Monday turned out to be a very interesting day, although both key instruments were practically stagnant and the market is resting. Several members of the FOMC have already spoken, with a few more scheduled to speak later. Additionally, an interview with European Central Bank President Christine Lagarde has taken place. Not every central bank representative's speech is capable of causing market movement, but you shouldn't blatantly ignore them, even if speakers don't mention anything important.

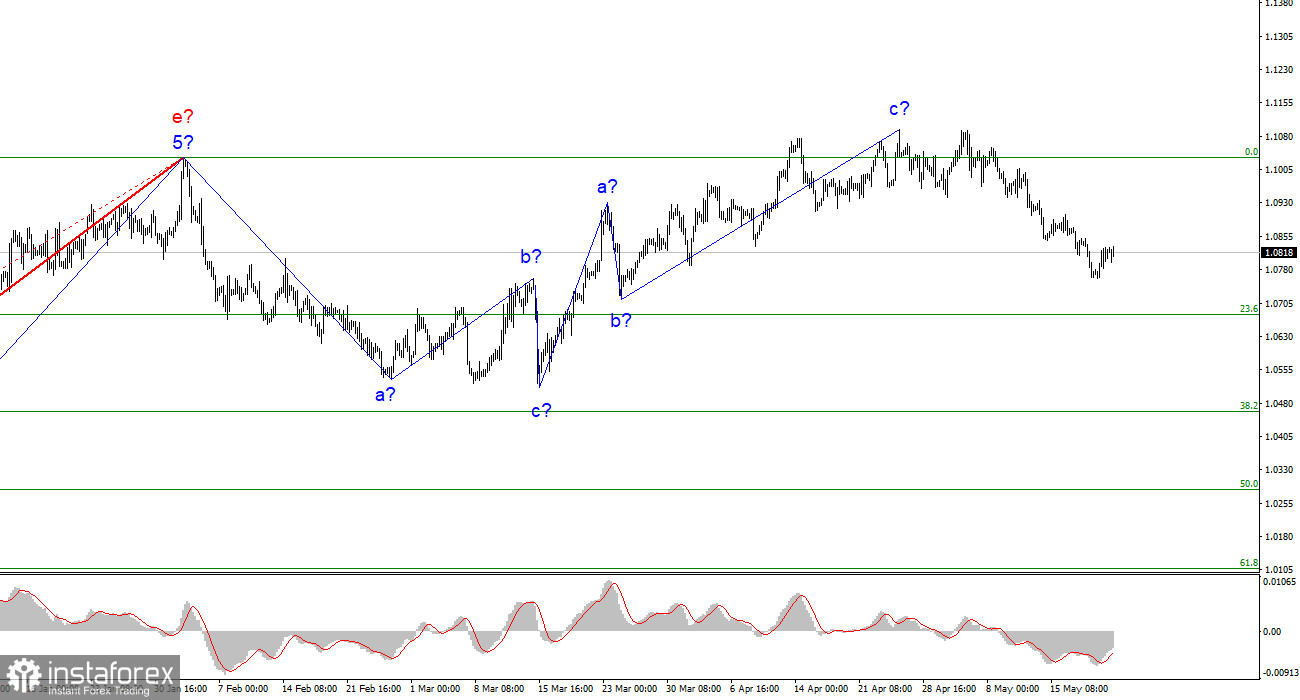

Lagarde said that the ECB has covered a significant portion toward taming inflation, but mentioned that "we are not done yet, we are not pausing based on the information I have today." She indicated that the most aggressive measures are behind them, but rates will continue to rise. Take note that the market is currently expecting two more quarter point rate hikes, and this view is almost unanimous. The fact that demand for the euro is falling at a time when monetary tightening in America is very likely to end, tells me that the EU rate changes have already been factored in and played back by the market. In my opinion, this means that the demand for the euro will continue to decline, which is necessary to maintain the current wave pattern.

Lagarde also highlighted the current level of inflation, describing it as "too high." She expressed concerns that inflation in the European Union may remain high for longer than currently anticipated. "So many things can go wrong that we cannot give what we call forward guidance," said Lagarde. Thus, the ECB will act according to incoming data. Her colleagues share a similar view, although some of them have a more hawkish stance. However, decisions will be taken by a majority vote, so I say we should leave the outlook for the two rate hikes unchanged.

If there is news of a stronger interest rate hike, it might have a favorable impact on the euro. However, we might not receive any news until three months later when the ECB implements its plan with two hikes. Three months is enough time to complete the construction of a three-wave downward set, and then the instrument can move into a new uptrend. I am not against the dollar's decline; I just think that the news background should correspond to what is happening in the market.

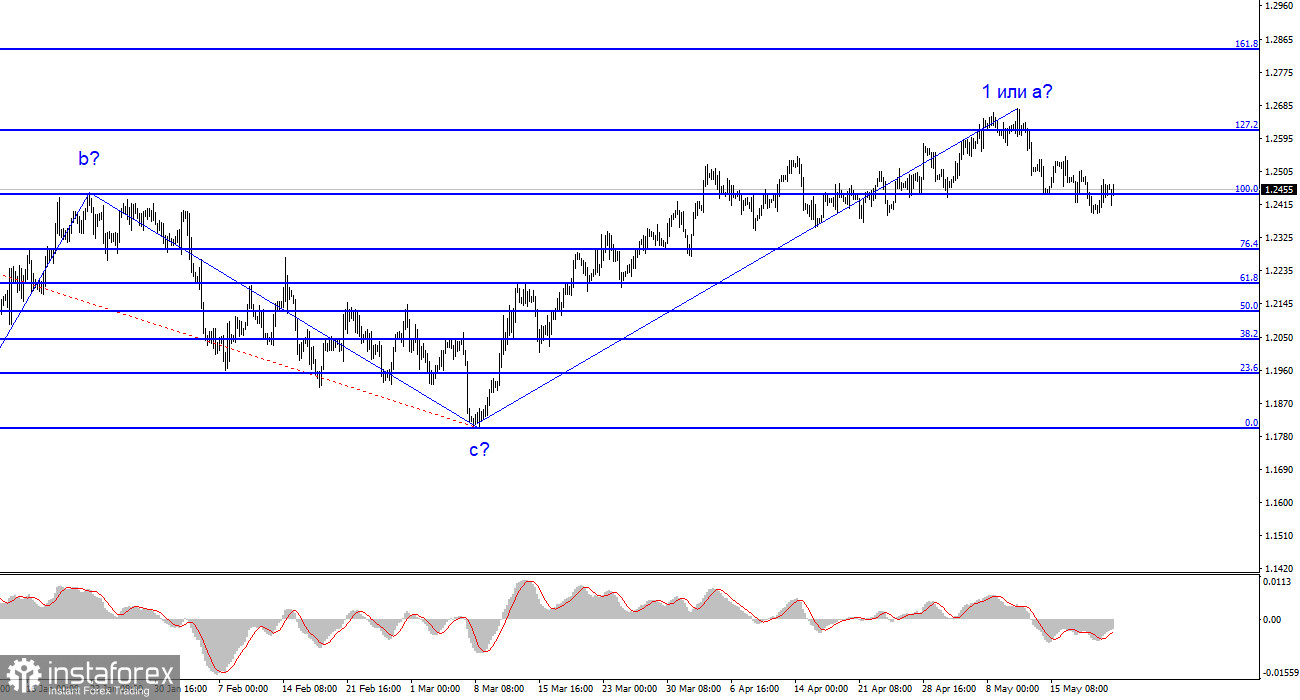

As for the British pound, the picture is similar. The Bank of England has already raised rates 12 times, and it is unlikely that this process will last for a long time. Therefore, we should not expect the pound to rally in the near future. At the moment, I see no reason to change the current wave structure for both instruments. I anticipate a decline.

Based on the analysis conducted, I conclude that the uptrend phase is complete. Therefore, I would recommend selling at this point, as the instrument has ample room for decline. I believe that targets around 1.0500-1.0600 are quite realistic. With these targets in mind, I advise selling the instrument on downward reversals of the MACD indicator.

The wave pattern of the GBP/USD pair has long indicated the formation of a new downtrend wave. Wave b could be very deep, as all waves have recently been equal. The first wave of the upward phase may become even more complicated. Failure to breach the 1.2615 level, which corresponds to 127.2% Fibonacci, indicates the market's readiness for selling, while a successful attempt to break through the 1.2445 level, equivalent to 100.0% Fibonacci, confirms this signal.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română