Both instruments continue their recent slowdown. The market is showing low interest in the topic of the US debt limit. I mentioned this over the weekend, and on Monday, analysts from several major banks reported the same conclusion. However, US Treasury Secretary Janet Yellen urges people to take the issue seriously, believing that the American economy could collapse if policymakers fail to resolve it within a week.

According to Yellen, June 1st is the deadline for resolving the debt limit issue. The chances of holding out until June 15, when new tax revenues come into the treasury, are extremely slim. Earlier, Yellen noted that default could occur on June 1st, or a few weeks later, as it is impossible to predict the exact size of tax revenues and the precise timing in advance. Treasury Secretary Janet Yellen said on Monday that a failure by Congress to raise the $31.4 trillion federal debt limit would cause a huge hit to the U.S. economy and weaken the dollar as the world's reserve currency. According to her, it will be a challenging moment for all Americans, and trust in the dollar and the American economy will sharply decline, leading to global changes in the world economy. "I continue to urge Congress to protect the full faith and credit of the United States by acting as soon as possible," and potentially "as early as June 1," Yellen stated.

I would like to remind you that the US Congress has also used a tactic in recent years. If they fail to agree on raising the debt ceiling within the deadline, they can postpone the decision for several months by "freezing" the relevant law. Additionally, the US Congress may increase the limit not by $1.5 trillion, as Yellen demands, but by several hundred billion, which would help sustain the American economy for a few more months, during which Republicans and Democrats can negotiate a higher limit.

US President Joe Biden stated on Monday that there was progress in the negotiations and they will resume. Therefore, Democrats and Republicans continue their work. I believe that the issue will be resolved within the next 7-8 days. Demand for the US currency may slightly increase if Congress approves the deal.

This week, the news background in the US and the European Union will be quite limited, but the UK will release an inflation report, which for the first time may show a significant slowdown. If inflation drops to 8.5% from the current 10.1%, demand for the pound may also decrease significantly. Bank of England Governor Andrew Bailey said that he expects price declines starting in April. If it does happen, the BoE will no longer have compelling reasons to continue raising interest rates. The market has actively used this factor in recent weeks and months to buy the pound.

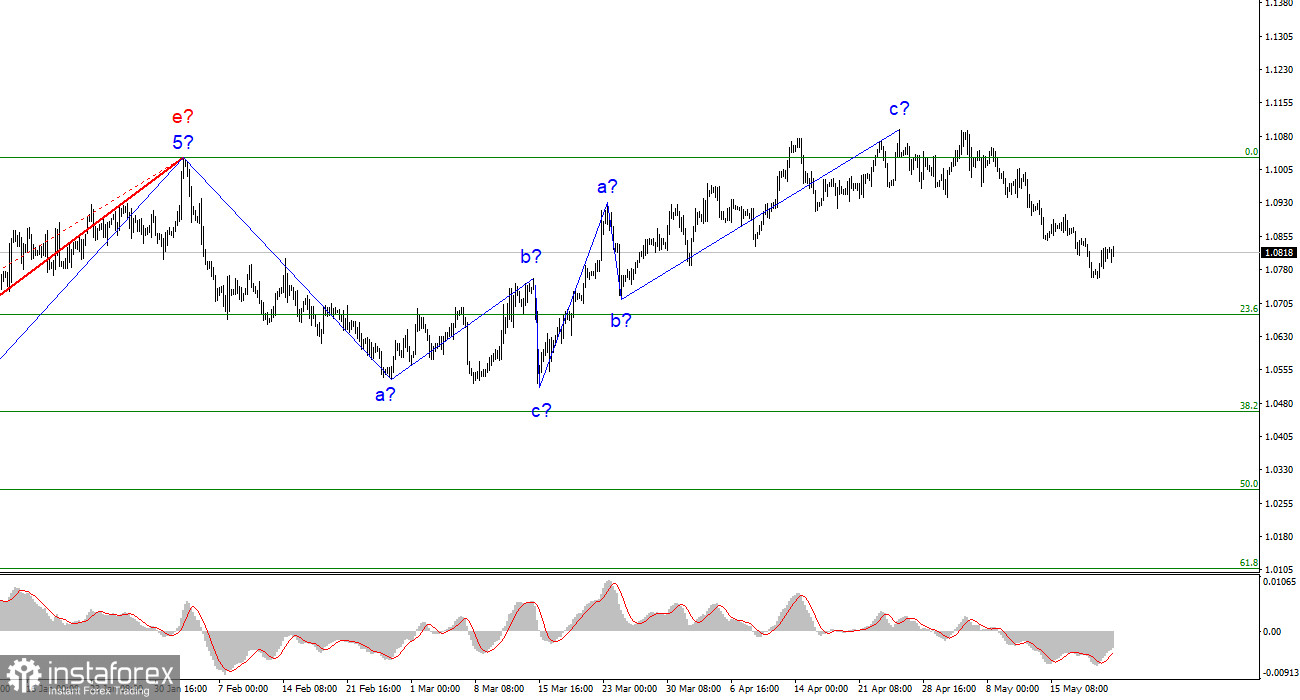

Based on the analysis conducted, I conclude that the uptrend phase is complete. Therefore, I would recommend selling at this point, as the instrument has ample room for decline. I believe that targets around 1.0500-1.0600 are quite realistic. With these targets in mind, I advise selling the instrument on downward reversals of the MACD indicator.

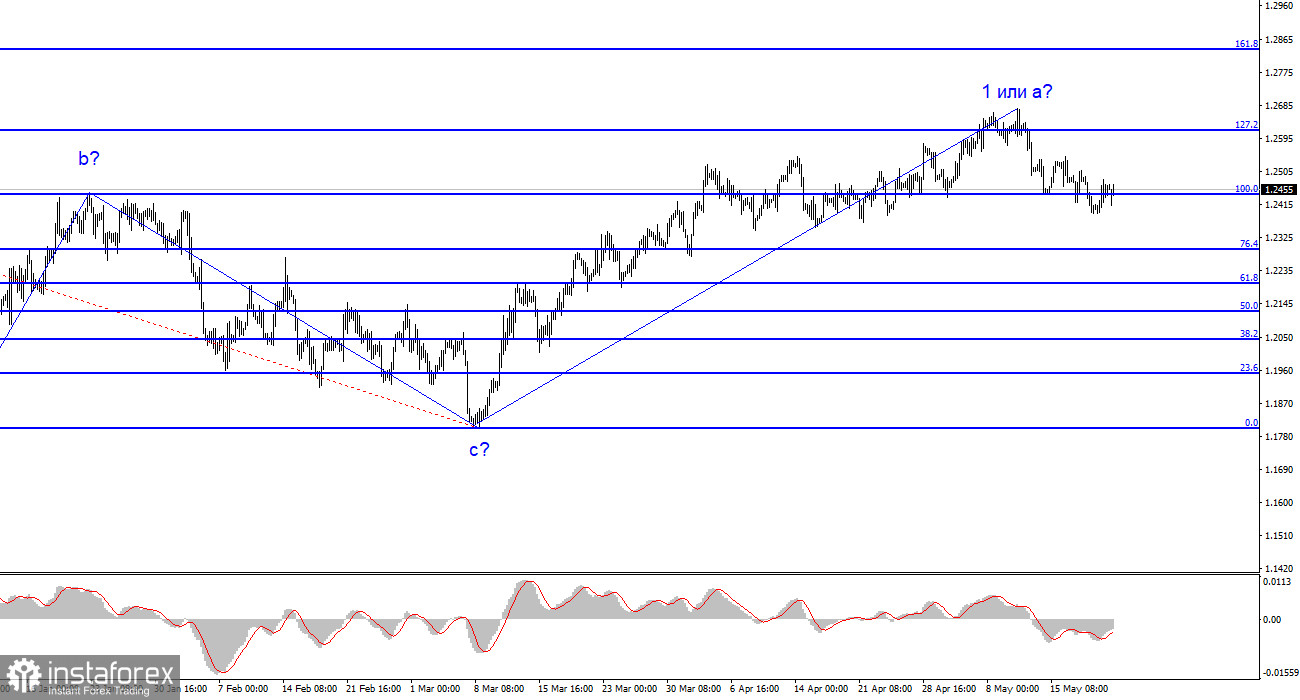

The wave pattern of the GBP/USD pair has long indicated the formation of a new downtrend wave. Wave b could be very deep, as all waves have recently been equal. The first wave of the upward phase may become even more complex. Failure to breach the 1.2615 level, which corresponds to 127.2% Fibonacci, indicates the market's readiness for selling, while a successful attempt to break through the 1.2445 level, equivalent to 100.0% Fibonacci, confirms this signal.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română