On Monday, the pound/dollar pair made an attempt to resume falling after an insignificant rise but volatility was too low. In general, the descending trend continues and the pound remains excessively overbought. The downward correction from the recent local high is not strong enough to cause a reversal. Therefore, we continue to expect a fall in the pound sterling.

On Monday, the pound/dollar pair made an attempt to resume falling after an insignificant rise but volatility was too low. In general, the descending trend continues and the pound remains excessively overbought. The downward correction from the recent local high is not strong enough to cause a reversal. Therefore, we continue to expect a fall in the pound sterling.

On Monday, there were no particularly important events in either the UK or the US. Several officials of the Federal Reserve delivered speeches but nothing significant was said just like last week. Some members of the US central bank's monetary committee supported one more interest rate hike in June but they are likely to remain in the minority. This information is not crucial for the US dollar at the moment. The currency is expected to go on strengthening against the pound, which was rising over the past 2.5 months without significant reasons. Thus, given almost any fundamental and macroeconomic data, we expect a further decline in the GBP/USD pair.

On the 24-hour time frame, the quotes settled below the critical line, which already provides some ground for a continuation of the decline. The first target is the Senkou Span B line, which lies just below the 22 level. Overall, we expect the British pound to fall by about 500-600 pips to the levels from which the last upward surge began.

Inflation in Britain may finally show a significant slowdown. There will also be a few important events in the UK this week. The flow of macroeconomic events starts today, on Tuesday, with the release of business activity indicators in the services and manufacturing sectors. As we have already mentioned, these are not the most important reports, and no significant changes are expected in May. On Wednesday, a much more important and resonant inflation report for April will be published. The consumer price index may show a significant slowdown. Inflation may slacken from 10.1% to 8.3-8.5% on a yearly basis. At the same time, according to forecasts, the core inflation may decrease by only 0.1% in annual terms. If British inflation starts to decline rapidly, as Andrew Bailey announced, the Bank of England will have fewer reasons to continue raising the key rate. The tightening cycle is nearing completion regardless of the inflation level. Therefore, the British currency should not receive support from these events.

On Friday, a report on retail sales for April will be issued in the UK. The data is expected to be weak again. As we have already mentioned, statistics from Britain continue to disappoint traders, despite the optimism of the head of the Bank of England. What is more, the data from the UK is certainly weaker than in the US.

In the US, there will also be a few important events this week. Today, we may take a look at the business activity indices, but not the ISM ones, which are considered more important. Tomorrow, the FOMC will issue its meeting minutes, which are also of minor importance. The fact is that the protocol rarely contains new information. On Thursday, traders may focus on the second GDP estimate for the first quarter and unemployment claims. The second GDP estimate is the least interesting indicator as it rarely differs from the first estimate and is not a final value. On Friday, the US will disclose data on its producer price index, personal income and spending, and durable goods orders. In addition, the University of Michigan will publish the consumer sentiment index figures. Theoretically, some of these reports may provoke a market reaction. However, the data should considerably differ from the expected figures. We believe that the current week will be relatively calm unless any shocking information emerges in the market.

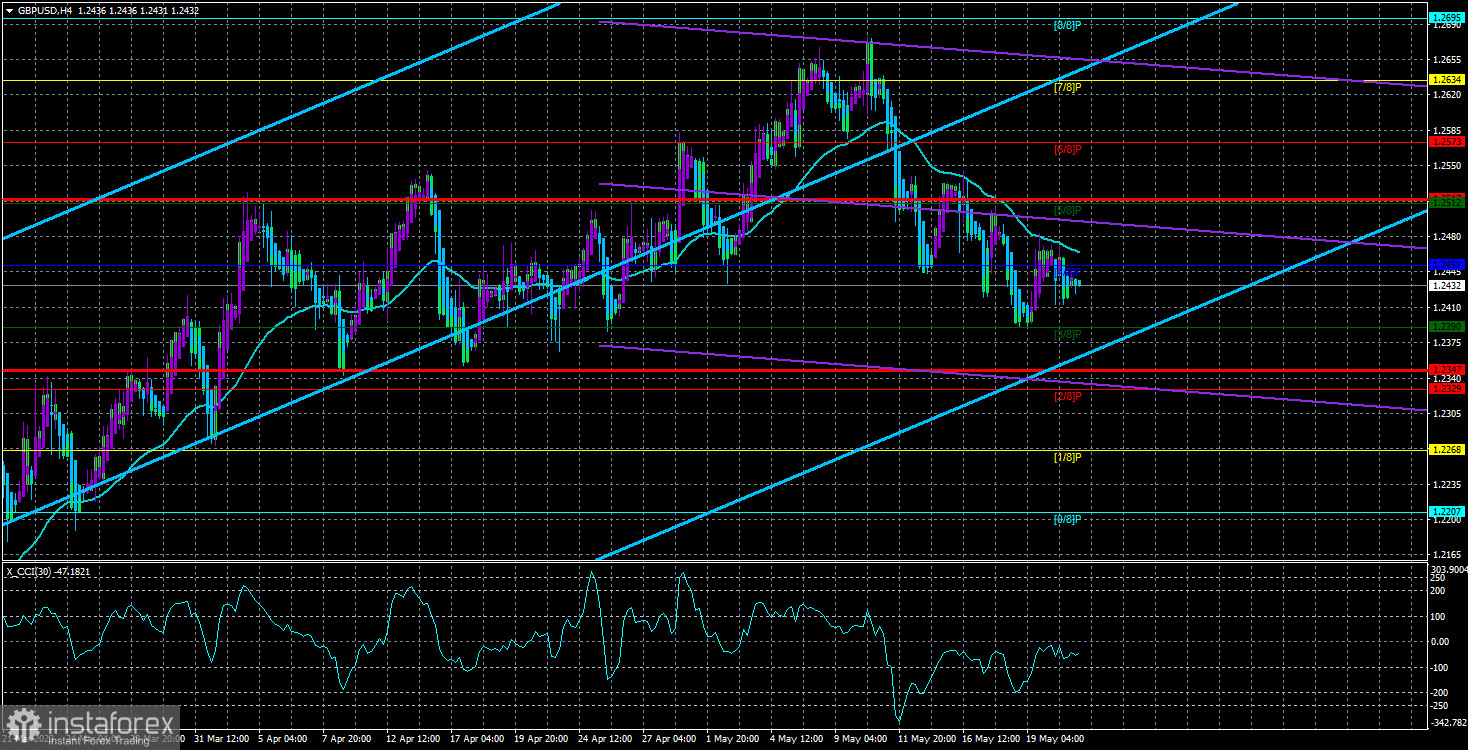

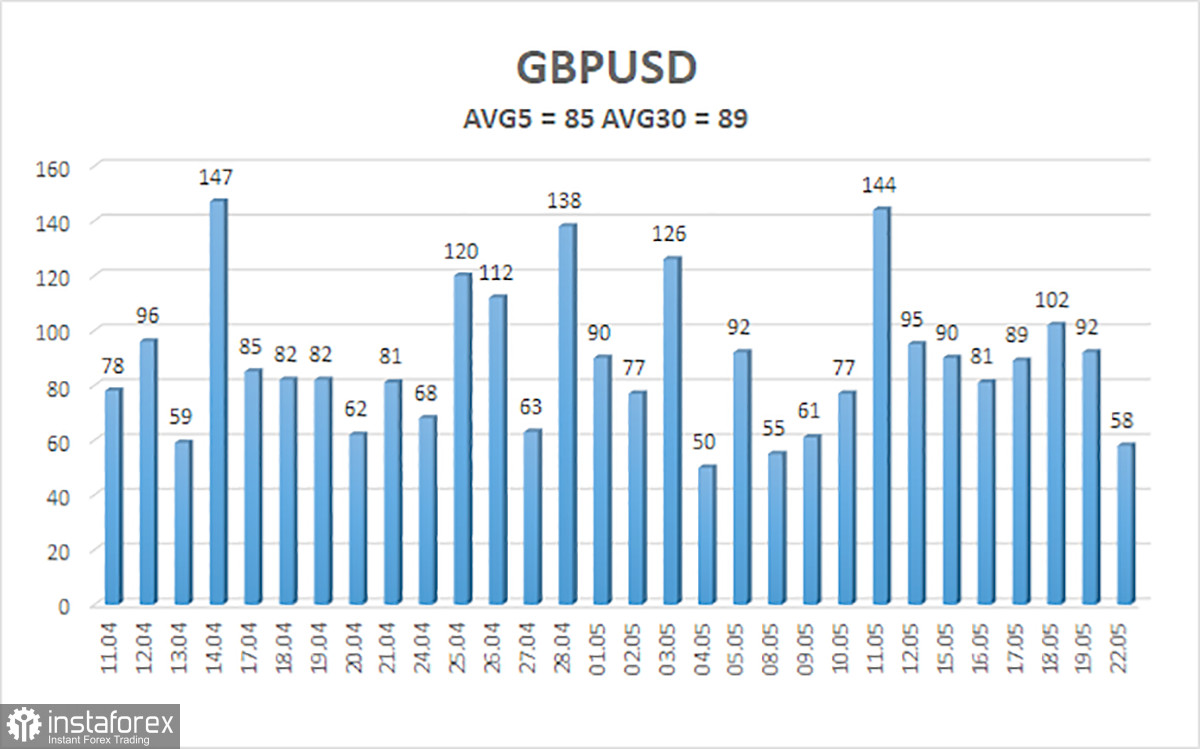

In the last five days, the average volatility of the GBP/USD pair has been 85 pips. For the pound/dollar pair, this value is considered average. Therefore, on Tuesday, May 23, we expect a movement within the range of 1.2347-1.2517. An upward reversal of the Heiken Ashi indicator will signal a new phase of the corrective movement.

The nearest support levels:

S1 - 1.2390

S2 - 1.2329

S3 - 1.2268

The nearest resistance levels:

R1 - 1.2451

R2 - 1.2512

R3 - 1.2573

Trading recommendations:

On the 4-hour time frame, the GBP/USD pair experienced a slight correction, so short positions with targets at 1.2390 and 1.2347 remain relevant until the Heiken Ashi indicator reverses upwards. Long positions could be considered if the price consolidates above the moving average with the targets at 1.2512 and 1.2573.

What we see on the trading chart:

Linear regression channels help determine the current trend. If both channels are headed in one direction, it indicates a strong trend.

The moving average line (20.0 - smoothed) determines the short-term trend and the direction in which trading should be conducted.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) stand for a probable price channel in which the pair will trade in the next 24 hours based on current volatility indicators.

CCI indicator. If it enters the oversold area (below -250) or overbought area (above +250), it points to an upcoming trend reversal in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română