EUR/USD

Higher timeframes

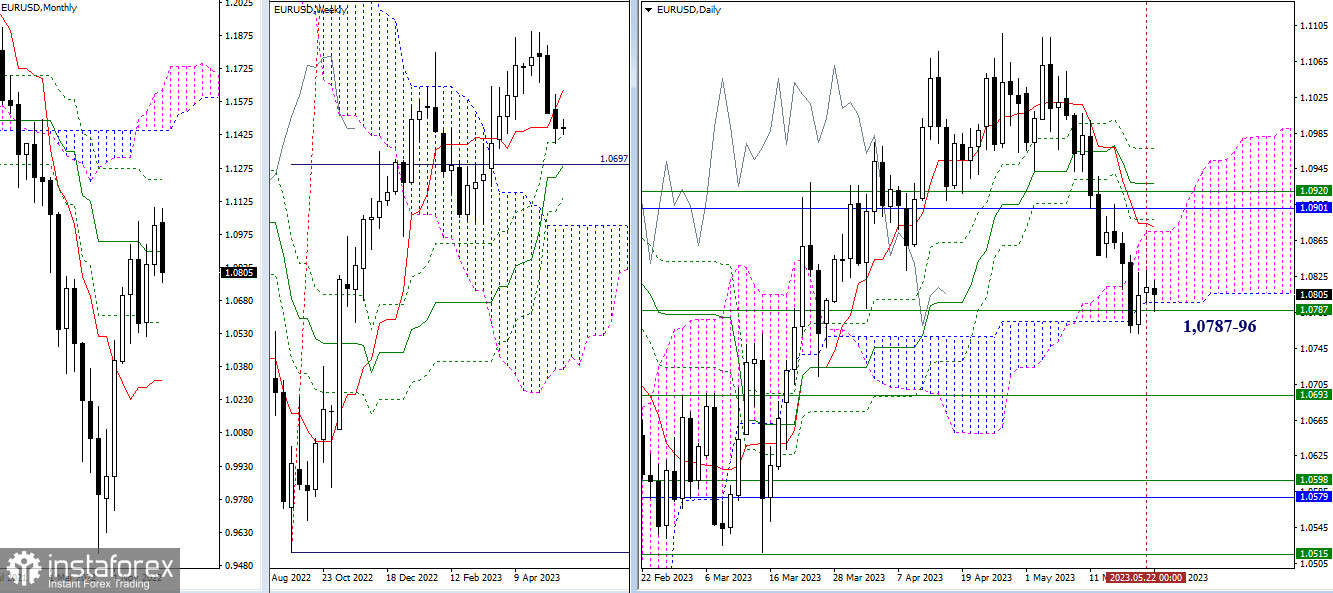

Over the past day, there have been no significant changes in the situation. The pair continues to hold a pause, using support levels at 1.0796 - 1.0787 (lower boundary of the daily cloud + weekly Fibo Kijun). A breakout could transfer initiative to the bears, with their immediate interest being the level of 1.0693 (weekly medium-term trend). A rebound and further position recovery will shift players' attention to resistance levels around 1.0875 - 1.0880 (upper boundary of the daily cloud + daily short-term trend) and 1.0901 - 1.0920 (monthly medium-term trend + weekly short-term trend).

H4 - H1

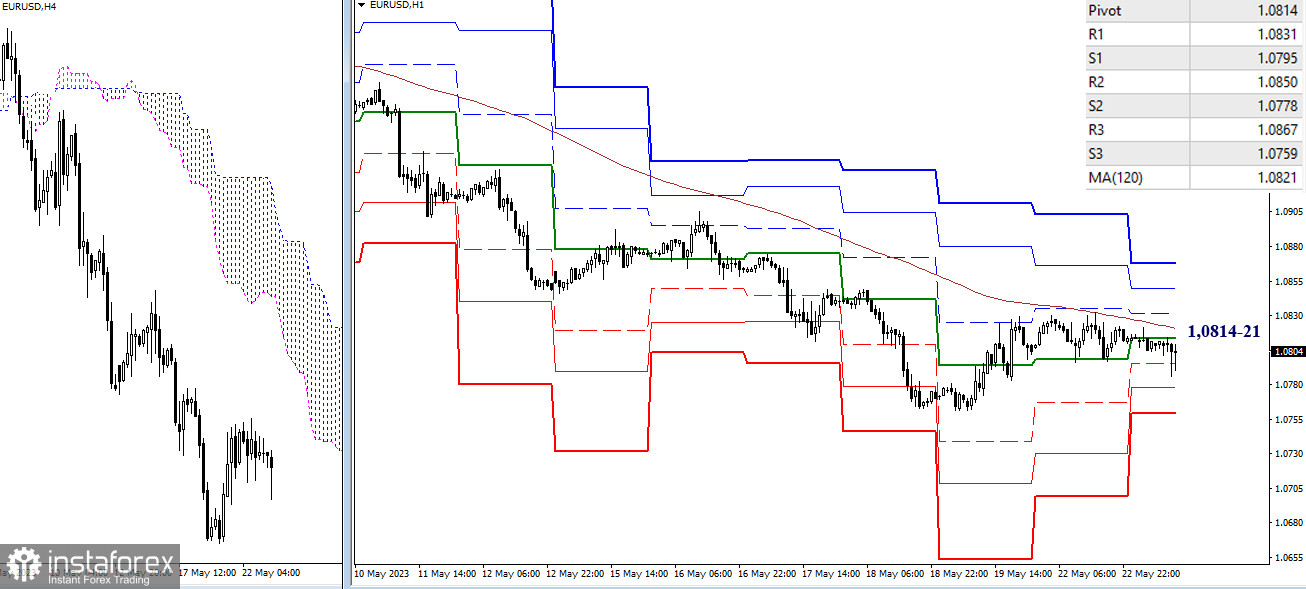

The pause on higher timeframes has maintained uncertainty on lower timeframes. Currently, the pair continues to operate near key levels, which are converging around 1.0814–21 (central pivot point + weekly long-term trend), with the main advantage still leaning towards bears. If there is progress in the price movement, the classic pivot points at 1.0795 - 1.0778 - 1.0759 (supports) and 1.0831 - 1.0850 - 1.0867 (resistances) may have significance within the day.

***

GBP/USD

Higher timeframes

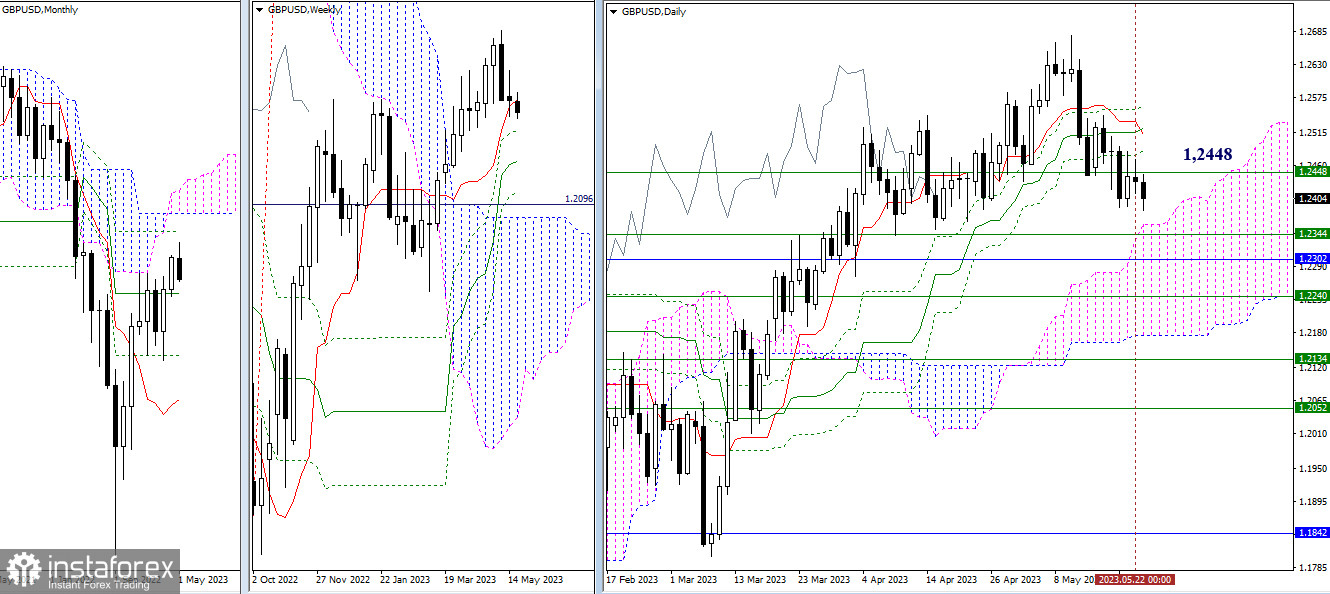

Not much has changed after yesterday's trade. The weekly short-term trend (1.2448) continues to exert influence, hindering the development of the situation. The nearest support zone is currently around 1.2361 - 1.2344 - 1.2302 (upper boundary of the daily cloud + weekly Fibo Kijun + monthly medium-term trend), while the nearest resistance zone is currently formed by the levels of the daily Ichimoku cross (1.2477 - 1.2515 - 1.2534 - 1.2553).

H4 - H1

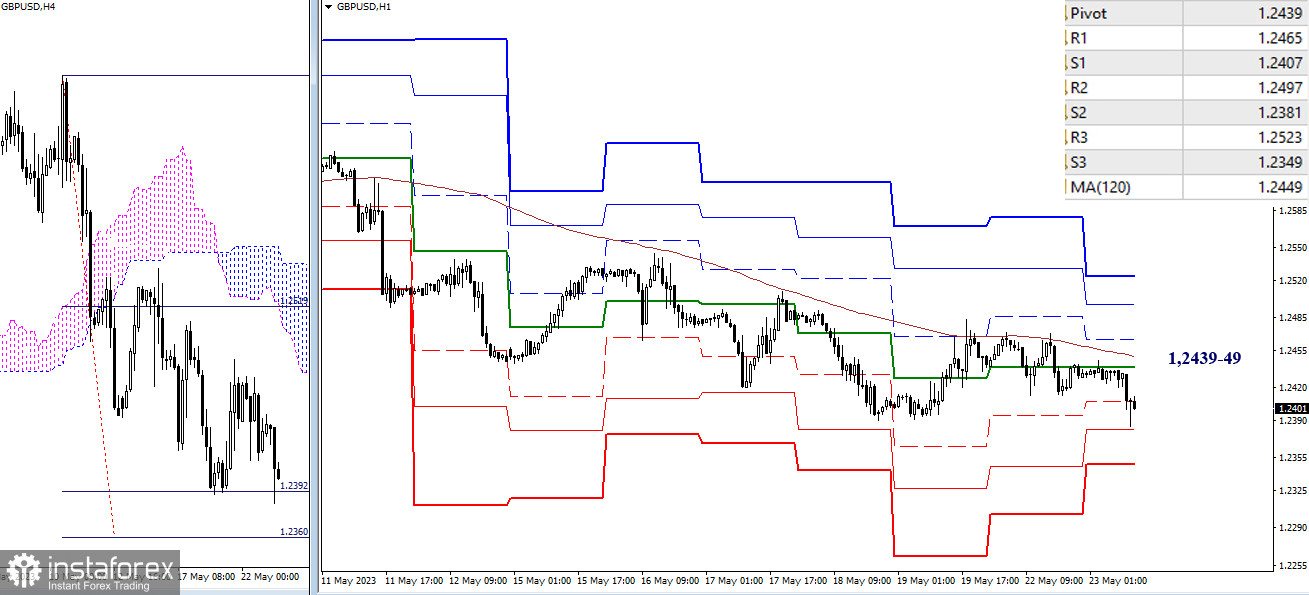

On the lower timeframes, the price continues to work below key levels. They have now almost merged around 1.2439–49 (weekly long-term trend + central pivot point of the day). Working below these key levels maintains the advantage for bears. The support levels of classic pivot points (1.2381 - 1.2349) serve as targets for further decline. A consolidation above the key levels may change the current balance of power. In that case, intraday attention will shift to the resistance levels of classic pivot points (1.2465 - 1.2497 - 1.2523).

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română