Moving Average Convergence/Divergence) indicator. Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands. Period 20.

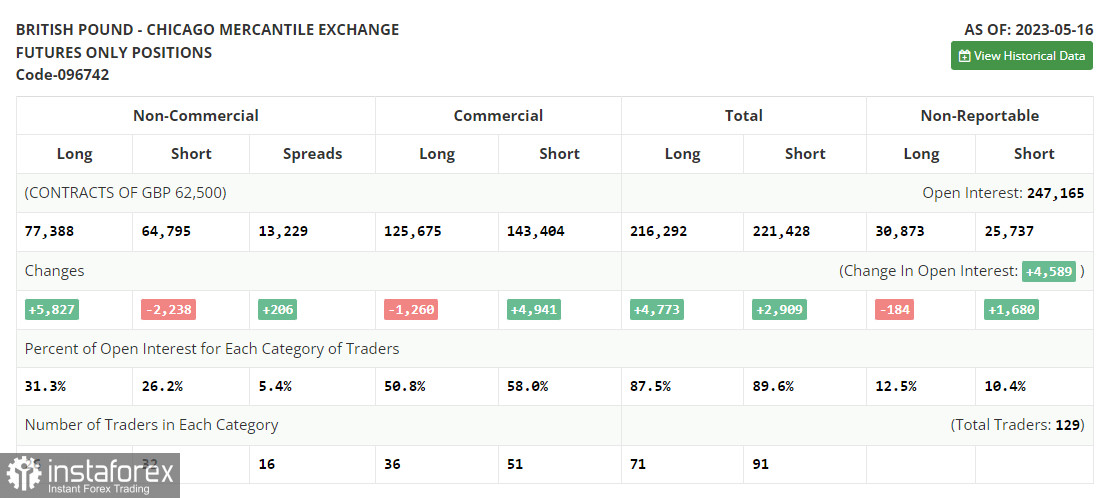

• Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

• Long non-commercial positions represent the total long open positions of non-commercial traders.

• Short non-commercial positions represent the total short open positions of non-commercial traders.

• Non-commercial net position is the difference between non-commercial traders' short and long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română